While risk assessments enable organizations to understand their business issues and identify uncertainties, the best assessments go further. They prioritize top risks, assign risk ownership, and most critically, integrate risk management and accountability into front line business decision-making. Simply put, “checking the boxes” just isn’t enough to achieve an organization’s real objectives.

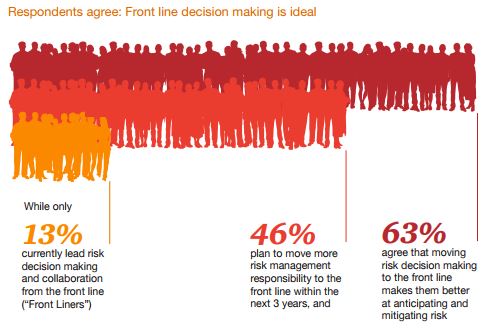

Effective risk assessments can also give organizations a true advantage. Our sixth annual Risk in Review study–comprising viewpoints from more than 1,500 corporate officers in 80 countries—finds that companies shifting risk management leadership and collaboration to the first line of defense are measurably better equipped to succeed. We call these companies “front liners.” While a majority of companies agree that front line decision-making is ideal, somewhat surprisingly, front liners represent only 13% of survey respondents.

Front liners use effective risk assessment strategies to enable revenue and profit growth, while also creating agility to bounce back from adverse events more quickly than their peers. They also outpace the pack when it comes to using risk management tools and techniques (such as a risk rating system or scenario planning).

Based on the study results, here are five strategies you can adopt to gain a front liner advantage:

- Put your risk assessments to use in real-time

For true impact, organizations incorporate risk assessment findings into their business decisions. Assessments should be efficient, and actions should be implemented quickly to address immediate challenges. Annual assessments are a best practice, but our study shows front liners have a robust risk culture, conducting regular assessments. Ongoing collaboration across all three lines of defense, reinforced by continuous monitoring, enables the organization to more effectively align business strategies with risk appetite.

- Develop actionable guidance and insights for leadership

Effective risk assessments are relevant and actionable. Be sure to interpret risk information and recommend next steps to help management incorporate the findings into their strategic decisions. Make it easy for boards and senior management to understand the key findings by providing thorough insights. Data will mean a lot more if you identify the recommendations, target outcomes and next steps. Gaining the front liner advantage is best achieved by integrating risk guidance holistically into the organization, including planning, growth strategy and investments to M&A, staffing, disaster recovery and crisis management.

- Speak in lay terms

Leaders outside the risk management function may perceive risk assessments as an onerous process loaded with abstract language and a heavy focus on negative outcomes. To help leaders see value in these assessments, define the risks, drivers and consequences in familiar terms using meaningful scenarios that are specific to the organization.

- Balance automation with the human touch

While automation enables mass data collection, organizations benefit most when risk assessment surveys are combined with facilitated discussions. Gathering important qualitative information, facilitators can bring together multiple viewpoints and encourage productive debate. Pre-reads may also be a helpful tool to level-set on the organization’s strategic objectives and overall risk landscape.

- Adopt a realistic view of risk management

It can sometimes be difficult for management to accept the findings of a risk assessment, especially if they believe there is a low probability such events will occur. To support strategic, risk-based decision-making, risk scenario analyses can spur productive discussions about the organization’s overall risk landscape, while dynamic, engaging tools like a risk scenario dashboard can help to draw in even the most reluctant participants.

Following these strategies can help your risk assessments to not only be relevant, but also essential to your organization’s business strategy and growth objectives.