While an increasing number of malicious actors are using technology to perpetrate fraud, the vast majority of companies are not using the technological resources available to fight it.

According to KPMG’s new report Global Profiles of the Fraudster, technology significantly enabled 29% of the 110 fraudsters analyzed in North America and 24% of the 750 fraudsters analyzed worldwide. What’s more, 25% of frauds that hinged on the use of technology were detected by accident rather than safeguards or analytics, compared to just 10% spotted by accident in cases where the criminals did not use technology.

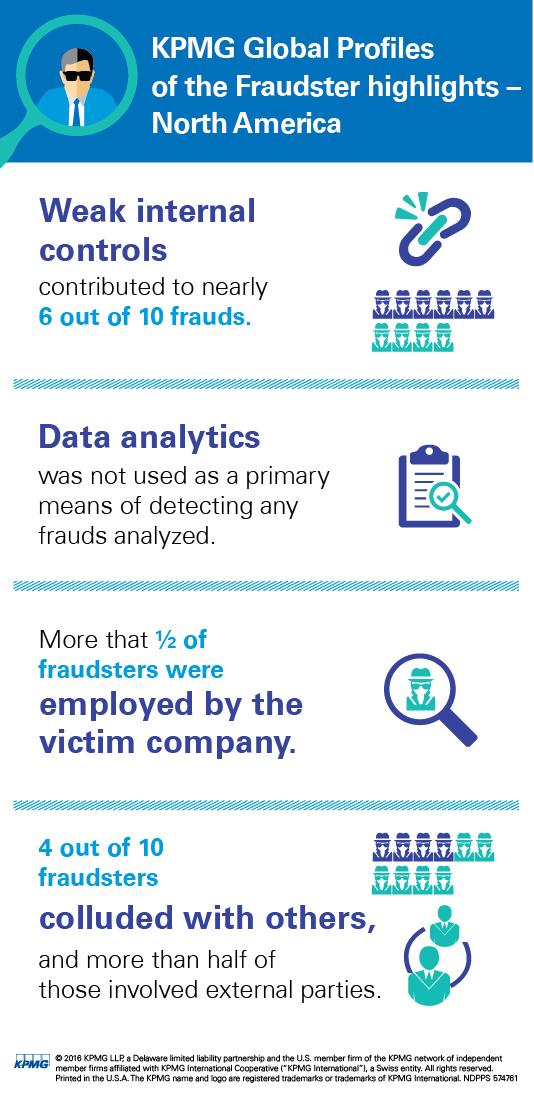

Indeed, proactive data analytics was not the primary means of detection in any North American cases and was only used to detect 3% of fraudsters worldwide.

In North America, the most common means of detecting fraud were: tip offs and complaints, management review, accidentally, suspicious superiors and internal audit.

KPMG found that weak internal controls contributed to 59% of frauds in North America.

buy symbicort online https://galenapharm.com/pharmacy/symbicort.html no prescription

Companies are failing to focus on strengthening controls, the firm reported, despite the increasing threat of newer types of frauds, such as cyber fraud and continued traditional forms of wrongdoing.

“In addition to ensuring internal controls are thoughtfully designed, companies should deploy effective training and instill a culture of integrity so that controls are properly executed,” said Phillip Ostwalt, partner and Global Investigations Network Leader at KPMG LLP. “Companies should also adopt new controls as their risk profiles change. Ongoing risk assessments can help cost-constrained companies ensure they are properly investing in such controls.”

- 65% are between ages 36 and 55

- 39% are employed by the victim organization for over six years, most in operations, finance or office of the chief executive

- 42% operate in groups and 52% of collusive frauds involved external parties

Check out the infographic below for more of the study’s findings: