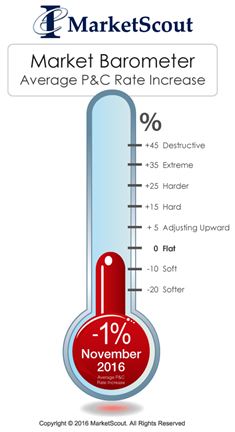

The November composite rate for insurers in the United States moved from minus 2% to minus 1% in November, with commercial insurance seeing the largest increases,  according to MarketScout.

according to MarketScout.

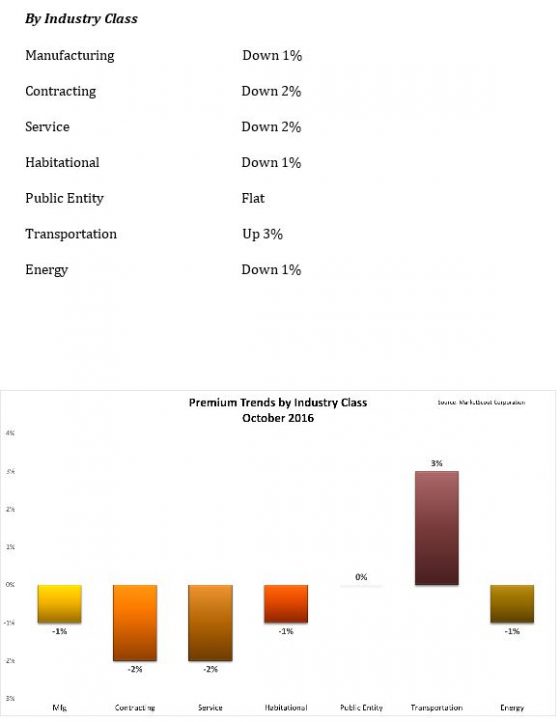

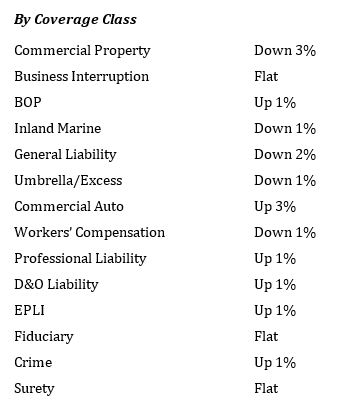

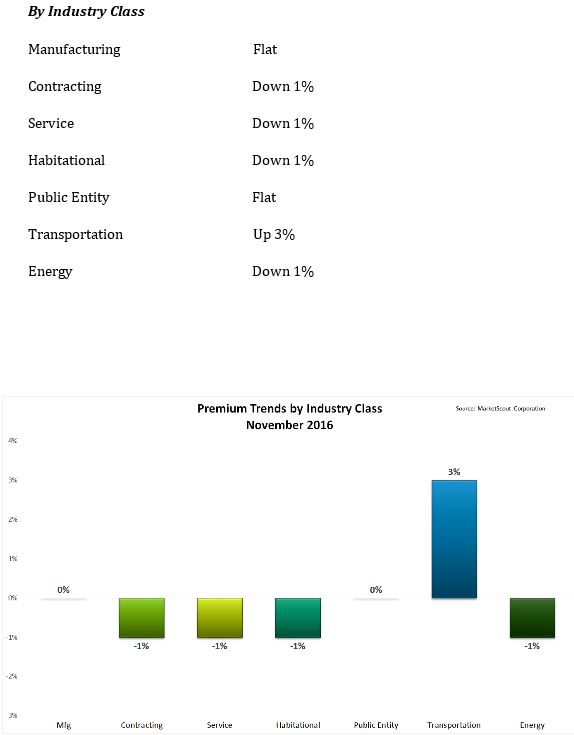

“The most notable coverage classification with an ongoing consistent rate increase is commercial auto at plus 3%,” said MarketScout CEO Richard Kerr. “The commercial auto classification includes all types of commercial vehicles. Not surprisingly, the most notable industry classification with an ongoing consistent rate increase was transportation, also at plus 3%.”

The transportation classification includes trucking, hauling, buses, “and most anything with wheels,” he said. Railroads and aviation are not included in the transportation class.

“Underwriters have long struggled with commercial auto, many writing the coverage only to capture the related casualty lines such as workers compensation, general liability and excess. Many insurers consider commercial auto as a loss leader,” Kerr said.

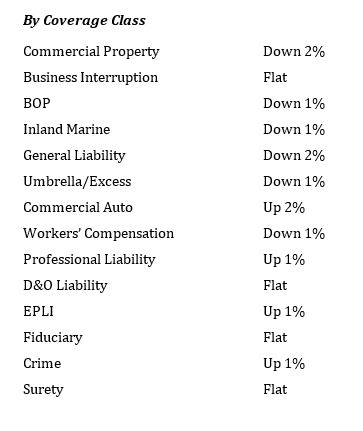

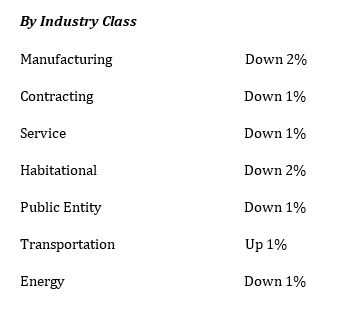

By coverage classification, from October to November, property was down from minus 2% to minus 3%, business owners policies (BOPs) were up 1% compared to down 1%, auto was up 3% from up 2% and D&O was up 1% from flat.

