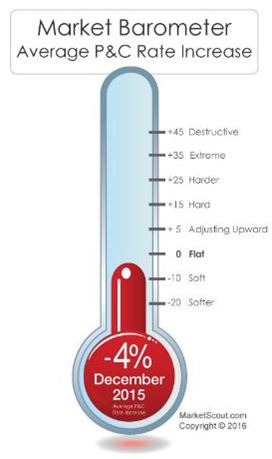

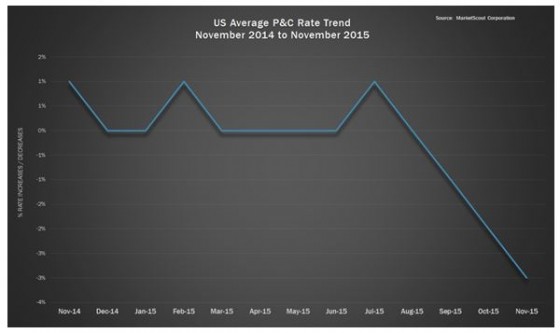

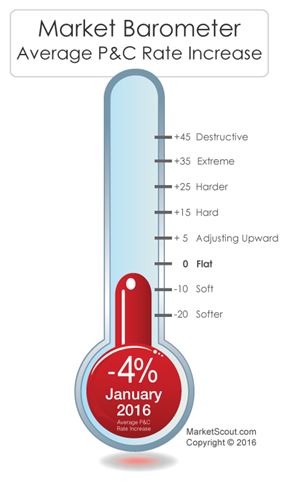

The composite rate for property and casualty business placed in the United States measured minus 4% in January. Rates dropped from minus 2% in December 2015 to minus 5% in January 2016, MarketScout reported.

“Commercial property insurers are getting ready to scratch each other’s eyes out as they fight for market share,” said Richard Kerr, CEO of MarketScout. “We see nothing to  prevent commercial property rates from dropping further.”

prevent commercial property rates from dropping further.”

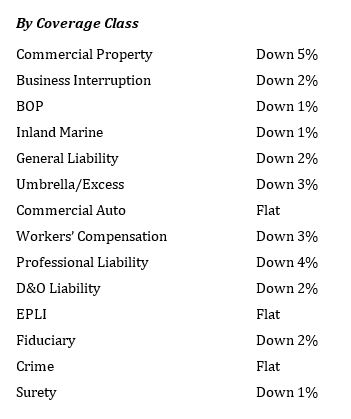

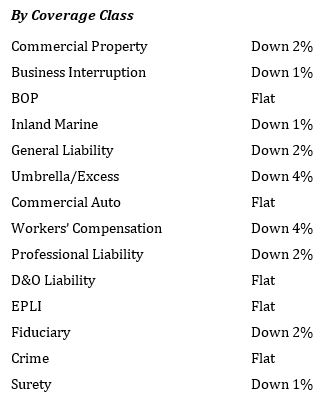

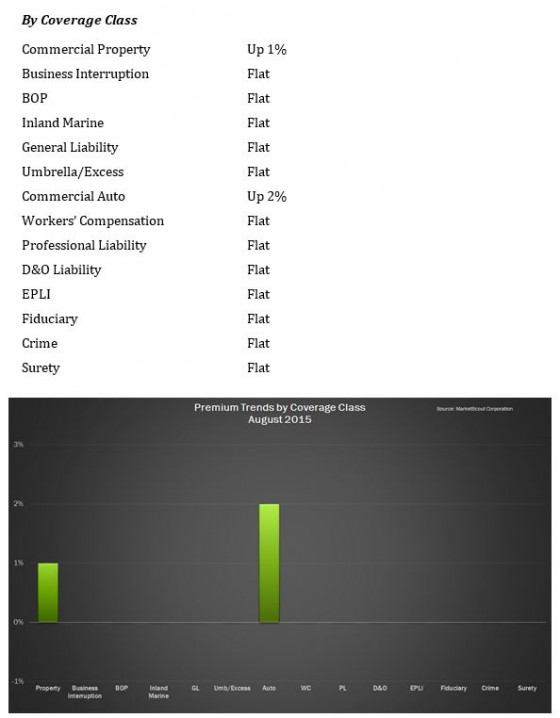

In addition to commercial property, business interruption, BOPs, professional liability, and D&O coverages were all more competitively priced in January compared to December 2015. Umbrella/Excess liability and workers compensation rates actually increased slightly over the same period, he said.

