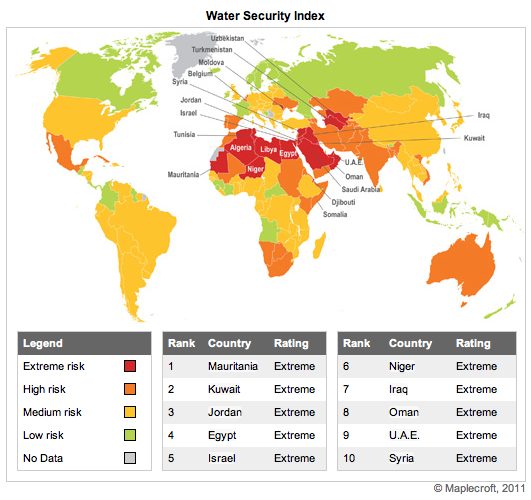

Water scarcity has become a hot topic within the last few years (we ran a feature on the the risk of water scarcity and its effect on businesses in our June 2009 issue). That risk, however, is far greater in certain areas of the world than others. On March 22nd, Maplecroft warned that Middle East and North African (MENA) countries top the list for extreme water security risks, which could lead to further increases in global oil prices and heightened political tensions in the future.

Maplecroft rated 18 countries at “extreme risk” with 15 of those located in the MENA region. Of the 12 organizations of the Petroleum Exporting Countries (OPEC), six are rated as “high risk.”

“Water security has the potential to compound the already fragile state of societal affairs in some countries,” says Professor Alyson Warhurst, CEO of Maplecroft. “For example, in Egypt water security may intensify the on-going civil tensions. In turn it is not unrelated to food security, which leads to cost of living protests and in turn violent oppression in less democratic societies.”

The report states that technological innovations, such as the desalination of salt water, may alleviate some of these risks. Businesses that require intensive water use (food and beverage, semiconductor manufacturing, etc.) will also need to consider their impacts and analyze options for lessening their reliance on water, especially in regions already experiencing shortages.