If the average food safety crisis or product recall forces companies to weather a storm, Chipotle has spent the past year trying to weather a category 4 hurricane. Now months into their recovery effort, it seems they are still seeing significant storm surges.

Last week, a group of Chipotle shareholders filed a federal lawsuit accusing executives of “failing to establish quality-control and emergency-response measures to prevent and then stop food-borne illnesses that sickened customers across the country and proved costly to the company,” the Denver Post reported. The suit accuses executives, the board of directors, and managers of unjust enrichment and seeks compensation from Chipotle’s co-CEOs, while also asking for corporate-governance reforms and changes to internal procedures to comply with laws and protect shareholders.

Sales remain significantly impacted by the series of six foodborne illness outbreaks last year.

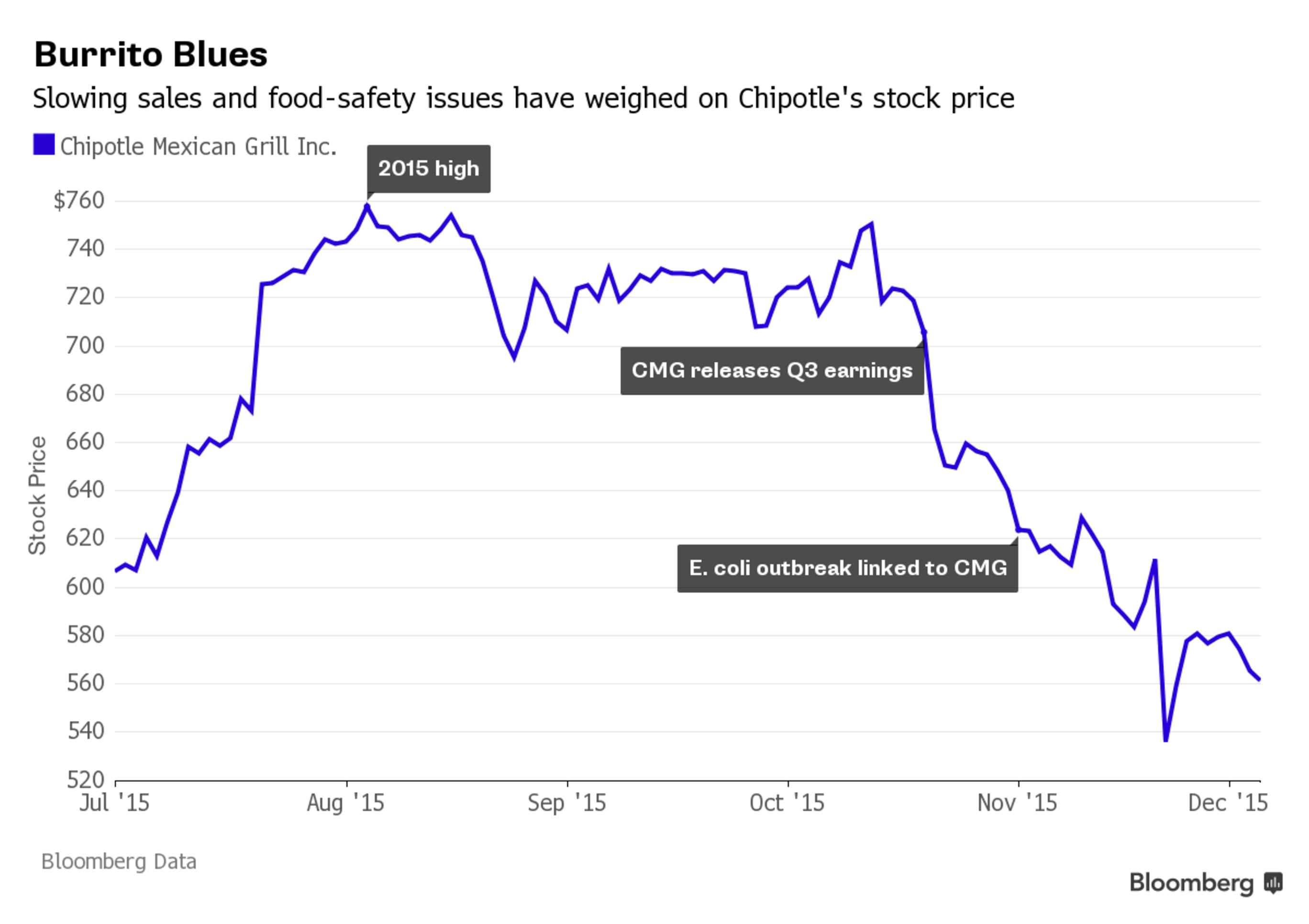

The company reported in July that same-store sales fell another 23.6% in Q2, marking the third straight quarter of declines for performance even lower than analysts had predicted. The company’s stock remains drastically impacted, currently trading at about 4 compared to a high of 9 before the outbreaks came to light a year ago.

In addition to the most recent shareholder lawsuit, the bad news for directors and officers specifically has also been further compounded recently.

Shareholder lawsuits were filed earlier this year alleging the company had misled investors about its food safety measures, made “materially false and misleading statements,” and did not disclose that its “quality controls were not in compliance with applicable consumer and workplace safety regulations.” In June, a group of shareholders sued a number of top executives for allegedly violating their fiduciary responsibilities and engaging in insider trading.

Relying on insider knowledge about insufficient food safety protocols, the suit alleges that the executives sold hundreds of thousands of shares in the first half of 2015 before the food poisoning scandal was made public.

Check out previous coverage of the Chipotle crisis in the Risk Management March cover story “Dia de la Crisis: The Chipotle Outbreaks Highlight Supply Chain Risks.”