New software for monitoring the probability of earthquakes in a targeted location could help energy companies determine where they can operate safely.

The free tool, developed by Stanford University’s School of Earth, Energy & Environmental Sciences, helps operators estimate how much pressure nearby faults can handle before rupturing, by combining three important pieces of information:

- Location and geometry of the fault

- Natural stresses in the ground

- Pressure changes likely to be brought on by injections

“Faults are everywhere in the Earth’s crust, so you can’t avoid them. Fortunately, the majority of them are not active and pose no hazard to the public. The trick is to identify which faults are likely to be problematic, and that’s what our tool does,” said Mark Zoback, professor of geophysics at Stanford, who developed the approach with graduate student Rail Walsh.

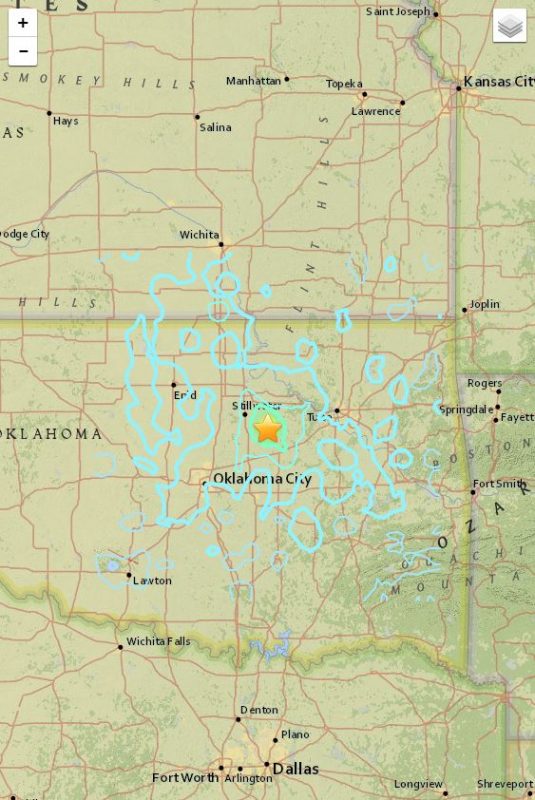

Fossil fuel exploration companies have been linked to the increased number of earthquakes in some areas—Oklahoma in particular—that have been determined to be the result of fracking. According to the Dallas Morning News:

Only around 10% of wastewater wells in the central and eastern United States have been linked with earthquakes. But that small share, scientists believe, helped kick-start the most dramatic earthquake surge in modern history.

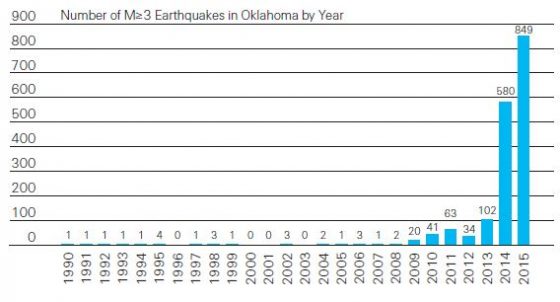

From 2000 — before the start of America’s recent energy boom — to 2015, Oklahoma saw its earthquake rate jump from two per year to 4,000 per year. In 2016, its overall number fell to 2,500, but its quakes grew stronger.

Five other states, including Texas, Arkansas and Kansas, have seen unprecedented increases in ground shaking tied to the wells, although North Texas had no earthquakes strong enough to be felt last year.

The insurance industry has also been monitoring the rise in temblors. A Swiss Re report concluded, “It’s highly likely that this dramatic rise in earthquake occurrence is largely a consequence of human actions.”

According to the report:

Along with the increase in seismicity, Oklahoma has seen a growth in its oil and natural gas operations since 2008, specifically hydraulic fracturing (often referred to as “hydrofracking” or “fracking”) and the disposal of wastewater via deep well injection. Both hydrofracking and deep well injection involve pumping high-pressure fluids into the ground. A consensus of scientific opinion now links these practices to observed increases in seismic activity. Earthquakes where the cause can be linked to human actions are termed ‘induced earthquakes,’ and present an emerging risk of which the insurance industry is taking note.