An increasingly key theme year over year, resilience is at the root of the latest Excellence in Risk Management India report from Marsh and RIMS—and the RIMS Risk Forum India 2021 virtual event, where the report was officially released today. In the second year of the COVID-19 pandemic, risk professionals in India reported acute short- and long-term concerns about the interconnected risks of COVID-19 cases, global economic recession, and surging cyberrisks amid shifts in work arrangements.

In addition to the death of more than 5 million people in India, the pandemic has taken a considerable economic toll on the region. “According to the Organization for Economic Co-operation and Development (OECD), India’s economy contracted by close to 8% in 2020, while the world’s economy contracted by 3.5%,” the report noted. “Despite the OECD’s projections for economic expansion—both in India and globally—in 2021 and 2022, the potential for a prolonged global recession remains a concern for organizations in India.

”

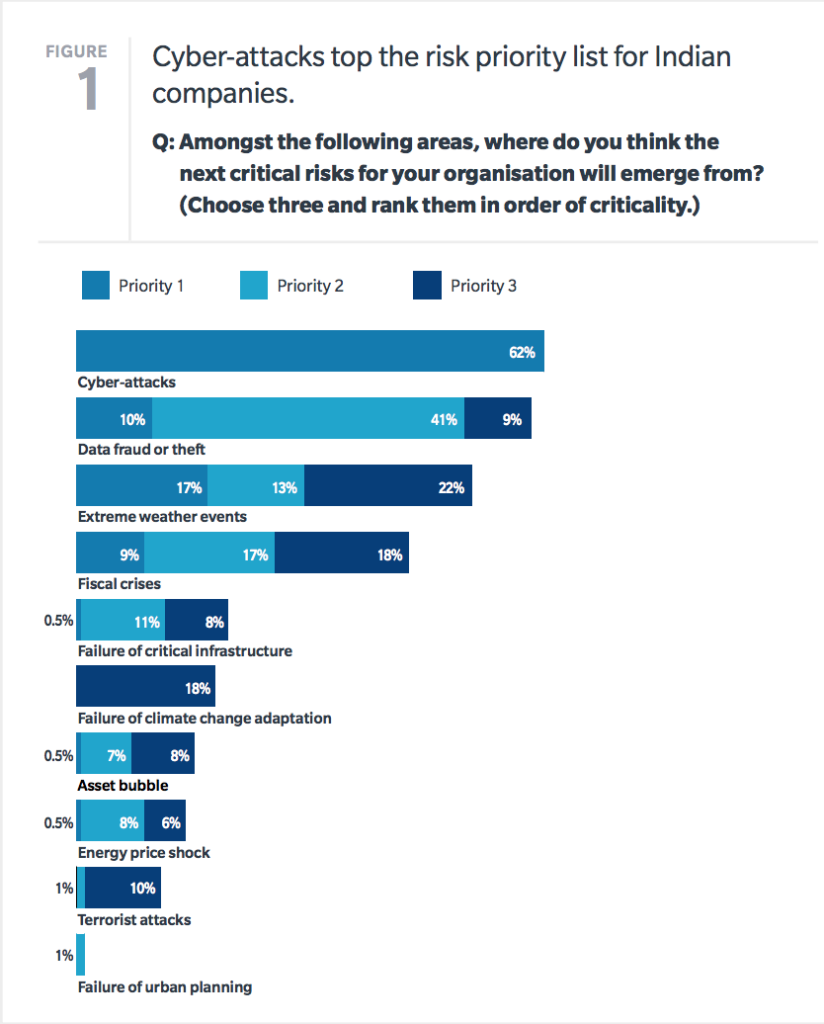

Previously one of the top risks for India-based risk professionals before COVID-19, cyberrisk has also increased significantly with the pandemic and the shift to remote work. “The shift to a remote workforce necessitated by sweeping lockdowns to stem the spread of the pandemic is widely seen as having increased cyberrisk,” Marsh and RIMS noted. “The Indian Computer Emergency Response Team (CERT-In) data indicated that cyberattacks in India rose by 300% in 2020, according to news reports. And cyber risk remained elevated in 2021, with more than 600,000 cybersecurity incidents reported in the first six months of the year alone, according to CERT.”

The continuing pandemic, resulting fallout, and ever-growing cyberrisk have presented the biggest risks for organizations in India in 2021, and the survey indicates that local risk professionals expect these to dominate the agenda for businesses in the year to come.

