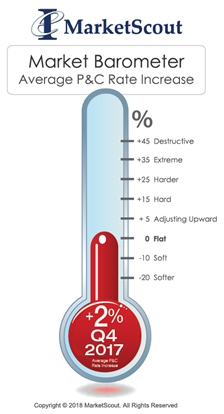

Property and Casualty rates in the United States were up 2.5% on average in the second quarter of 2018, with continued tough conditions for trucking and auto, MarketScout reports.

“Insurers seem to have a longer memory these days. It’s hard to find a commercial insurer who hasn’t suffered from a book of auto/trucking risks in the past 10 years,” Richard Kerr, MarketScout chief executive officer said in a statement. He noted that previous bad experiences and challenges have meant that fewer insurers are willing to write auto or trucking risks. “The demand is exceeding the supply so rates continue to trend upward,” he said.

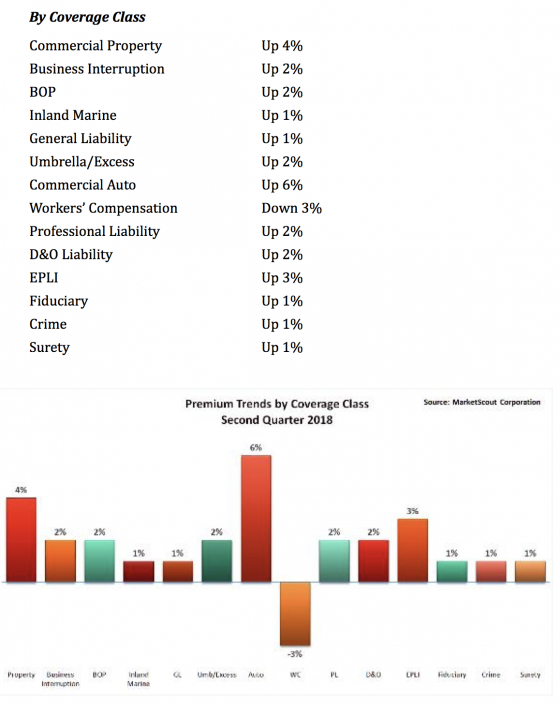

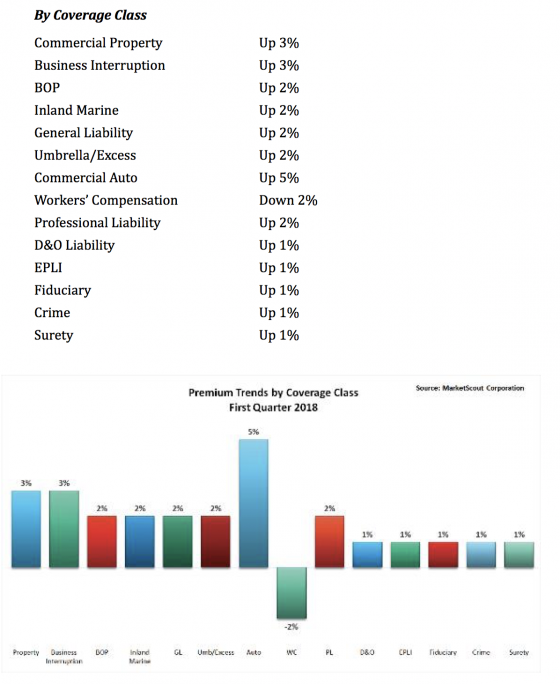

Compared to the first quarter of 2018, property, auto, directors & officers and employment practices liability rates saw increases. Business Interruption and general liability rates moderated. Workers compensation rates dropped from minus 2% to minus 3%. All other coverage classifications held steady.

