Recently, the Association for the Management of Risk And Insurance of Enterprise (AMRAE) and EY jointly released the 11th edition of the RMIS Panorama, offering an in-depth look at the organizations and professionals who are using risk management information systems (RMIS), how well they have adapted, and guidance for those seeking their first or newest framework.

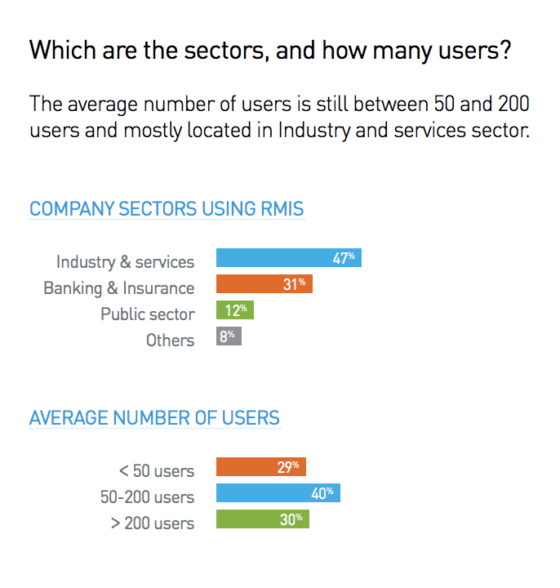

After surveying 570 risk managers and 36 vendors from more than 30 countries, Panorama’s authors note the top reported benefits from RMIS were the ability to spend more time analyzing (and not collecting) data, harmonizing practices and reducing silos. Of those who have adopted these systems, 47% are in the industry and services sector, followed by 31% in banking and insurance and 12% in the public sector.

After surveying 570 risk managers and 36 vendors from more than 30 countries, Panorama’s authors note the top reported benefits from RMIS were the ability to spend more time analyzing (and not collecting) data, harmonizing practices and reducing silos. Of those who have adopted these systems, 47% are in the industry and services sector, followed by 31% in banking and insurance and 12% in the public sector.

Some other key takeaways from the report include:

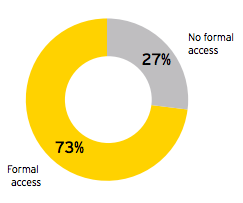

- 54% of risk managers already use an RMIS and report a 71% satisfaction rate.

- Though a majority of risk managers said they wish to keep RMIS costs at less than €300,000, last year marked the first increase for RMIS budgets totaling more than €1 million (approximately $1.12 million). This trend was largely driven by activity in North America, and a 2% increase is projected for 2019.

- Ease-of-use is still the main criteria for selecting an RMIS tool. The market is seeing an increasing demand for “ergonomic and advanced reporting” within the solution.

According to the report (which can be found here in both English and French), there has been a 60% year-over-year increase in RFP solicitations for RMIS from the international risk management community since 2013. Francois Beaume, AMRAE vice president and VP of risks and insurance at Sonepar, said he expects the trend to continue and noted that the report can serve as impartial guidance to help risk professionals find the right RMIS vendor and system for their organization.

The report also offers insight on best practices around the RMIS lifecycle from the original requirement design phase to the change management program following implementation.

“Our approach is based on two critical pillars – objectivity and neutrality,” Beaume explained. “As an increasing number of risk professionals seek their first or new RMIS models, they may need help selecting or even adapting them to their own methodologies.”

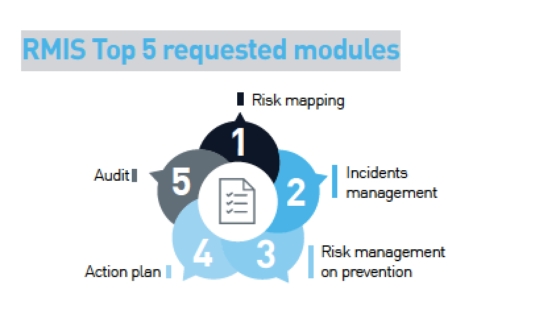

Panorama also explores the most requested RMIS modules, which range from risk mapping and incidents management to audit. Internal control and audit garnered high satisfaction rates among professionals, both exceeded 80% in cumulatively “meeting” or “exceeding” expectations.

Additionally, the report includes testimonials from six global risk managers on their experiences with RMIS.

For example, according to Susan Hiteshew, a RIMS board member and senior director of insurance for the Americas at Marriott International, RMIS systems provide a “one-stop shop for data aggregation, reporting and analysis” that “builds a single source of truth when making decisions.”

To fellow risk managers starting the process, Hiteshew advised, “Rather than reproducing work within the system, companies undergoing an implementation must begin with the end in mind and work backward to build and validate processes to realize the full RMIS value. This helps minimize the execution risk that can materialize and offset the system’s advertised value proposition.

“

Francois Beaume was recently a featured guest on RIMScast to discuss the Panorama‘s findings and international market trends. Download the free podcast episode here.