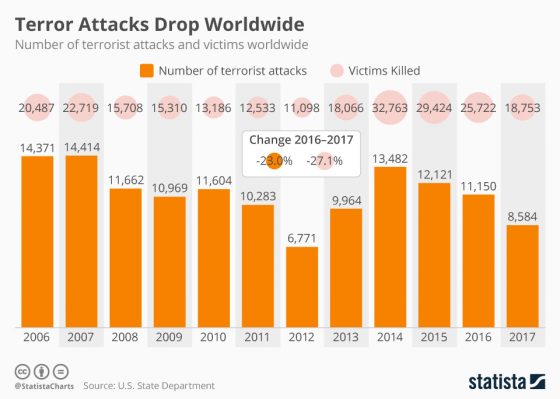

There is some good news for international travelers: Terror attacks and casualties continue to decline worldwide. New information released by the U.S. State Department last week found that there has been a 23% drop in attacks from 2016 to 2017 and a 27.

1% drop in victims killed in the same one-year period.

According to Statista, the number of incidents dropped to 8,584 and deaths to 18,753. Seventy percent of those fatalities were concentrated in five war-torn countries: Afghanistan, Iraq, Nigeria, Somalia and Syria.

Statista reported:

President Trump is doubling down on this tough stance, which is part of a wider pivot happening across the State Department [and] the Bureau moving away from a decades-long focus on fighting foreign extremist groups to concentrating on state adversaries.

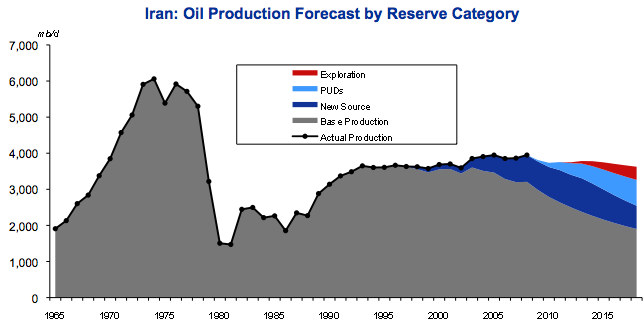

The focus on Iran echoes sentiments from the State Department, which last week published a report warning of Iran’s illegal and destructive activities:

In addition to its support of proxies and terrorist groups abroad, Iran also harbors terrorists within its own borders, thereby facilitating their activities. Iran continues to allow Al Qaeda operatives to reside in Iran, where they have been able to move money and fighters to South Asia and Syria.