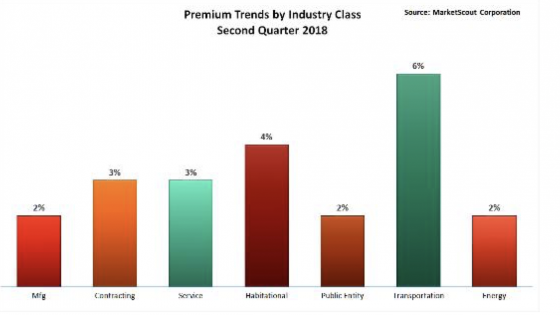

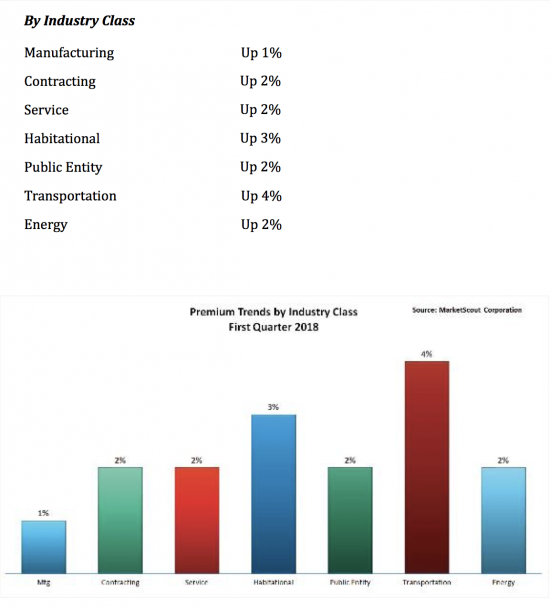

Transportation risks saw a notable rate increase, up 6% in the second quarter of 2018 compared to up 4% in the first quarter. Habitation, service, contracting and manufacturing risks saw a slight rate increase from the first quarter of 2018 to the second. All other industry groups remained unchanged, MarketScout said.

Transportation risks saw a notable rate increase, up 6% in the second quarter of 2018 compared to up 4% in the first quarter. Habitation, service, contracting and manufacturing risks saw a slight rate increase from the first quarter of 2018 to the second. All other industry groups remained unchanged, MarketScout said.

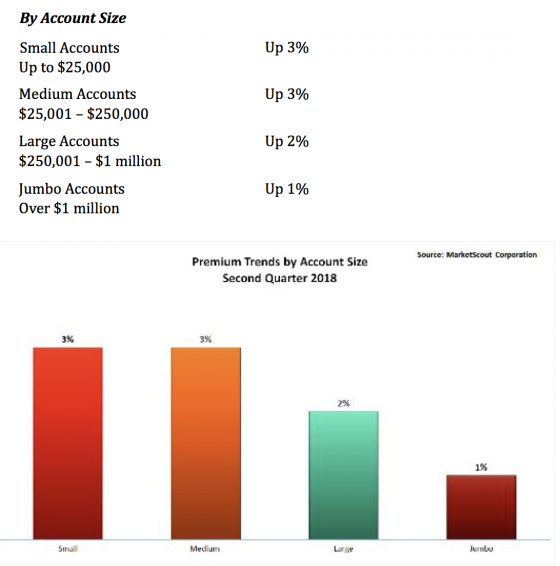

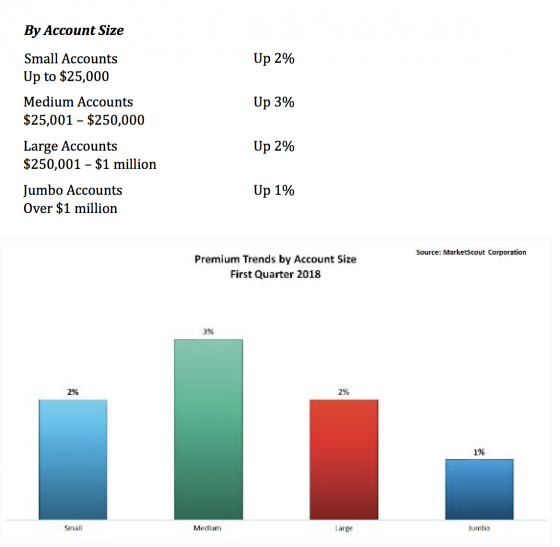

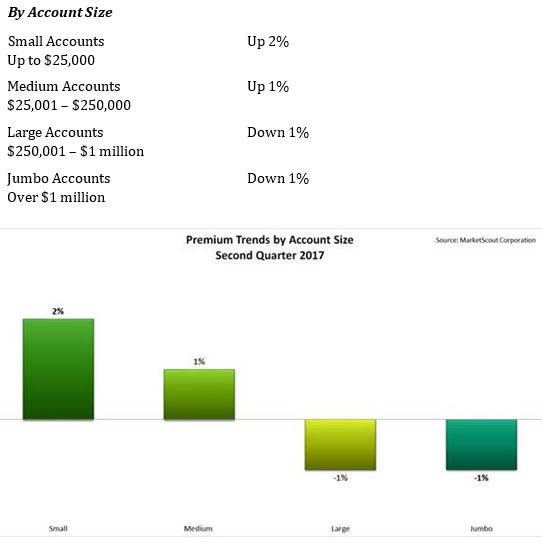

Small accounts saw a slight rate increase while all other accounts were unchanged from the first to the second quarter of 2018, according to MarketScout.