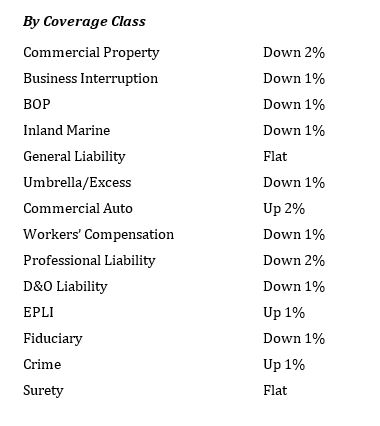

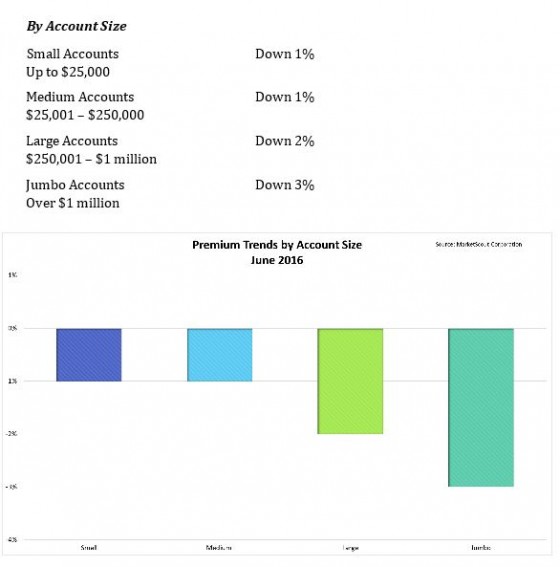

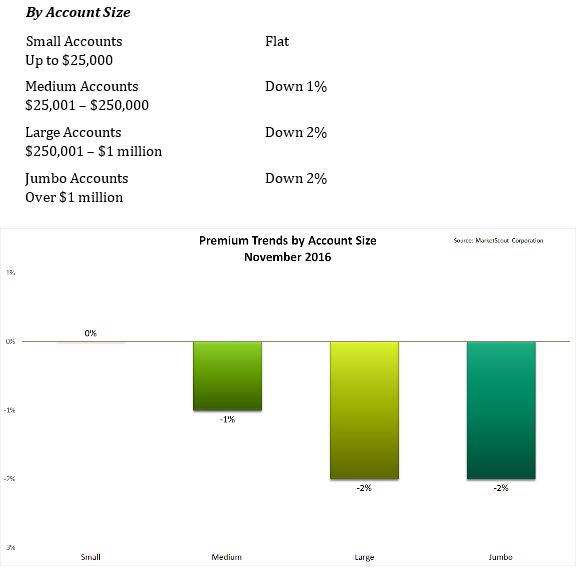

By premium size, small accounts (up to $25,000) were flat in November compared to down 1% in October. Medium accounts ($25,001 to $250,000) were down 1% in November compared to down 2% in October. Large accounts ($250,001 to $1,000) saw more aggressive pricing, with rates down more in November (minus 2%) compared to October (minus 1%). Jumbo accounts (over $1 million) remained stable at minus 2%.

Insurers reversed their rate reductions for the contracting and service industries, moderating rate reductions from minus 2% in October to minus 1% in November. Manufacturing rates were flat in November compared to down 1% in October, MarketScout said.

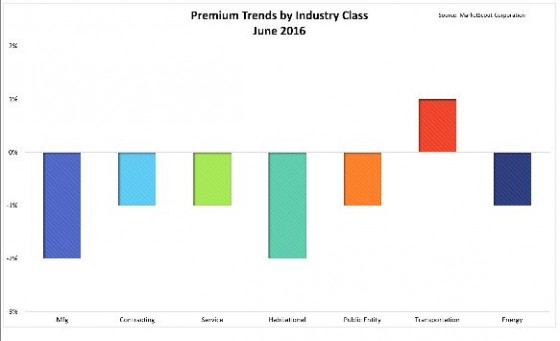

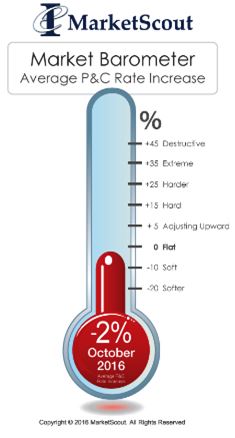

rates were down 2% compared to down 1% in June, July, August and September, according to

rates were down 2% compared to down 1% in June, July, August and September, according to