Despite the considerable concern, few respondents said their company is fully prepared for the continued fallout from COVID-19 or future pandemics. Asked to rate their organization’s preparedness from 1 to 5 (not prepared to fully prepared, respectively), the majority of India-based risk professionals ranked their organization a 3, and only 10% said they are fully prepared. While cyberrisk has been a top threat for longer, preparation is not much better for the threat—only a quarter of Indian companies said they are fully prepared for a cyberattack. This is particularly concerning as “some extent of remote work is expected to remain, leading to concerns of increased cyberattacks due to unsecured home networks,” Marsh said in a press release.

According to the report, this underscores the imperative to develop robust risk management strategies for both current and emerging risks and to focus on building resilience. Marsh identified four “common behaviors among companies that are on the path to becoming more resilient”: anticipating risk, connecting risk management to business strategy, avoiding gaps in the perception of preparedness, and measuring relevant data. Marsh and RIMS explained these further, defining key pillars that have set successful businesses apart, and potentially also offering considerations for other organizations to develop more mature risk management programs:

- Anticipation: Resilient companies expect the unexpected. They have crisis management plans in place, but they also dig deeper, look farther ahead. Consider that during the pandemic even organizations with thorough business continuity plans struggled. Why? Many of them didn’t fully anticipate the widespread, long-lasting damage a pandemic could create.

- Integration: Another key behavior among resilient organizations is to fully integrate risk management with operations and strategy. Doing so increases the ability to develop effective responses. Most organizations do not connect resilience planning with their long-term investment strategy. Those that do make the connection are on the path to better mitigating financial exposure, reputational damage, business interruption, and other losses.buy solosec online orthomich.com/img/blog/jpg/solosec.html no prescription pharmacy

- Preparedness: On the journey to resilience, it’s important to develop an accurate perception of an organization’s preparedness. A false sense of security can halt an organization in its tracks. Companies often overestimate how quickly and effectively they will be able to respond to and recover from a given risk.buy antabuse online orthomich.com/img/blog/jpg/antabuse.html no prescription pharmacy

- Measurement: There is no shortage of data and analytics in today’s business environment. But consistently applying metrics can be a stumbling block. Many companies fail to conduct a high rate of modeling and forecasting even on risks they see as important. And among the companies that do so, most only model in select areas.

Marsh and RIMS recommended that organizations in India focus on resilience heading into 2022 and beyond. “Resilience means being able to absorb the impact from a range of emerging risks and depends in large part on having robust risk management strategies in place,” the report explained. “This includes anticipating risk, connecting risk management to business strategy, ensuring your organization’s perception of preparedness doesn’t lead to a false sense of security, and measuring relevant data.”

Respondents largely indicated that their organization planned to increase investment in risk management, with 55% saying they expect increased resources, 27% expecting investment to stay the same, and only 4% expecting a decrease. This could be a critical differentiator in navigating COVID-19 recovery and other emerging risks in 2022. Indeed, 42% cited budget at the most critical barrier to understanding the impact of emerging risks on risk management.

Among the takeaways from the report, Marsh and RIMS urged organizations to invest in preparedness. “Look beyond pandemic as you develop a risk management strategy that is prepared to respond to any number of emerging risks,” the report said. “For example, shifting work patterns have intensified an already escalating cyber risk landscape that calls for a range of responses, from scenario planning to financial quantification.”

In addition to a panel on the Excellence in Risk Management India report, the RIMS Risk Forum India 2021 virtual event includes a number of sessions that address resilience challenges and opportunities for risk professionals in India. The program includes keynote addresses by Ajay Srinivasan, chief executive officer at Aditya Birla Capital Limited (ABCL), and Dr. Soumya Kanti Ghosh, group chief economic advisor at the State Bank of India, as well as education sessions like “Cyber Risk Management: A Priority for a Resilient Economy,” “Climate Risk and Your Path to Resilience,” “What COVID-19 Has Taught Us About ESG Risks and Why Risk Management Needs to Change,” and “Breaking the Chain: How Understanding Business Interruption Exposures Can Mean Supply Chain Resilience.”

The RIMS Risk Forum India 2021 virtual event continues tomorrow, December 4, and sessions will also be available for on-demand viewing for the next 60 days. Registration can be found here: https://www.rims.org/events/rf/india-forum-2021