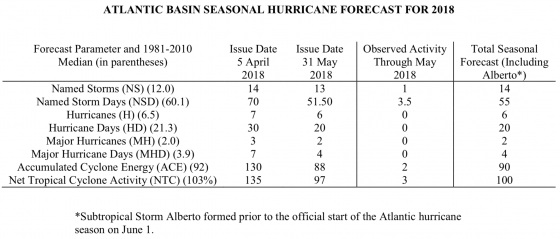

With so many businesses and individuals affected by Hurricanes including Maria, Harvey and Irma in 2017, risk managers and insurers are looking to revised forecasts of this year’s hurricane season for a glimmer of hope that 2018 will not bring the same destruction. They may have found it in new information released by Colorado State University, which indicates that a near-average season is likely. It predicts 14 named storms between now and Nov. 30, of which six would become hurricanes. But the caveat is that one immense storm during a “near-average” season can still wreak havoc on businesses and homes.

The criteria is heavily based on the number of hurricanes and not their economic impact. Look to other years with similar buzzword descriptors to determine if its impact is included in your organization’s systematic risk.

The criteria is heavily based on the number of hurricanes and not their economic impact. Look to other years with similar buzzword descriptors to determine if its impact is included in your organization’s systematic risk.

“The years 1960, 1967 and 2006 had near-average Atlantic hurricane activity, while 1996 and 2011 were both above-normal hurricane seasons,” said Phil Klotzbach, research scientist in the Department of Atmospheric Science and lead author of the report.

Most of those years endured damage caused by heavy tropical storms—the most noteworthy was 2011 when Hurricane Irene touched down and ultimately cost $15 billion alone. Klotzbach’s team predicts that 2018 hurricane activity will be about 135% of the average season. By comparison, 2017’s hurricane activity, highlighted by Harvey, Irma and Maria, exceeded average season expectations by about 245%.

Given the outlook, experts are still optimistic about the insurance industry’s resilience. A recent Moody’s report noted that despite last year’s losses, the reinsurance industry has sufficient capital to absorb hurricane-related claims.

“Hurricanes, particularly Harvey, Irma and Maria, alongside other catastrophe events last year wiped out a number of reinsurers’ profitability for the year and drove the sector’s profitability to its lowest level since 2005,” analyst Rocio Nunez said in a statement.

Here Comes The Flood

There is another risk associated with hurricanes that could also explain the rising costs and number of claims. The storms themselves—not their windspeeds—have been moving slower than they did 70 years ago. With the collective pace of weather systems slowing down, the risk for flooding increases. Jim Kossin, a researcher at the National Oceanic and Atmospheric Association (NOAA), recently published findings and offered some theories to explain why storms and hurricanes are overstaying their welcome.

According to his recent report, A Global Slowdown of Tropical Cyclone Translation Speed:

One thing scientists do know is that the location where tropical cyclones reach maximum intensity has been shifting toward the poles. And, this may be related to or even causing the overall slowdown.

Using the ‘operational best-track’ data from the Automated Tropical Cyclone Forecasting System (ATCF), the 2017 mean-over-land Atlantic translation speed is 17.9 km h-1, which is at the slowest 20th percentile of over-land translation speeds for the period since 1949.

Some experts believe that global warming also contributes to the slower pace since it “weakens the summertime circulation of the atmosphere in the tropics.” Still, a stalled hurricane and ongoing precipitation may be too much for some infrastructures to handle, as was demonstrated in Houston last year.

Hindsight

The 2017 hurricane season was undoubtedly a wakeup call for the United States, as it saw 12 named storms causing 100 deaths—68 from Hurricane Harvey alone—and is considered the 17th deadliest hurricane season since 1990. With regard to economic impact, last year’s natural disasters between June 1 and Nov. 30 caused $200 billion in reported damages, making it the second-costliest season on record behind the 2005 season.

“Hurricane Harvey was a different beast—its movement stalled because of high pressure regions that essentially blocked its path. It’s not clear whether we’ll see that specific situation more commonly as the world warms,” an Ars Technica article noted. Other ways in which climate change contributed to Harvey’s impact—like warmer ocean water and warmer air holding more water vapor—are more obvious.

Risk Management Monitor reported that the majority of senior executives of large U.S. companies with operations in Texas, Florida or Puerto Rico admitted to being unprepared for the hurricanes that devastated their communities in 2017. According to a survey by FM Global, 64% of respondents said the hurricanes had an adverse impact on their operations, a full 62% said they were not entirely prepared.