Small accounts saw a slight rate increase while all other accounts were unchanged from the first to the second quarter of 2018, according to MarketScout.

By account size, rates for medium accounts ($25,001 to $250,000 premium) increased from plus 2% in the final quarter of 2017 to plus 3% in the first quarter of 2018.

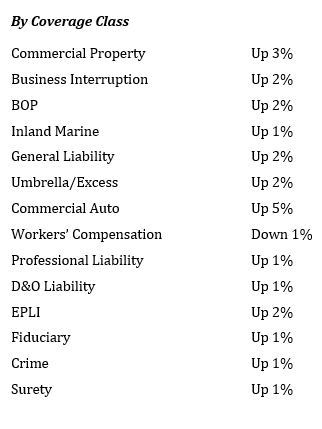

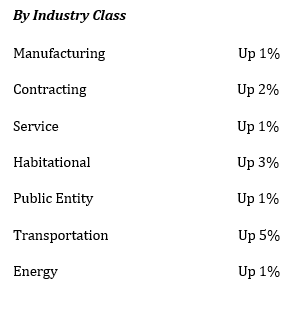

By account size, rates for medium accounts ($25,001 to $250,000 premium) increased from plus 2% in the final quarter of 2017 to plus 3% in the first quarter of 2018. By industry group, service contractors, public entities, and energy accounts were assessed larger rate increases in the first quarter of 2018 than in last quarter of 2017. Transportation accounts had a quarter-over-quarter price decrease from plus 5 to plus 4%.

By industry group, service contractors, public entities, and energy accounts were assessed larger rate increases in the first quarter of 2018 than in last quarter of 2017. Transportation accounts had a quarter-over-quarter price decrease from plus 5 to plus 4%. Richard Kerr, chief executive officer of MarketScout noted, “Automobile and transportation exposures continued to experience the greatest rate increases due to increasing expenses and adverse claim development. Insurers are struggling with this segment of our industry. Part of the problem is actual underwriting results, part is expense ratios, and in our view, a larger part is the uncertainty of the long-term prospects for the auto insurance industry.”

Richard Kerr, chief executive officer of MarketScout noted, “Automobile and transportation exposures continued to experience the greatest rate increases due to increasing expenses and adverse claim development. Insurers are struggling with this segment of our industry. Part of the problem is actual underwriting results, part is expense ratios, and in our view, a larger part is the uncertainty of the long-term prospects for the auto insurance industry.”

On average, underwriters assessed rate increases for all industry groups except transportation and public entities. “Keep in mind, rates are calculated on a composite basis and represent exposures from businesses across the U.S. Insureds in catastrophe exposed areas incurred higher rates/premiums,” Kerr said.

On average, underwriters assessed rate increases for all industry groups except transportation and public entities. “Keep in mind, rates are calculated on a composite basis and represent exposures from businesses across the U.S. Insureds in catastrophe exposed areas incurred higher rates/premiums,” Kerr said.

MarketScout also noted that large accounts were seeing increases averaging 1%, while others saw 2% increases.

MarketScout also noted that large accounts were seeing increases averaging 1%, while others saw 2% increases.

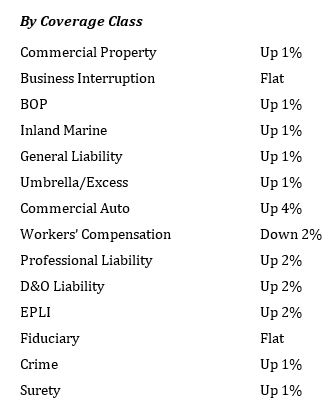

transportation sector, most notably auto-related exposures, is seeing the highest increases, up to 4%, according to a report released today by MarketScout.

transportation sector, most notably auto-related exposures, is seeing the highest increases, up to 4%, according to a report released today by MarketScout. By coverage class, commercial property and inland marine adjusted from down 1% in the first quarter, to up 1% in the second quarter. Commercial auto rates rose from up 3% to up 4%. EPLI also went from up 1% to up 2%. Fiduciary adjusted downward to flat or no increase compared to up 1% in the prior quarter. All other coverage classifications were unchanged from the previous quarter, according to the report.

By coverage class, commercial property and inland marine adjusted from down 1% in the first quarter, to up 1% in the second quarter. Commercial auto rates rose from up 3% to up 4%. EPLI also went from up 1% to up 2%. Fiduciary adjusted downward to flat or no increase compared to up 1% in the prior quarter. All other coverage classifications were unchanged from the previous quarter, according to the report. By industry class, public entity rates moderated from up 1% to flat.

By industry class, public entity rates moderated from up 1% to flat.