More than 6.5 million homes along the U.S. Atlantic and Gulf coasts are at risk of storm surge inundation, representing nearly $1.5 trillion in total potential reconstruction costs, according to Corelogic’s 2014 Storm Surge Report. Of that risk, more than $986 billion is concentrated within 15 major metropolitan areas.

While many homes and businesses most vulnerable to hurricane damage are in Federal Emergency Management Agency flood zones, these represent just a fraction of the structures that suffer a hurricane’s effects.

Homeowners who live outside the FEMA flood zones typically do not carry flood insurance, given that there is no mandate to do so, and therefore may not be aware of the potential risk storm surge poses to their properties, Corelogic explains.

Uncertainty about the geographical and meteorological risks may lull many into a false sense of safety.

buy synthroid online https://galenapharm.com/pharmacy/synthroid.html no prescription

“This year’s season is projected to be slightly below normal in hurricane activity, but the early arrival of Hurricane Arthur on July 3 is an important reminder that even a low-category hurricane or strong tropical storm can create powerful riptides, modest flooding and cause significant destruction of property,” said Dr. Thomas Jeffery, senior hazard scientist for CoreLogic Spatial Solutions.

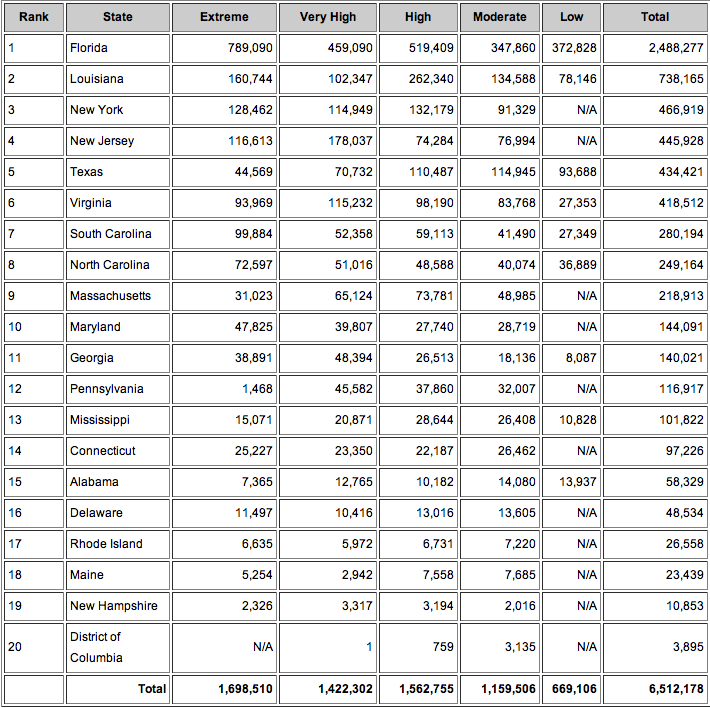

Florida ranks number one for the highest number of homes at risk of storm surge damage, with nearly 2.5 million homes at various risk levels and $490 billion in total potential exposure to damage. Here’s how all 19 states studied stack up, based on number of homes at risk:

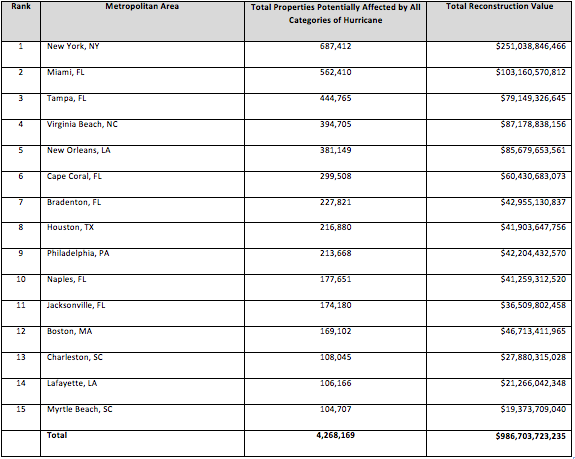

At the local level, the New York metropolitan area (including northern New Jersey and Long Island) contains not only the highest number of homes at risk for potential storm surge damage (687,412), but also the highest total reconstruction value of homes exposed, at more than $251 billion. Take a look at the storm surge risk for the top 15 metro areas:

Corelogic also noted variation in the costs of rebuilding, which does not directly correlate to the amount of property at risk. The total reconstruction cost value of homes along the Atlantic coast is nearly 1 billion, for example, which is approximately double the value of at-risk properties in the Gulf region’s 5 billion.