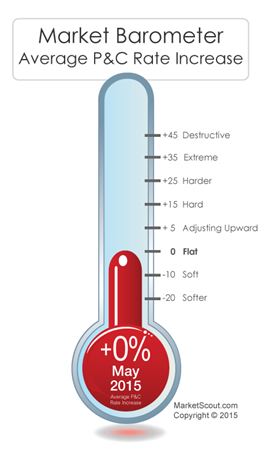

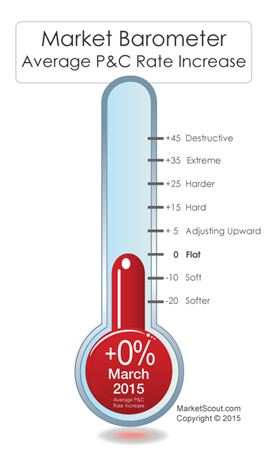

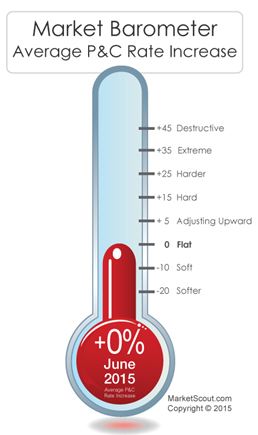

The property and casualty insurance market remained flat through the first four months of this year, with many large P&C insurers holding a steady line, as rates, for the most part, have remained unchanged, according to MarketScout.

“We are in the insurance doldrums. There really isn’t even a breeze of significant movement anywhere,”  Richard Kerr, CEO of MarketScout said in a statement. “The absence of rate movement could be yet another signal that insurers simply are not going to participate in a price-slashing war as was done in previous market cycles. Low interest rates and better underwriting tools are making insurers cautious.”

Richard Kerr, CEO of MarketScout said in a statement. “The absence of rate movement could be yet another signal that insurers simply are not going to participate in a price-slashing war as was done in previous market cycles. Low interest rates and better underwriting tools are making insurers cautious.”

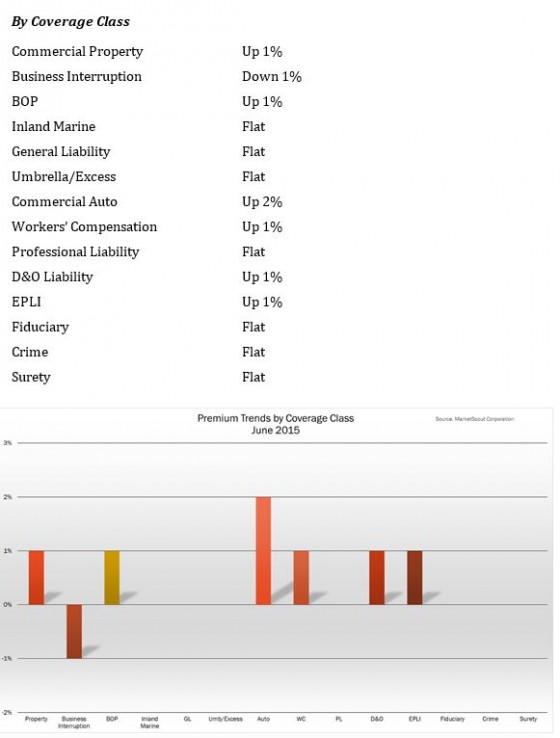

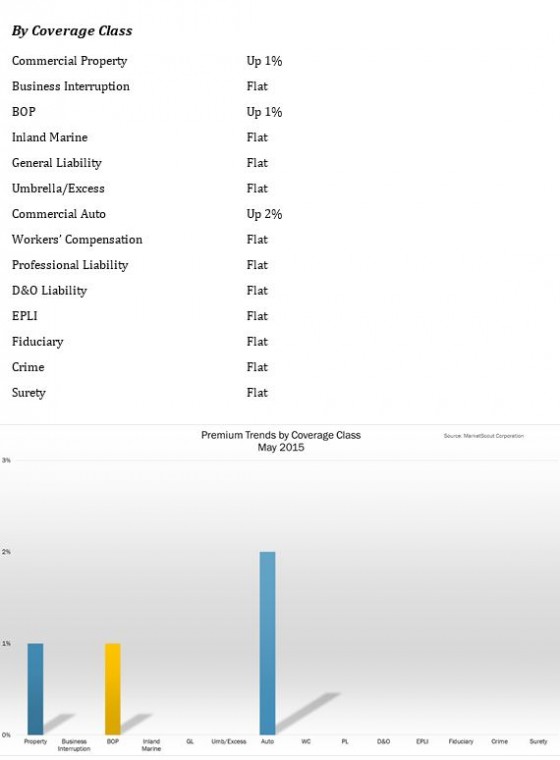

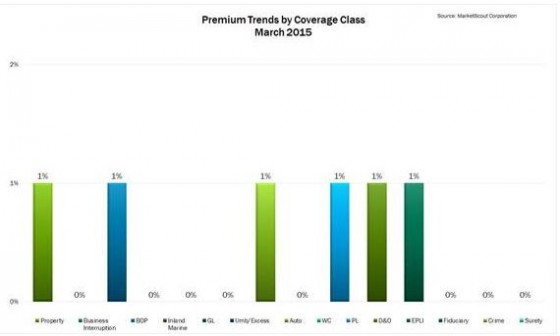

By coverage classification, only one line—business interruption—was down from last month at minus 1% versus flat, or zero increase. Workers compensation, directors and officers and EPLI were up from flat to plus 1%, according to the report.