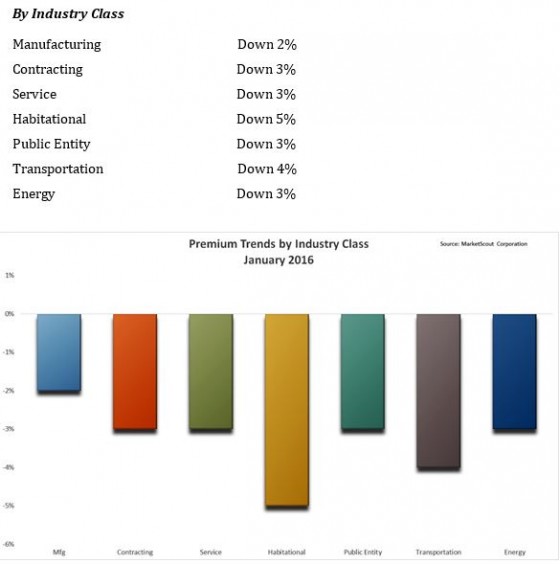

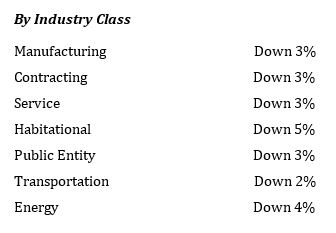

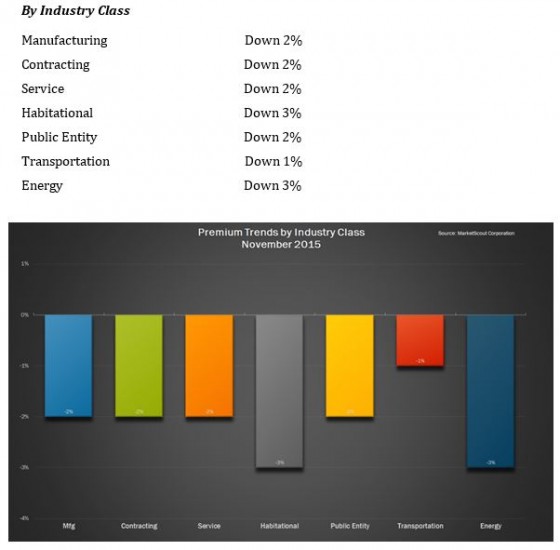

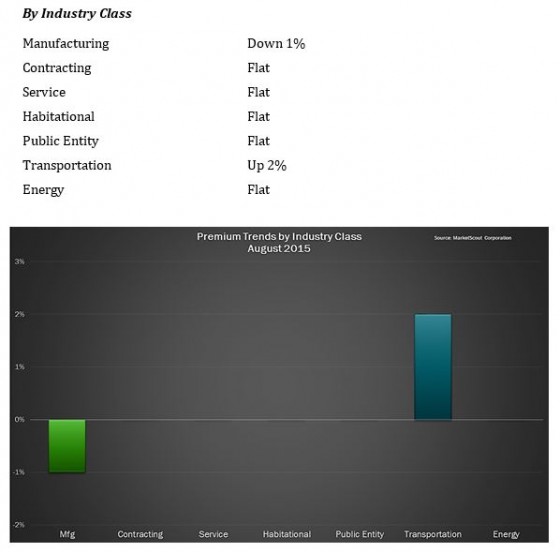

Transportation companies were assessed rate decreases of 4% in January 2016 versus 2% in December 2015. Rates for manufacturing and energy accounts were slightly higher in January 2016 than in December 2015. All other industries remained unchanged.

