OTTAWA—The 2023 RIMS Canada Conference is officially underway here in Ottawa, Ontario, convening more than 1,400 Canadian risk professionals in the nation’s capital.

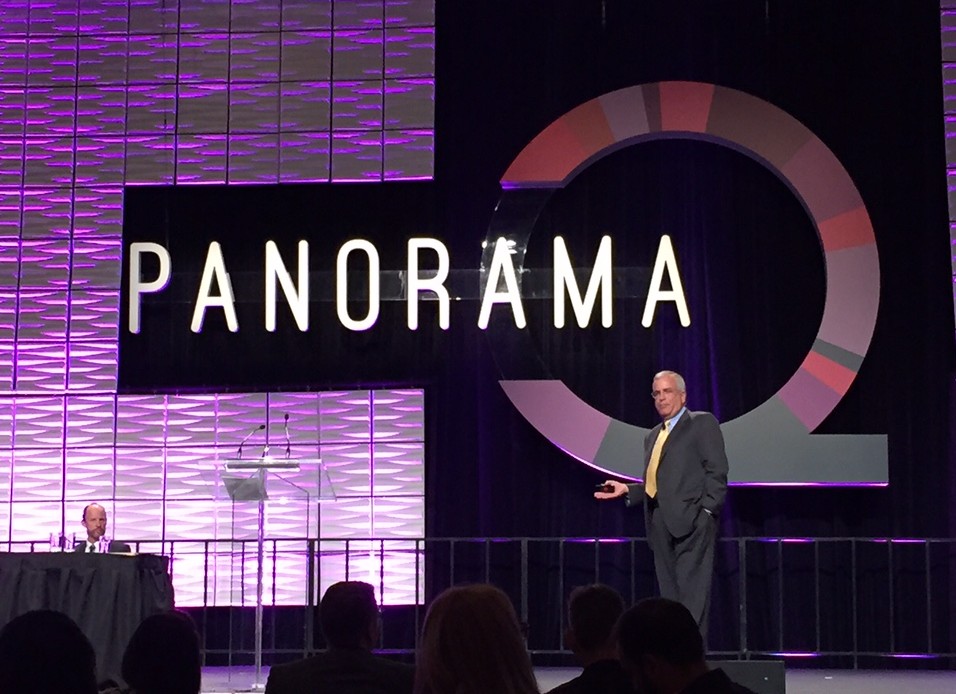

After opening remarks from RIMS CEO Gary LaBranche and RIMS Canada Council Chair Steve Pottle (below), the conference began with recognition for outstanding accomplishments from RIMS Canada members. Considered the highest honor in the Canadian risk management community, this year’s Donald M. Stuart Award went to Catherine Dowdall, director of insurance and loss control at AECON Construction.

Presented by the Ontario chapter of RIMS (ORIMS), the award recognizes exceptional contributions to the risk management profession by a risk practitioner from any of the nation’s 13 provinces.

“Risk management is constantly evolving, but the guiding principles behind the Donald M.

Stuart Award—a commitment to building relationships, sharing experiences, thought-leadership and altruism—have remained the same,” said Valerie Fox, vice president of ORIMS. “In addition to being a trailblazing risk leader, day-in and day-out, Catherine Dowdall graciously devotes her time to helping up-and-coming risk professionals navigate the profession and leverage opportunities to succeed.”

“The risk community is filled with amazing business leaders who are genuinely passionate about supporting others in this wonderfully, rewarding profession,” said Catherine Dowdall. “For those just starting out, don’t be afraid to ask questions, reach out to your peers, volunteer with your local RIMS chapter, take advantage of opportunities that are presented to you. I am truly humbled to be joining previous Donald M. Stuart Award winners, many of whom I have worked alongside with and whom I deeply respect for their continued commitment to risk management excellence.”

During her 40-year risk management career, Dowdall has worked for an array of prominent Canadian corporations, including AECON Construction, Tim Hortons, Canada Post, OLG, Brookfield Properties, Cadillac Fairview, as well as the Ontario Ministry of Government Services. She has also held a number of positions on the board of ORIMS, including serving as president from 1999 to 2000.

“It is always such a pleasure to be able to present this prestigious award to an outstanding individual in our profession,” Fox said. “This year is extra special as I have known and admired Catherine for a long time and have seen first-hand how she embodies all of the creeds that the award represents, particularly the creed of always giving back.”

The Fred H. Bossons Award was also bestowed during the opening session. The award recognizes the individual with the highest average score on the three exams required for the Canadian Risk Management (CRM) designation.

This year’s winner was Mattieu Shorgan, a senior account executive at Wells Fargo.