Just one day after the U.K. set in motion its process for withdrawal from the European Union by triggering Article 50, Lloyd’s announced it was establishing a subsidiary in Brussels, intending to be able to write EU business for the Jan. 1, 2019, renewal season.

subsidiary in Brussels, intending to be able to write EU business for the Jan. 1, 2019, renewal season.

The new company will write risks from all 27 European Union countries and three European Economic Area states once Brexit is completed. Because Britain remains a full member of the EU for at least two more years, there will be no immediate impact on existing policies, renewals or new policies, including multi-year policies written during this period of time, the insurer said. The Brussels subsidiary will have its own board of directors and, unlike some banks that have said they will move hundreds of employees to the EU, it will only employ dozens of staff in areas such as information technology and compliance.

Hank Watkins, president of Lloyd’s North America spoke to Risk Management about the company’s plans and the why it chose Belgium as its new location.

RM: How did the process of finding a new EU base begin?

Watkins: Within a week or two of [the Brexit vote] last June, Lloyd’s was on its way, looking across Europe for a new domicile, if you will, for our European business. We are not moving out of London—what we have done is set up an insurance company in Brussels, purely to allow us to passport around the European Union. Because we are not necessarily confident that the U.K. will be able to negotiate passporting rights with the other countries, we are assuming they are not. If they are ultimately successful, then we will just close up and go back home, but that probably will not be the case.

RM: How will the subsidiary work?

Watkins: If you are a policyholder with Lloyd’s, where you previously would have received a policy with all of the syndicates subscribed to it, and that would have been stamped by each of those syndicates, you will also receive an identical policy for the European exposures. It will have the Lloyd’s insurance company name on it and the syndicate stamp of that insurance company and the Lloyd’s syndicates. It is just a little more paperwork for us. The policy is the same—it does not change coverage and it does not change pricing—It is more of an administrative effort to align with what the regulator expects. And our ratings are not affected, we are still S&P-, AM Best- and Fitch-rated A or better and the central fund is still very strong.

RM: Why Belgium?

Watkins: We found a regulator there who is allowing us basically to cede 100% of the premium and the risk back to the syndicate in London. Every other country has some variation of wanting to maintain part of the risk in their country but that does not work for us. So Belgium is a very strong regulator centered in the heart of Europe and a great talent pool as we build out the platform—which won’t be that large, by the way, because we are not necessarily moving people there.

RM: How will insureds be impacted?

Watkins: Companies with no risks in the European Union will see no impact, and it will be seamless for international companies with risks in the EU. Also, it is probably not as well known, but because we are not just large, commercial risks, we do insure a lot of homeowners on the coastlines and a number of private yachts and aircraft, so this is a way to seamlessly include coverage for them in Europe as well.

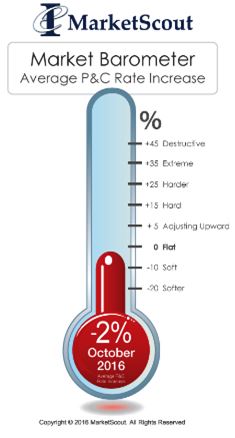

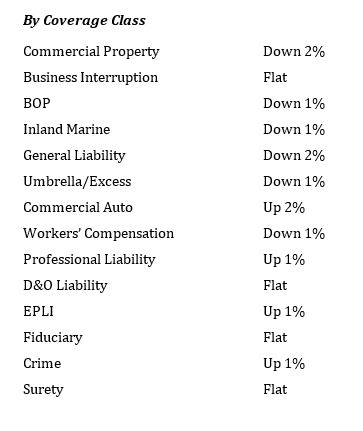

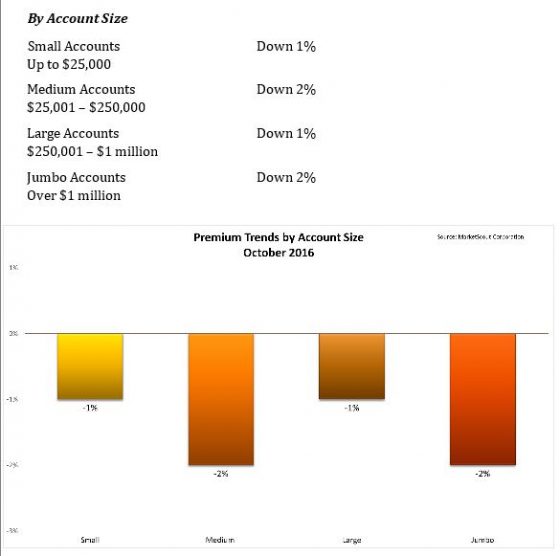

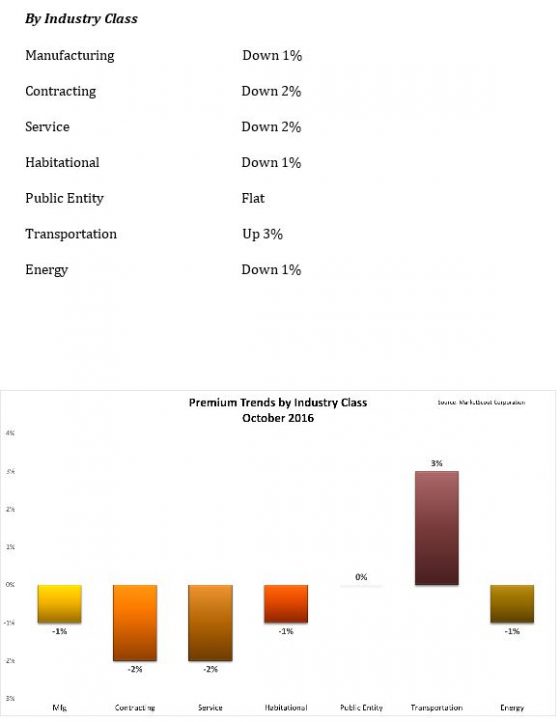

rates were down 2% compared to down 1% in June, July, August and September, according to

rates were down 2% compared to down 1% in June, July, August and September, according to

December,

December,