Establishing state and local building codes would insure resilient construction and stop the cycle of spending to rebuild after disasters such as hurricanes, according to the Insurance Institute for Business & Home Safety (IBHS). The organization said it supports the  BuildStrong Coalition’s National Mitigation Investment Strategy, which calls for a comprehensive federal plan to improve disaster resilience across the U.S.

BuildStrong Coalition’s National Mitigation Investment Strategy, which calls for a comprehensive federal plan to improve disaster resilience across the U.S.

The plan focuses on investment in pre-disaster funding using unspent, non-FEMA grant program funds to reduce damage caused by natural disasters—funds that were established in the wake of Hurricane Sandy, IBHS said.

“We can’t keep doing things the same way, with lives and communities being destroyed over and over again by disasters, year after year,” said Julie Rochman, IBHS president and CEO said in a statement. “The National Mitigation Investment Strategy will help break this cycle of destruction.”

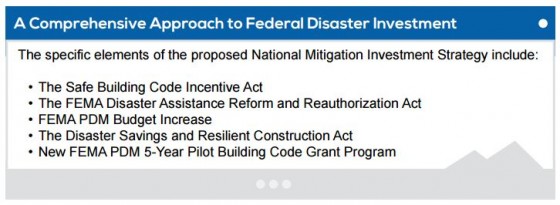

The Strategy recommends:

- establishing a new FEMA-administered resilient construction state and local building code grant program to help qualified states defray cost of enforcing building codes

- increasing FEMA funding for pre-disaster mitigation activities by $100 million per year from fiscal years 2016 to 2020

- passing new congressional initiatives to create resilient construction incentives for states, builders, and individual homeowners

According to the BuildStrong Coalition:

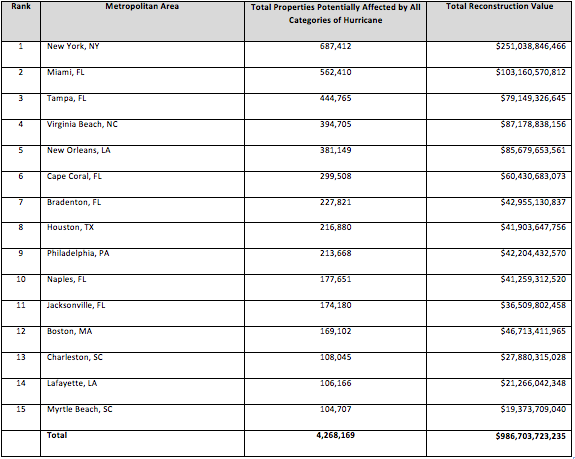

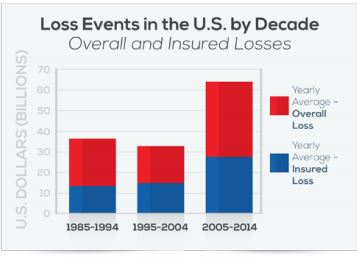

The reality of the nation’s current disaster policy is this: costs associated with natural disasters in the United States continue to rise, and the federal government is absorbing more and more of the costs as sympathy for victims often creates a political expediency for billions in off-budget, unaccountable federal spending that is allocated for cleanup and recovery. The result is an endless cycle of destruction where cities are rebuilt only to be devastated again by the next big storm. A new approach to federal disaster policy is needed.

The report looks into why more needs to be done before a disaster and describes ways to target more resources to building codes. Doing so through a new national disaster policy focused on pre-disaster mitigation will benefit homeowners and building owners that are of the most immediate concern post-storm.