An organization buys insurance to transfer certain types of risks (depending on the policies purchased). If a covered event occurs that results in a loss, you submit a claim and get paid. Simple, right? That’s how it would seem, but many experienced risk managers know it doesn’t always go that smoothly.

A recent RIMS Executive Report discusses one of the most common instances when things don’t go according to plan, and the insurer sends along some unpleasant surprises. In “A Risk Manager’s Guide to Reservation of Rights,” we learn how an insurer protest against paying a claim is commonly initiated and communicated: the dreaded reservation of rights letter.

In case you’ve never had the pleasure of receiving one, a reservation of rights letter is “a notice that the insurer has reserved its rights to either limit or deny coverage for the claim, based on the terms and conditions of the policy or information uncovered in an investigation of the claim itself.” In other words, these legal notices can become hurdles for an organization trying to realize the value of the insurance it has purchased.

Many risk managers do nothing when they receive this letter—they assume that the insurer will act in good faith and everything will work out.

The authors of the RIMS Executive Report, however, strongly encourage a more active response. At the very least, the risk manager should compare the wording of the letter to the insurance policy language in question, as well as draft a response to the letter. The authors state: “Generally, there is no requirement that a policyholder respond to an insurer’s reservation of rights letter, disagreeing with the reservation or the bases thereof. However, it is highly recommended that the policyholder do so.”

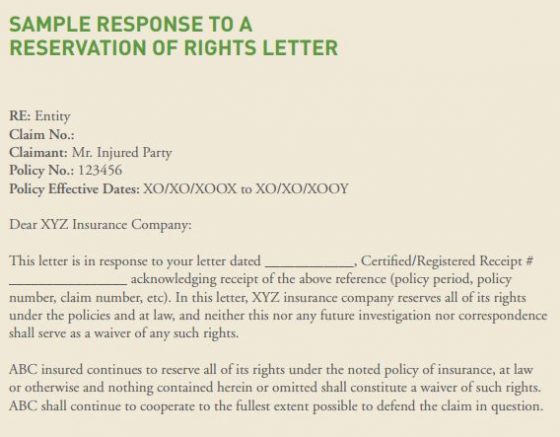

A response letter might look something like this:

In some cases, a well thought-out response can save an organization a large amount of money. A good example is the common insurer-proposed reservation to recover defense costs spent on defending a policyholder if the insurer determines at a later date that it did not, in fact, have a responsibility to defend. In order to reject this reservation and the big legal bills that could come with it down the road, many jurisdictions in the United States require that the insured respond to the reservation of rights letter and specifically disagree with this detail.

In some cases, a well thought-out response can save an organization a large amount of money. A good example is the common insurer-proposed reservation to recover defense costs spent on defending a policyholder if the insurer determines at a later date that it did not, in fact, have a responsibility to defend. In order to reject this reservation and the big legal bills that could come with it down the road, many jurisdictions in the United States require that the insured respond to the reservation of rights letter and specifically disagree with this detail.

According to the authors: “Receipt of a reservation of rights notice should prompt a review by risk managers…leading to an informed decision and deliberate action: whether to accept the insurer’s interpretation of the coverage and defense obligations, or respond with a reservation of its own rights. If not, unexpected and unintended consequences may result.”

The report also includes more in-depth information on obligatory communications, the use of tolling agreements and conflicts of interest that arise in these situations. In a reservation of rights situation, there can be some tricky territory to navigate. For example, insureds are almost always contractually obligated to cooperate with the insurer’s investigation and defense of claims. Failure to communicate or cooperate with these efforts can be a breach of contract and result in loss of coverage.

buy flexeril online https://royalcitydrugs.com/flexeril.html no prescription

It is important for the insured (i.e., the risk manager) to “understand its obligations in the claims management and settlement process, and the continuing obligations when a reservation of rights notification is issued.”

The balancing act is that “Insureds need to continue cooperating…regardless of any coverage disputes, to preserve the continuity of claim management as well as meet the policy obligation.”

As the coordinator between functional areas and the in-house risk expert, risk professionals have an important role in all of these stages.