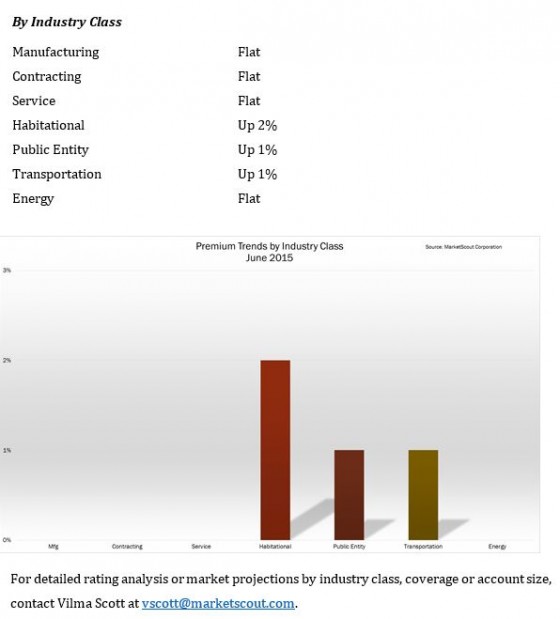

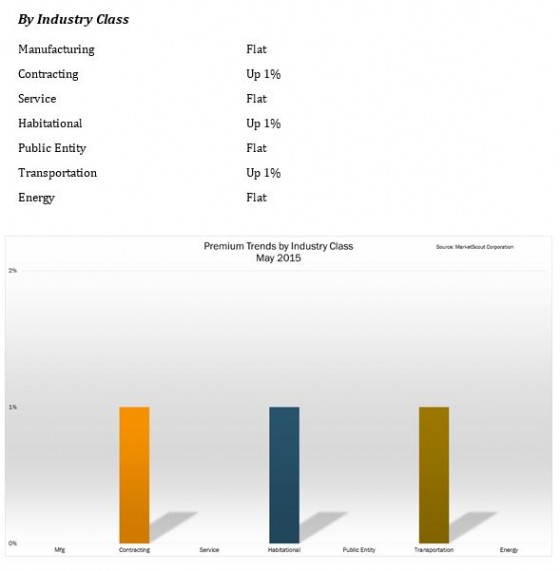

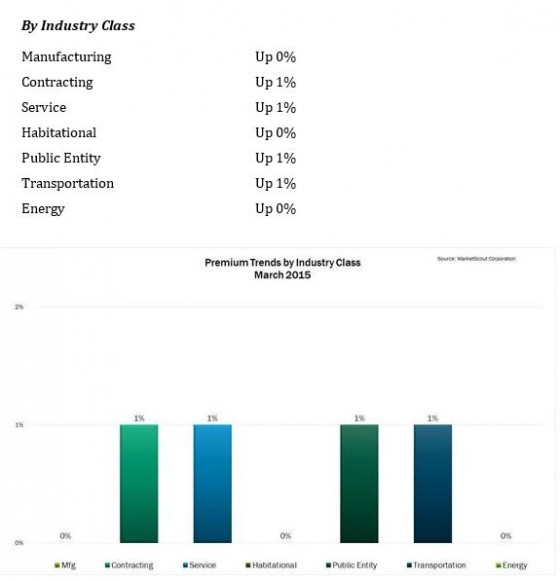

Industry classes balanced out rate movement with contracting adjusting from plus 1% to flat, habitational from plus 1% to plus 2%, and public entity up from flat to plus 1%.

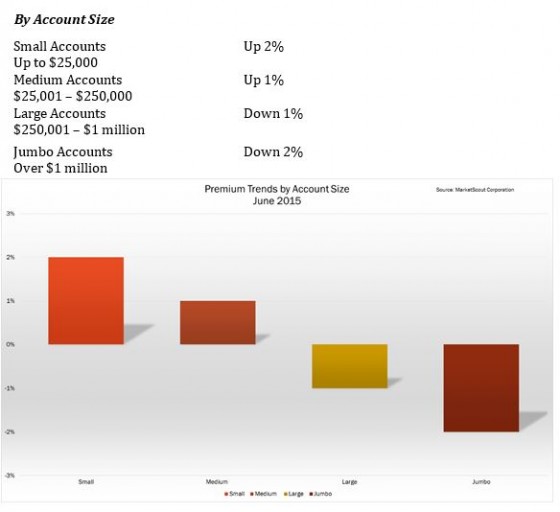

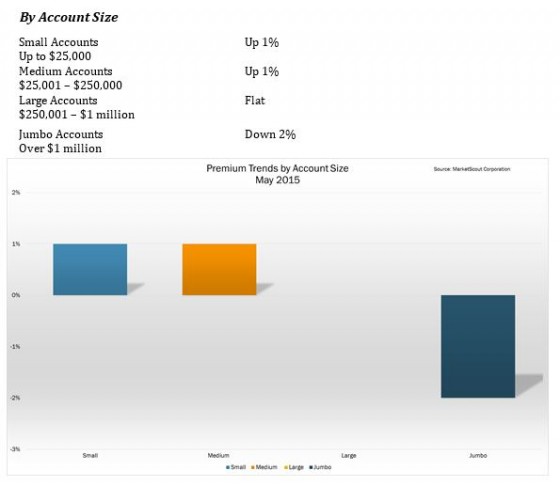

Measured by account size, small accounts (up to $25,000 premium) were up from plus 1% to plus 2%. Large accounts were down from flat to minus 1%. Rates for all other account sizes remained unchanged.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions.

Following is a summary of June 2015 rates by coverage, account size and industry class: