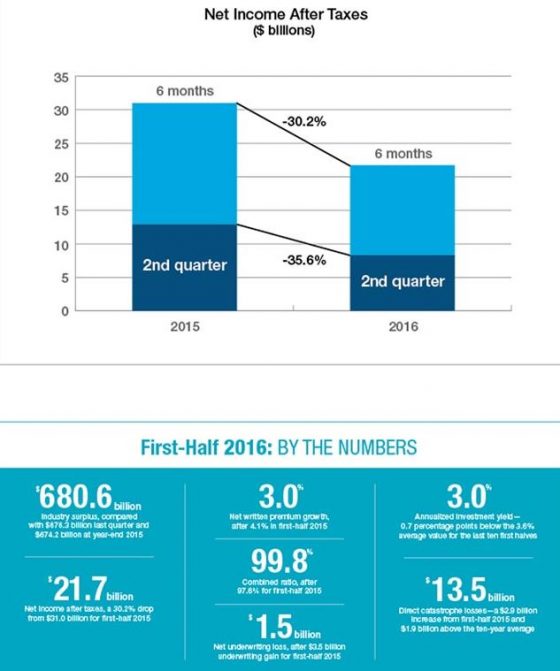

A deteriorated combined ratio seen by insurers along with slow net written premium growth contributed to net underwriting losses of $1.5 billion in the first half of 2016. Insurers’ combined ratio deteriorated to 99.8% from 97.6% in the first-half of 2015, and net written premium growth slowed to 3.0% from 4.1% a year earlier, according to a report from ISO and the Property Casualty Insurers Association of America (PCI).

The Insurance Information Institute’s Steven N. Weisbart explained:

In general, premiums may grow for any or all of several reasons. First, there is growth in the number and/or value of insurable interests (such as property and liability risks). Second, there is an increase in the willingness of buyers who had some or no insurance to purchase or add to their insurance protection, net of those who reduce or drop it. And third, there is an increase in rates (that is, the price per unit of coverage).

buy amoxil online cphia2023.com/wp-content/uploads/2023/08/jpg/amoxil.html no prescription pharmacy

Net investment income dropped to $22.1 billion in the first-half from $23.4 billion a year earlier, and realized capital gains decreased to $4.4 billion from $8.2 billion, resulting in $26.5 billion in net investment gains for the first-half, down $5.1 billion from a year earlier.

Direct insured property losses from catastrophes in the United States totaled $13.5 billion in the first-half, up from $10.7 billion a year earlier—above the $11.6 billion average for first-half direct catastrophe losses for the past 10 years, according to the report.

“The industry’s results continued to worsen in the first half of the year, as insurers reported a first-half net underwriting loss for the first time since 2012 and saw their combined ratio exceed 99%,” Beth Fitzgerald, president of ISO Solutions, said in a statement. “Catastrophe losses remained higher than in previous years. Texas was hit by a hailstorm that has been described as the costliest in the state’s history, and several states in the central United States experienced severe thunderstorms. With interest rates and investment yields remaining low, insurers must find ways to improve operational efficiency while still providing valuable coverage for their policyholders.”

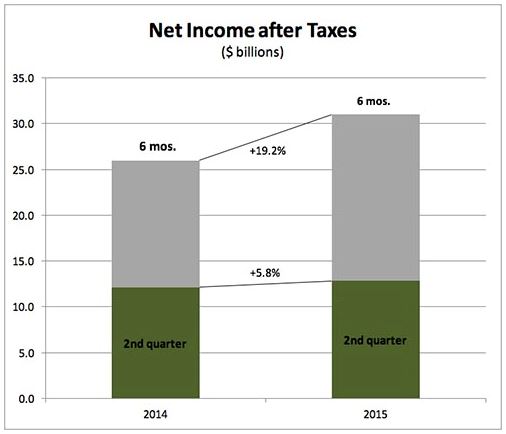

In the second quarter of this year, insurers’ net income after taxes fell to $8.3 billion from $12.9 billion in the second-quarter of 2015, and their combined ratio worsened to 102.

buy orlistat online https://royalcitydrugs.com/orlistat.html no prescription

1% in second-quarter 2016 from 99.4% a year earlier.

Their annualized rate of return on average surplus dropped to 4.

9% in second-quarter 2016 from 7.7% a year earlier. Net written premiums rose 2.9% in second-quarter 2016 compared with 4.

5% in second-quarter 2015.