With fall in full swing and holidays on the horizon, new information about animal collisions on the road have been made available for employers and employees.

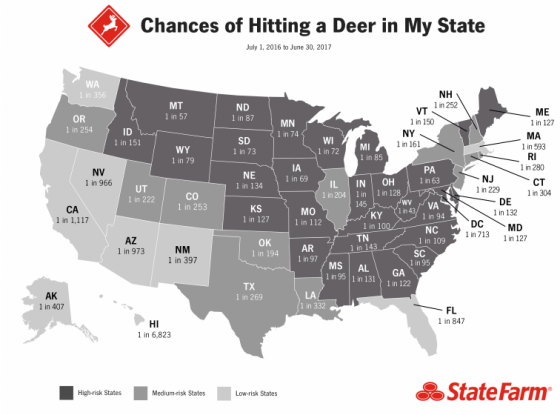

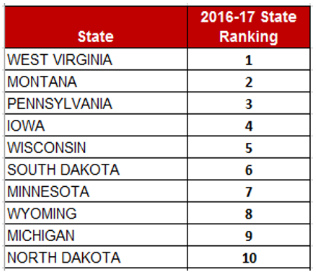

State Farm’s 16th annual deer-vehicle collision study indicates that overall in the U.S., drivers had a 1-in-167 chance of having a crash with a deer, elk, moose or caribou.

This is a five-point drop from last year when the national odds were 1-in-162.

What’s more, State Farm reports that the national per claim average rose for the second year in a row to $4,341 from $4,179 during 2016-17.

The chance of hitting a deer, or another large animal, doubles in the fall. The months with the most claims are November, October and December, in that order.

buy flagyl online https://galenapharm.com/pharmacy/flagyl.html no prescription

Some tips for avoiding animal crashes include:

- Slow down, particularly at dusk and dawn.

- If you see one deer, be prepared for more deer to cross the road.

- Brake if you can, but avoid swerving.

buy amoxil online rxbio.com/images/milestones/jpg/amoxil.html no prescription pharmacy

This can result in a more severe crash.

- Avoid distractions. Devices or eating might cause you to miss seeing an animal.

- Do not rely on products such as deer whistles. They are not proven effective.

Additional Autumn Road Hazards

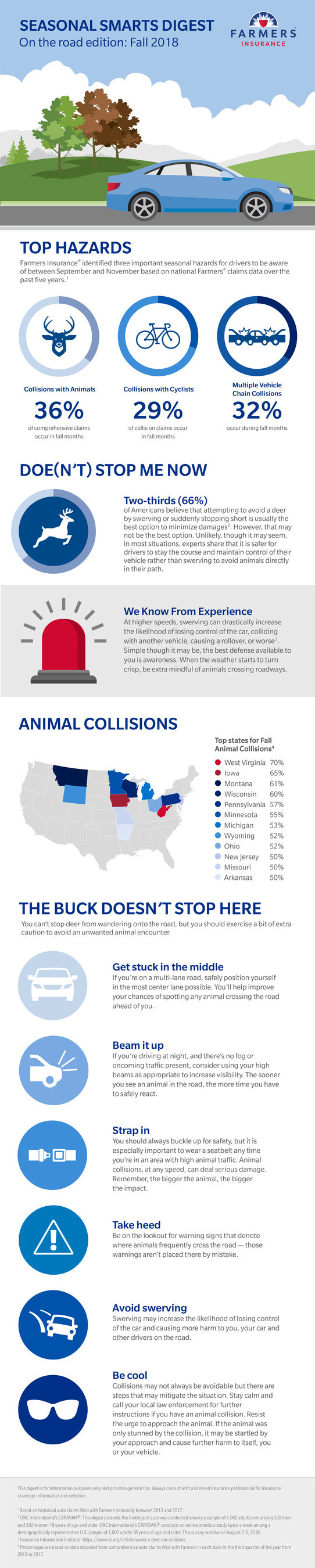

The modest drop in deer collisions doesn’t mean the risk isn’t still prevalent. In its Fall 2018 Seasonal Smarts Digest, Farmers Insurance identified collisions with animals as the top seasonal hazard for drivers between September and November over a five-year period. Collisions with cyclists and multiple vehicle chain collisions followed closely behind as the top types during fall months.

“If you do find yourself in a situation involving a potential collision with deer or other animals this fall, try to stay the course,” said Jim Taylor, head of claims customer experience for Farmers Insurance. “Believe it or not, it may be safer for you and other vehicles on the road to remain calm and stay the course rather than swerving at high speeds in an attempt to avoid the animal.

”

Drivers beware: Whether operating a company or personal vehicle, it’s that time of the year again—mating season for deer, causing them to be more active and more than doubling the likelihood of a collision through December. What’s more,

Drivers beware: Whether operating a company or personal vehicle, it’s that time of the year again—mating season for deer, causing them to be more active and more than doubling the likelihood of a collision through December. What’s more,  with one out of every 43 drivers likely to hit a deer or other large animal.

with one out of every 43 drivers likely to hit a deer or other large animal.