Risk management is maturing and is playing a larger role in insurance companies, both strategically and with their compliance objectives.

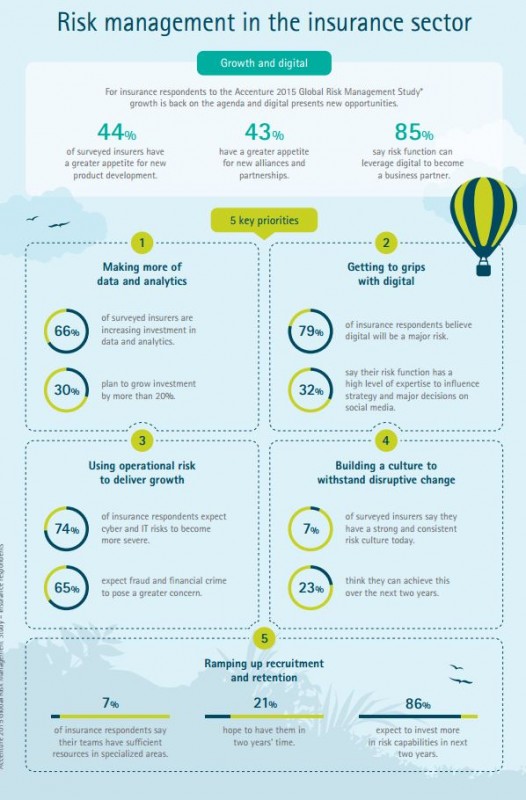

As a result, the key task for chief risk officers is to help their company achieve balance between upstream and downstream activities, according to Accenture’s 2015 Global Risk Management Study of risk management in the insurance sector.

“Neither an unfettered approach to growth, nor an excessive focus on compliance, will deliver the desired outcomes.

Instead, the risk function should steer a course between an informed, connected risk agenda, and the need for a sustainable and innovative strategic business direction,” the survey found.

While organizations mostly agree that risk management has helped their long-term business growth (85%), a large number believe that silos of business functions are hindering the effectiveness of their risk management programs.

According to the report, because of the continuing low interest rate environment, which creates pressure on margins and returns, insurers are looking into other areas for growth, making it “increasingly urgent for the risk function to become more engaged in the evolution and reinvention of the business in order to anticipate and steer clear of competitive threats.”

To do this, respondents to the study are:

- Working to understand what the new environment implies for both the risk management function and the business – and whether CROs and their teams currently have what they need to meet the requirements

- Seeking to identify areas where there is a gap to be closed, with priorities that include:

- Getting to grips with digital

- Strengthening data and analytics capabilities

- Developing operational risk management in a more systematic way to turn it into an enabler of sustainable, profitable growth

- Ramping up the focus on recruitment and retention

- Building a more consistent risk culture at all corporate levels.

The study also found that digital is playing an important role in growth: