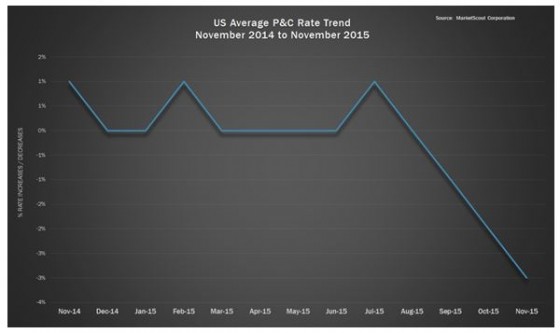

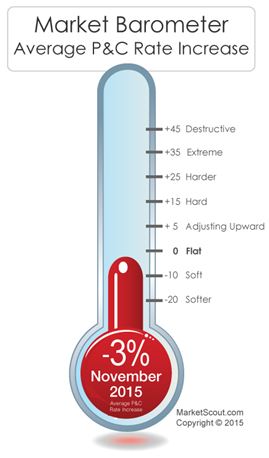

As 2015 draws to a close, U.S. property and casualty insurers continue to adjust rates downward. The composite rate index for all P/C business placed in the United States was down 3% in November 2015, compared to down 2% in October, according to MarketScout.

States was down 3% in November 2015, compared to down 2% in October, according to MarketScout.

“There are very few signs of rate increases. The only coverage with seemingly steady rate increases is cyber liability,” Richard Kerr, CEO of MarketScout said in a statement. “Underwriters don’t have a lot of data to use for pricing cyber so we expect pricing to be inconsistent in the near term.”

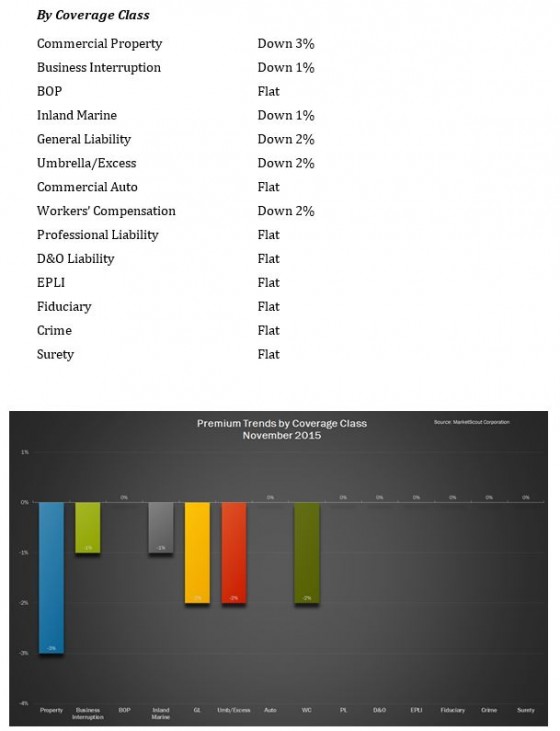

By coverage classification, property, business interruption, business owners’, inland marine, auto, umbrella, and crime coverages all adjusted down an additional 1% from the prior month. General liability and workers compensation were down an additional 2% compared to last month.

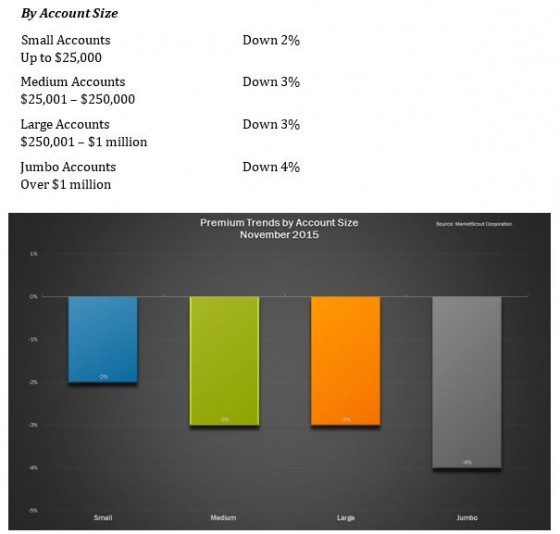

By account size, jumbo (more than million) and large (0,001- million) accounts were the most competitively priced and were down an additional 2% from the preceding month.

Medium ($25,001-$250,000) and small (up to $25,000) accounts were down an additional 1% from October, MarketScout said.

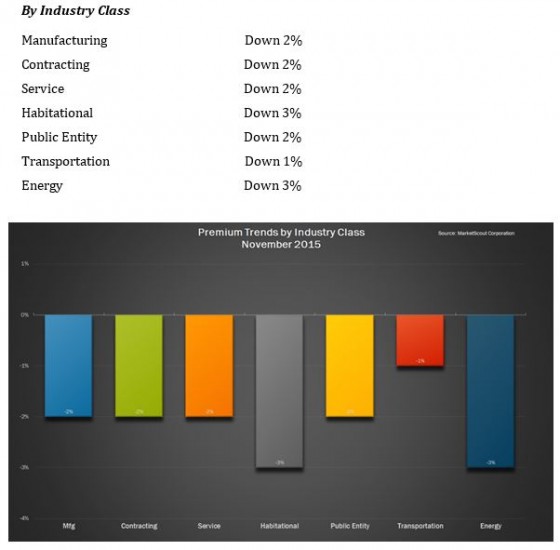

Manufacturing and service industries were down an additional 2% from the prior month. Habitational, contracting, public entity and energy were down 1% from last month. Transportation was unchanged.

Summary of November 2015 rates by coverage, account size and industry class:

Annualized year-on-year rate adjustments from November 2014 to November 2015: