Electricity is the foundation of society, making the electric grid one of our most critical infrastructures.

It is also one of the most vulnerable, and is subject to a number of variables, according to, Lights Out: The risks of climate and natural disaster-related disruption to the electric grid, a study by students of Johns Hopkins University’s School of Advanced International Studies, funded by Swiss Re.

According to the report, in recent years there has been a trend of more natural disasters globally, with 191 natural catastrophes in 2016 and a 24% increase from the level in 2007.

In the United States, 43 natural catastrophes caused huge property losses in 2016, almost double those of 2007.

Lights Out focuses on the Pacific Northwest, which is an “illustrative case study in climate and natural disaster related electric grid disruption. The region is prone not only to high-frequency, low-intensity natural disasters such as droughts and flooding, but also at risk of catastrophes like the Cascadian Subduction Zone (CSZ) event, an earthquake-tsunami combination that is expected to devastate the coastline from northern California to southern British Columbia,” according to the report.

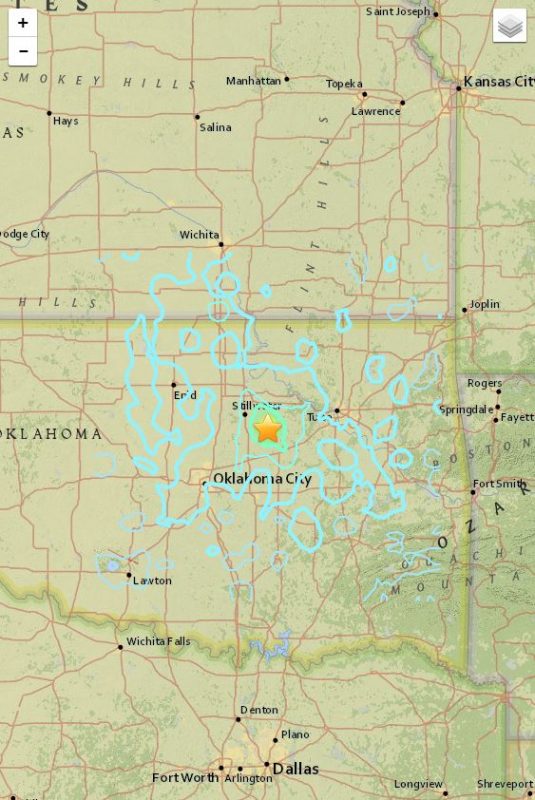

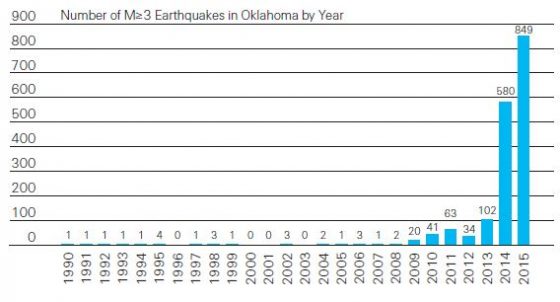

As climate change alters the seasonality of water runoffs in the Pacific Northwest, the study found that electricity generation and the operation and maintenance of hydroelectric dams face greater challenges. What’s more, different parts of the grid are vulnerable to different perils. For example, above-ground lines are vulnerable to weather events, while underground lines are susceptible to earthquakes. In Oregon, for example:

More than 50% of substations would be damaged beyond repair in the event of a magnitude 9.0 earthquake. In addition, the vulnerability of the electric grid is highly interdependent with other critical infrastructure systems, including roads, water and sewage treatment, and natural gas pipelines. In the event of a major earthquake, damage to road networks can make it impossible to repair transmission and distribution lines, thereby preventing the restoration of all other electricity-dependent lifeline services (water, sewage, telecommunications).

The costs of outages for construction and restoration of the grid are estimated to be 1.59 times higher in highly populated locations versus flat land areas with fewer inhabitants. Costs are also higher when infrastructures such as emergency roads are destroyed, which would slow down repairs to roads, in turn delaying restoration of electric power and impacting telecommunications, water and sewage services.

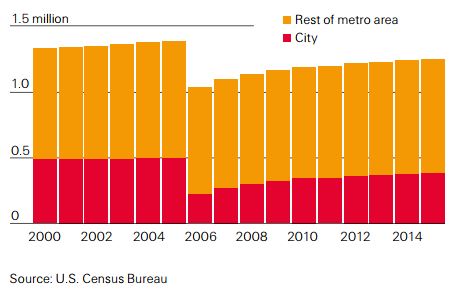

There may be long-term financial implications as well, as entire communities would be impacted, leading to a possible migration of residents to areas not effected by the disaster. Following Hurricane Katrina in 2005, for example, the population of New Orleans dropped dramatically, and 10 years later, had only returned to 90% of its pre- 2005 levels.

Total population of New Orleans 2000-2015; Hurricane Katrina hit New Orleans in 2005:

With the increase in natural disasters, the recent destruction caused by Hurricane Katrina and Superstorm Sandy as well as the prospect of a magnitude 9.0 Cascadia earthquake, “It is imperative that public and private sector entities explore potential solutions for combating and mitigating damage to the electrical grid and disruption from power outages.” The report urged utilities to increase the resilience of their systems in a number of ways, beginning with conducting utility vulnerability assessments to identify vulnerable infrastructure and develop resilience plans. While many utilities have taken the initial step of identifying the resilience and mitigation strategies that they intend to implement, their implementations after these assessments vary widely by utility.

Utilities have several options for hardening the resilience of their systems, depending on the specific types of natural hazards they face. For example, checking poles for rot and moving infrastructure out of flood zones and landslide-prone areas helps to maintain distribution and transmission infrastructures, keeping them from going down in regions with heavy rainfall and flood risk. Pruning trees to protect wires from falling branches is also important in regions experiencing higher intensity storms, according to the report.

Highlighted trends:

- Climate change is causing more severe and frequent natural disasters, meaning power systems face increased strain from catastrophes.

- The interdependence of systems creates further complications: if the electric grid is down for an extended period, collateral effects can lead to disruptions in other services such as water, sewage and telecommunications.

- The economic implications are challenging governments and energy providers. Not only do they require pre-disaster financing provided by insurance, they must address how to make their systems more resilient to future flooding, droughts and earthquakes.