Speeding. Harsh stops. Rapid acceleration. Cornering. Fleet managers are likely familiar with these buzzwords related to driver behavior, but what is the real impact of not fixing the way employees operate company vehicles?

According to the National Highway Traffic Safety Administration, driver error causes 94% of all vehicle collisions. Along with the physical and psychological consequences that accidents cause all parties, they can also have far-reaching financial liabilities for businesses if company drivers are found to be the negligent party.

Driving in winter weather amplifies these risks, and without the proper precautions, a company’s drivers may cause a fatal accident on icy or snow-covered roads if they speed when running late, make harsh stops when distracted, or rapidly accelerate in traffic.

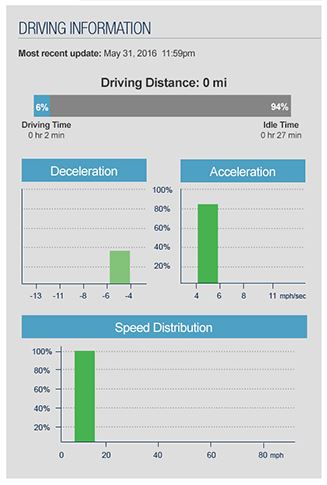

We know the basic rules of thumb for driving in winter weather: Slow down, leave extra distance between your vehicle and the one in front of you, turn the wheel into a skid. But for employees who drive company vehicles, there is an added layer to safer driving in winter weather: telematics. Telematics are devices that gather and send data from the vehicle to fleet operators, providing insight into drivers’ actions and their safety, and other information like the conditions of the vehicles and roads.

Here are three tips for using telematics to keep drivers safe during winter weather:

- Closely monitor driver speed

Usually, companies set real-time speeding alerts with some room for driver error. Leaving this room for drivers includes setting posted speed alerts that do not trigger unless the driver is traveling at least 10 miles per hour over the posted speed limit, or setting high speeding thresholds in general where the alert only hits if the driver is going above 80 miles per hour.

A best practice during winter months is to set these thresholds much lower and become more stringent on violations. For example, setting the posted speed limit violation threshold to 2 miles per hour over the posted speed of the road can ensure that drivers are staying close to the limit and taking their time getting to their next stop.

- Stay alert on maintenance demands

Telematics solutions can monitor for various vehicle maintenance needs, such as oil life and tire pressure, in real time and notify the fleet manager when maintenance is needed.

Batteries die faster in cold weather, especially when they sit for extended periods. By using a telematics solution, fleet managers can receive alerts when batteries drop below a specific voltage. Setting this alert serves as a reminder to start the vehicle or investigate to prevent a dead battery.

This knowledge can save a fleet thousands of dollars in unnecessary maintenance costs and improve safety for drivers by reducing the number of faulty vehicles.

- Proactively coach drivers to navigate tough road conditions

Speeding, rapid acceleration and harsh braking should always be avoided, but these actions are particularly dangerous in winter weather environments. By harnessing GPS telematics and predictive analytics, fleet managers can catch patterns of unsafe driving behavior before it results in a serious accident. Rather than rely on general training for all drivers, fleet managers can provide one-on-one evaluations that focus on each driver’s pain points using real-time alerts, reactive reports and driver scorecards.

Enforcing a business safety culture backed by actionable telematics data can ultimately help companies ensure the safety of their employees and the public in real time. No business wants its drivers to be put in harm’s way on the road, but safety also makes good business sense.

Company vehicles are driving billboards, and along with the potential to put the public in harm’s way, it will ultimately hurt the bottom line if the brand is associated with accidents, fatalities and poor driving habits.

about driving behavior—insights that can shed light on a driver’s risk category. In a further innovation, 2016 brought the establishment of a telematics data exchange, enabling risk managers to make use of this data with the consent of drivers.

about driving behavior—insights that can shed light on a driver’s risk category. In a further innovation, 2016 brought the establishment of a telematics data exchange, enabling risk managers to make use of this data with the consent of drivers.