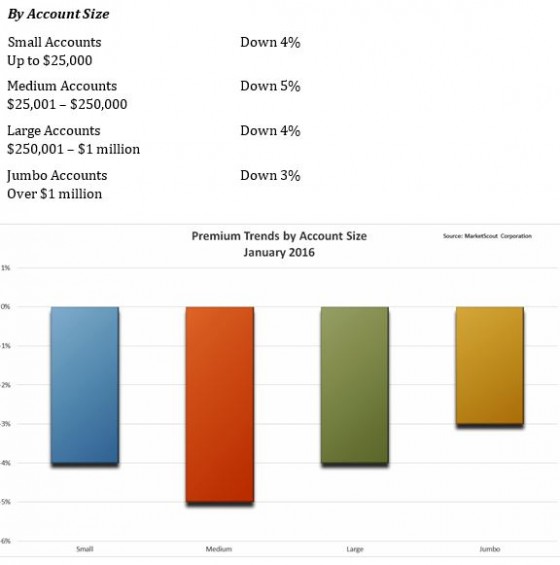

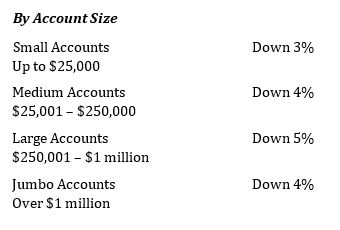

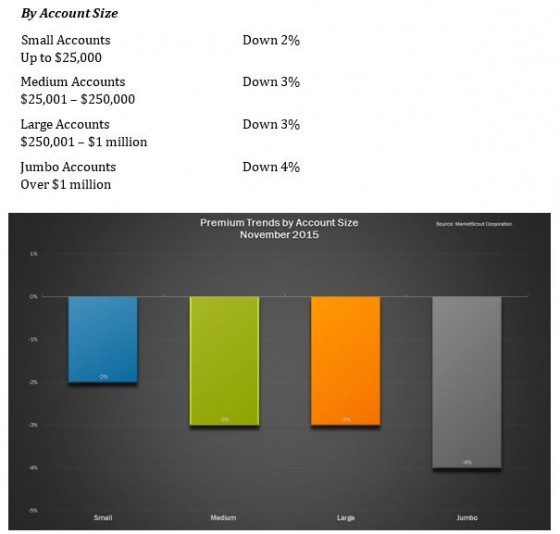

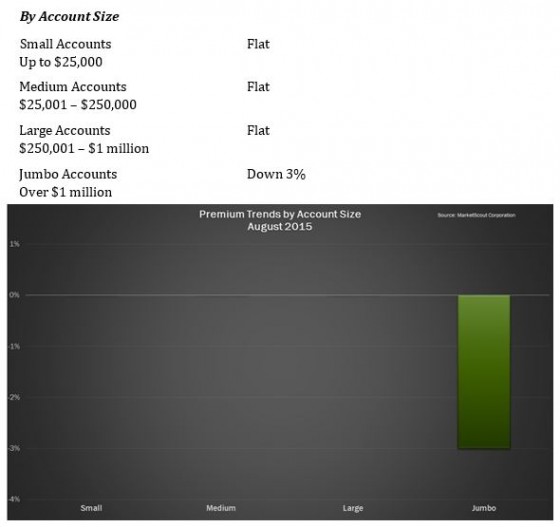

By accounts size, rates for small and medium sized accounts (all under $250,000) were more competitive in January 2016 than in the prior month. Large and jumbo accounts (over 250,001) were assessed rates slightly higher in January versus December.

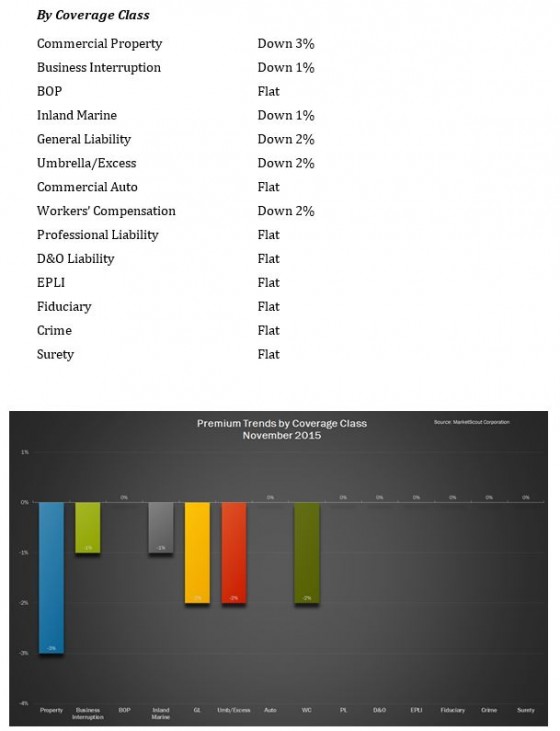

Summary of the January 2016 rates by coverage, industry class and account size: