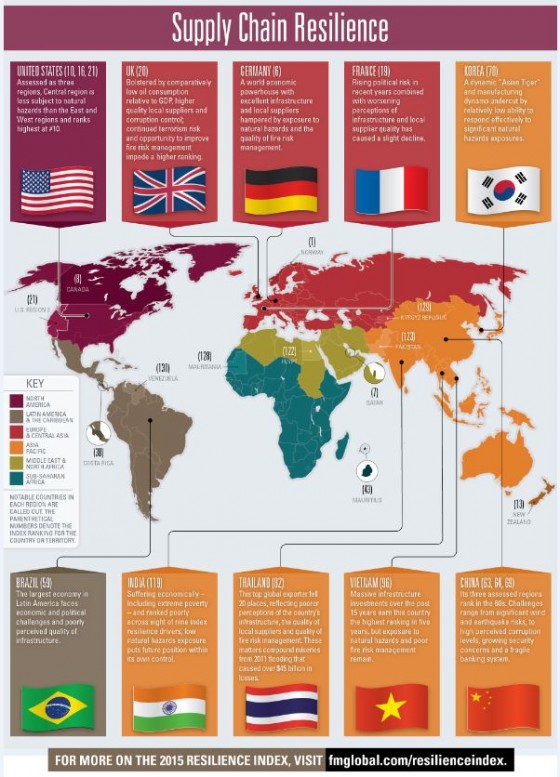

Businesses are more dependent on their supply chains than ever, with supply chain disruption one of the leading causes of business instability. To thrive, companies need to be resilient, and part of that is their location and the location of suppliers. According to FM Global’s 2015 FM Global Resilience Index, Norway tops the list of resilient countries, with Switzerland in second place.

The study’s purpose is to help companies evaluate and manage their supply chain risk by ranking 130 countries and regions in terms of their business resilience to supply chain disruption. Data is based on: economic strength, risk quality (mostly related to natural hazard exposure and risk management) and supply chain factors (including corruption, infrastructure and local supplier quality).

According to the study:

1. Norway retains its top position in the index from last year, with strong results for economic productivity, control of corruption, political risk and resilience to an oil shock. The country’s management of fire risk offers opportunity to improve still further.

2. Despite its massive oil reserves, Venezuela ranks 130, placing it at the bottom of the index, and reflecting the many challenges South America faces, ranging from economic and political to geological, with its west coast on the Pacific ‘Ring of Fire’.

3. Taiwan has jumped the most in the index – 52 places in the annual ranking to 37; more than any other country. Its rise is due mainly to a substantial improvement in the country’s commitment to risk management, as it relates both to natural hazard risk and fire risk. Given the country’s location at the western edge of the Philippine Sea plate, this is a welcome development.

4. Ukraine, ranked 107, and Kazakhstan, ranked 102, dropped more places this year than any other country; a fall of 31 places each. Unsurprisingly, for Ukraine, the worsening political risk, combined with poorer infrastructure, was to blame. The fall for Kazakhstan this year reflects a poorer commitment to natural hazard risk management in the region.

5. In the European Union (EU), Greece fell from position 54 to 65. The recent victory of the anti-austerity Syriza party almost certainly will usher in a period of greater friction and turbulence with its EU partners.

6. France, ranked 19, trails Germany at 6, the leading EU nation. France has slid down the index in recent years reflecting a rising risk of terrorism – evidenced tragically in Paris – and deteriorating perceptions of both infrastructure and local suppliers. Also exposed to terrorism risk is the United Kingdom, which nevertheless held steady at 20 for the third year running, aided by its relative resistance to oil shocks.

New to the top 10 this year are Qatar, ranked 7, and Finland, ranked 9. Qatar benefits from its macroeconomic stability, efficient goods and labor markets and high degree of security. The country owes its rise of 8 places to a considerable improvement in commitment to fire risk management in the region. Finland’s strengths derive from its innovative capabilities, a product of high public and private investment in research and development, strong links between academia and private sector companies, and an excellent record in education and training, according to the study.

In 10th place is U.S. Region 3, the central region of the United States. While this part of the country is subject to a variety of natural hazards, there is less exposure than states on the east or west coasts of the country. Belgium, ranked 11, and Australia, ranked 14, dropped out of the top 10–barely–and both countries retain high positions in the 2015 index.