According to a recent survey from PricewaterhouseCoopers, economic crime is on the rise, particularly in the United States. Of organizations in the U.S., 45% suffered from some type of fraud in the past two years, compared to the global average of 37%. Further, 23% of companies that reported economic crime experienced accounting fraud, up from 16% in 2011.

So who is committing these crimes?

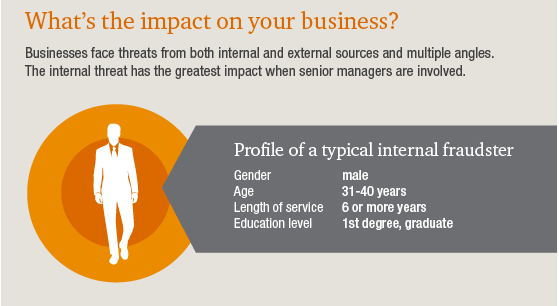

External perpetrators are on the rise, closing the gap with internal perpetrators — it’s now 45% versus 50%, respectively. But the profile of these internal actors has changed since the last survey in 2011.

Now, most internal frauds are perpetrated by middle management (54%, compared to 45% in 2011), and fraud by junior staff has dropped by almost half, now totaling 31%.

The typical internal fraudster is now a white male in middle management, age 31-40, who has been with the company for six years or more.

In good news, PwC also found that awareness of risk is higher among U.S. companies, for example, seven out of 10 American respondents perceived an increased risk of cybercrime in the last two years, compared to just under half globally. The C-suite is also increasingly getting the message about the risk of economic crime:

For more details on the 2014 Global Economic Crime Survey, check out the report from PwC here.