On August 25, the Alameda County Superior Court in California declared that Proposition 22 (better known as Prop 22) violated the state’s constitution, overturning it and potentially putting a portion of the state’s gig work industry in peril. The controversial California ballot measure designated app-based gig workers like rideshare and food delivery drivers as independent contractors, meaning that the companies they ostensibly work for would not have to provide a minimum wage, health insurance, unemployment, sick leave or other benefits. Because the initiative was a ballot measure, the court found the law restricted the state legislature’s ability to regulate compensation rules, and said the measure also illegally prevented workers from collective bargaining and unionization. However, this ruling does not mean that gig workers will automatically be considered employees, as no previous law mandated that classification.

Before Prop 22’s passage in November 2020, California passed AB 5 in May 2019, which instituted a more rigorous test to determine whether workers were employees or independent contractors: if “the person is free from the control and direction of the hiring entity in connection with the performance of the work,” the work was outside the company’s usual business, and if the worker “customarily engaged in an independently established trade, occupation or business of the same nature as that involved in the work performed.”

Rideshare companies like Uber and Lyft essentially ignored AB 5 and poured $224 million into fighting for Prop 22, making it “the most expensive ballot measure in California history,” according to the Los Angeles Times. The measure passed with around 59% of the vote.

In a small concession for workers, Prop 22 did provide for a health insurance stipend, but an August 2021 UC Berkeley Labor Center survey of 500 drivers showed that only around 10% of workers were receiving it, and 40% had not heard about it at all. Since work hours are only defined by the time spent driving with a passenger, others do not work the required 15 hours per week on one app to qualify for the stipend. These and other factors prompted drivers and the Service Employees International Union (SEIU) to sue the state seeking to overturn the law.

For now, the Superior Court ruling will likely not change much for gig workers in California, as Uber and other companies have announced their intention to challenge it in higher courts and may ignore any of its other legal implications, leaving everyone involved with a shaky status quo: an overturned law that is effectively still being followed.

As Risk Management wrote in May, one danger of the continuing ambiguity surrounding gig worker classification is misclassifying workers, which can lead to heavy fines or lawsuits. For example, in January 2020, D.C.-based contractor Power Design Inc. agreed to pay $2.5 million for misclassifying 500 workers as independent contractors rather than employees. In August, food delivery app company Postmates settled with the city of Seattle for nearly $1 million for violating the city’s Gig Worker Paid Sick and Safe Time (PSST) ordinance. The payment will go to cover city fines and compensate more than 1,600 workers for back wages. Additionally, withholding benefits, overtime, and meal and rest breaks (whether a result of misclassification, or in general) can result in workers filing class action lawsuits against the company, potentially resulting in significant costs, impacting productivity and damaging the organization’s reputation.

Another risk for gig work companies is insufficient safety measures for workers. Unlike with formal employees, companies often do not provide gig workers with safety training and may not offer formal ways to report safety concerns. This creates an environment where workers who are often under pressure to complete as many rides or tasks as quickly as possible may get into accidents or leave dangers unreported, creating liabilities for themselves and the company.

Other states have their own gig work regulations either on the books or in the works and President Joe Biden has expressed support for gig worker classification as employees, but there is currently no national legislation on this issue. However, in March, the House of Representatives passed the Protect the Right to Organize Act (or PRO Act), which would reclassify gig workers as employees, affording them all the benefits included in that status.

The Senate has not yet taken up the measure.

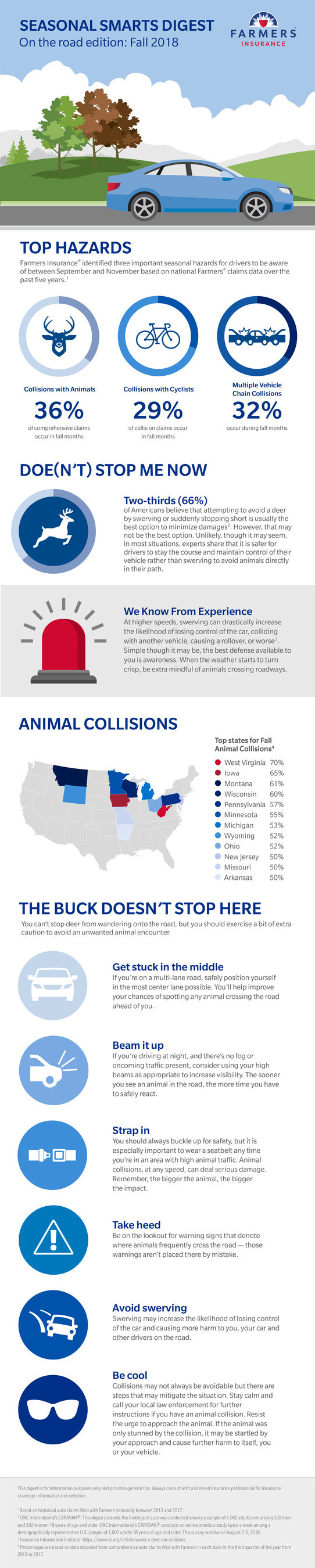

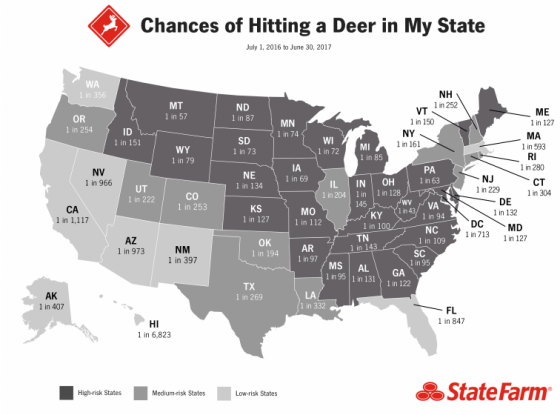

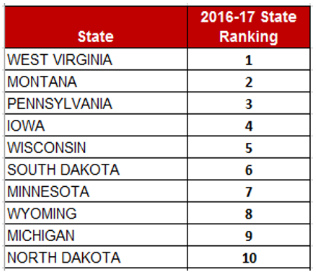

Drivers beware: Whether operating a company or personal vehicle, it’s that time of the year again—mating season for deer, causing them to be more active and more than doubling the likelihood of a collision through December. What’s more,

Drivers beware: Whether operating a company or personal vehicle, it’s that time of the year again—mating season for deer, causing them to be more active and more than doubling the likelihood of a collision through December. What’s more,  with one out of every 43 drivers likely to hit a deer or other large animal.

with one out of every 43 drivers likely to hit a deer or other large animal.