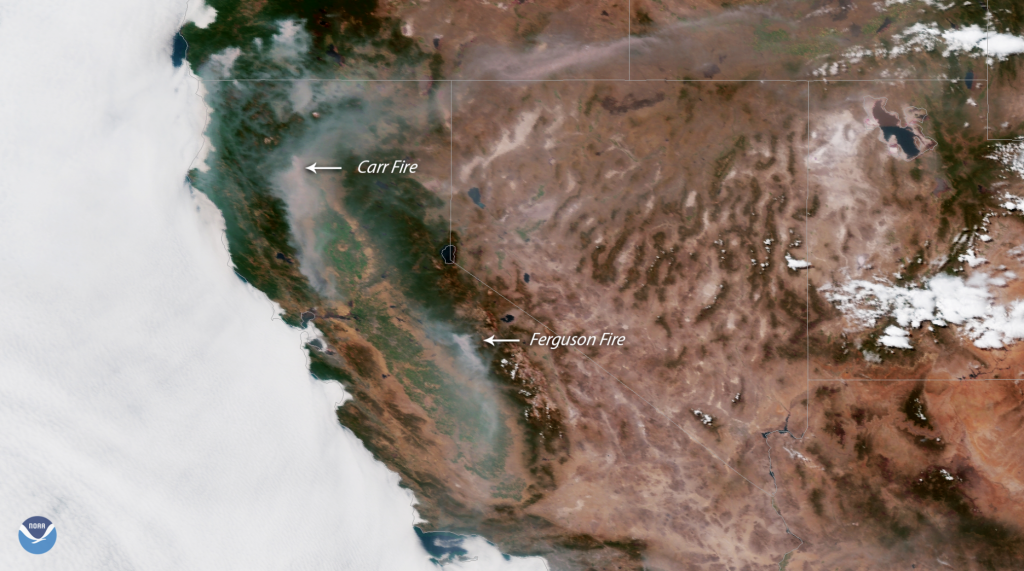

Just when it seemed like things couldn’t get any worse in California, the Carr wildfire ignited, claiming six lives so far. The fire in Northern California near the city of Redding has been burning since July 23 and is now one of the largest in the state.

Just when it seemed like things couldn’t get any worse in California, the Carr wildfire ignited, claiming six lives so far. The fire in Northern California near the city of Redding has been burning since July 23 and is now one of the largest in the state.

Almost 90,000 acres have burned, destroying more than 500 homes and commercial buildings and damaging 135 structures. Firefighters, who are working 24- to 36-hour shifts with little rest in between, said they are making progress and are now on the offense rather than in a defensive mode.

“Although it’s too early for credible insured loss estimates, the current California wildfires could noticeably impact exposed insurers’ 3Q 2018 earnings,” KBW said in a statement today.

Wildfires are also burning in Mariposa County California. The Ferguson Wildfire has closed large parts of Yosemite National Park, the Risk Management Monitor reported. That fire began July 13 at about 8:30 p.

m. and by July 15 had nearly doubled to 9,300 acres. By July 27 it had burned 45,000 acres and was contained 5%, according to NOAA.

While authorities have not declared an official cause for that fire, Colin Gannon, senior data analyst at Four Twenty Seven, which studies the economic risk of climate change, said weather and environmental conditions are certainly contributing factors.

The Associated Press reported that hotter weather attributed to climate change dries out vegetation, allowing for more intense, faster-spreading wildfires. Another issue is expansion of subdivisions into previously undeveloped areas.

“There are just places were there should not be subdivisions,” Kurt Henke, a former fire chief in Sacramento who now serves as a consultant to fire organizations told the AP. “We’re not talking about a single family who wants to build a house in the woods.

buy xifaxan online https://royalcitydrugs.com/xifaxan.html no prescription

I’m talking about subdivisions encroaching into the wild land urban interface that put them in the path of these destructive fires.”

Henke said that more funding needs to come from the state legislature to position firefighters in areas where conditions are ripe for fast-moving fires—so they can be respond quickly if a blaze breaks out.

Gov. Jerry Brown said last year that drought and climate change mean California faces a “new reality” where lives and property are continually threatened by fire.

The state is experiencing longer periods of warm temperatures and dry conditions that are making major fires nearly a year-round possibility, said Daniel Swain, a climate scientist at the University of California, Los Angeles.

On July 28 President Trump signed an emergency declaration for California and authorized federal aid for disaster relief.

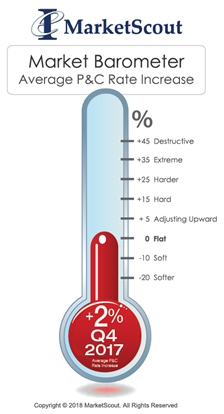

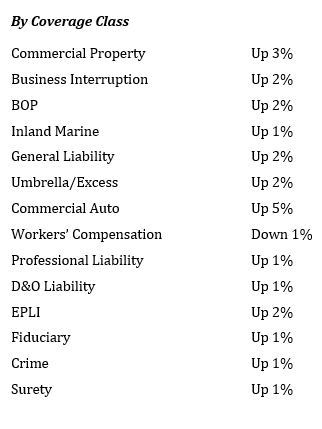

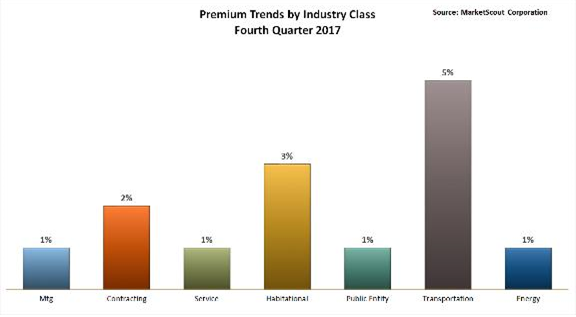

On average, underwriters assessed rate increases for all industry groups except transportation and public entities. “Keep in mind, rates are calculated on a composite basis and represent exposures from businesses across the U.S. Insureds in catastrophe exposed areas incurred higher rates/premiums,” Kerr said.

On average, underwriters assessed rate increases for all industry groups except transportation and public entities. “Keep in mind, rates are calculated on a composite basis and represent exposures from businesses across the U.S. Insureds in catastrophe exposed areas incurred higher rates/premiums,” Kerr said.

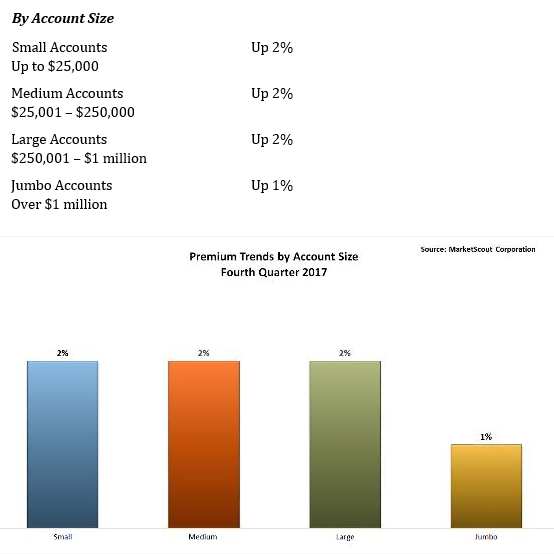

MarketScout also noted that large accounts were seeing increases averaging 1%, while others saw 2% increases.

MarketScout also noted that large accounts were seeing increases averaging 1%, while others saw 2% increases.