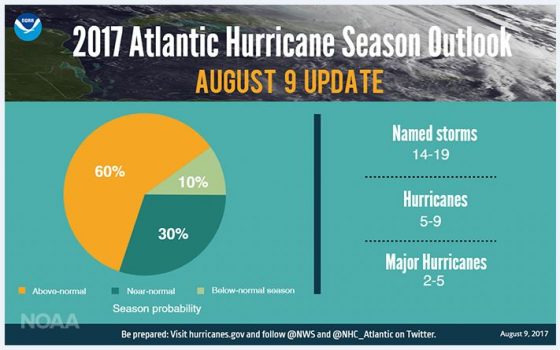

Despite early predictions of a mild 2017 Atlantic hurricane season, the latest forecasts reflect the likelihood of more named storms than originally anticipated. If that is not ample motivation for risk managers to double-check their hurricane preparation, then the reality that it only takes one major storm to generate a widespread disaster should be sufficient to warrant a review of their claims preparation.

This process will not only help spot potential gaps in your insurance, but also any issues in your planning that may affect the amount and delay the timing of a claim recovery. Based on recent experience, here are some tips for hurricane claims preparation and management.

This process will not only help spot potential gaps in your insurance, but also any issues in your planning that may affect the amount and delay the timing of a claim recovery. Based on recent experience, here are some tips for hurricane claims preparation and management.

Conduct a thorough review of your property insurance. Start by checking your deductible. After a loss, the first question risk managers often get from leadership is: “What’s our retention?” You also need to see if your policy has a blanket or percentage deductible. If the latter, is it a percentage of total insured value (TIV)? Do separate deductibles apply to physical damage and business interruption? Double-check your business interruption deductible. A 2% deductible on a business interruption loss equals seven days of self-retention (365 days x 2%).

In reviewing your policy, check the definitions of covered perils. Look for specific references to “storm surge,” “named windstorm” and “flood.” You’ll also want to make sure your policy covers costs to protect and preserve insured property that sustains physical damage and addresses business interruption losses when a facility is closed to preserve or protect property.

Check fee coverage for claims preparation. In a catastrophe, you may need to retain an outside claims consultant to manage your claim; this coverage—standard in some policies and optional for a nominal surcharge in others—comes in handy for complex claims.

Risk managers also shouldn’t overlook the extended period of indemnity, which gives policyholders additional time after a damaged property is restored to regain market share. And don’t miss assessing how your business interruption coverage addresses payroll; most policyholders want coverage that treats payments to hourly workers as a fixed expense (ordinary payroll), especially during catastrophe events.

During your policy review, be sure not to miss the opportunity to pre-select your adjuster. Designate an adjuster in your insurance policy and meet with them and your insurer’s claims director or examiner before any loss. Besides informing them about your company’s operations and claim strategy, a meeting helps structure the claims process.

List your claims team in your emergency response plan. Creating a team in advance—including claim advocate, restoration company, forensic accountant, engineers and building consultants—will mean they can be mobilized immediately following a major loss event.

After a loss event, communicate with key internal stakeholders. Keep your c-suite, operations, procurement and legal teams fully informed of your loss situation and claim process. And be sure all employees have ample instruction. They will need guidance for setting up loss accounts, invoicing, tracking internal labor, inventory, fixed asset ledgers and on any purchases to help mitigate the loss. They also need to understand the sensitive nature of any discussions with insurance company representatives.

Act quickly to assess the loss. Immediately evaluate the extent of property damage and obtain recommendations on temporary repairs and remediation needed to preserve and protect property. Show the adjuster the full scope of the loss so an appropriate reserve is established.

Designate a key member of your claims team to coordinate, manage and communicate activities of emergency resources, remediation, restoration vendors, environmental specialists and other providers involved in your claim. This encompasses all site inspections and remediation, timelines, target dates, ownership of issues and accountability, and facilitates expedited reviews of damaged inventory.

Work closely with your insurer throughout the loss adjustment process, as well, to negotiate partial payments based on expected short-term expenditures.

Get outside help for complex losses. By bringing expertise and special resources, such as drones and other technology, to determine extent and scope of loss, prepare accurate damage and business interruption assessments, claim experts can make a significant difference in your recovery.

Large-scale catastrophes can involve delays in insurance adjustment and elongated downtime, which can have enduring and widespread negative consequences for an enterprise. With careful planning, risk managers can help their organizations achieve faster and more complete recoveries.

For more information on hurricane preparedness and natural catastrophe planning, visit: http://www.aon.com/disaster-response/

Excellent article — every risk manager or business owner should read this

Nice one. Will use this to remind our customers of the advice we’ve given them. thanks for sharing.