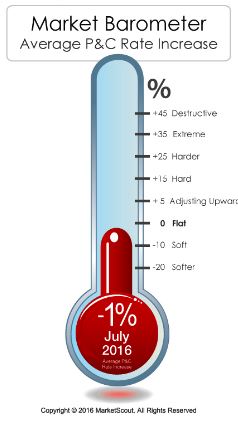

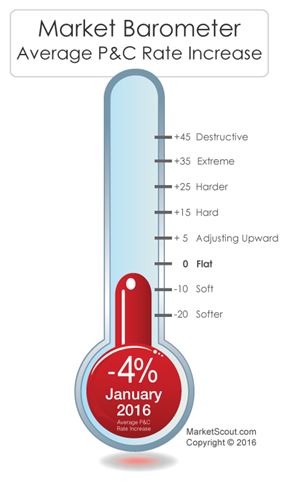

The property and casualty composite rate for July was the same as June’s rate, which was minus 1%, MarketScout reported today, adding that insurers are working to stop the downward trend.

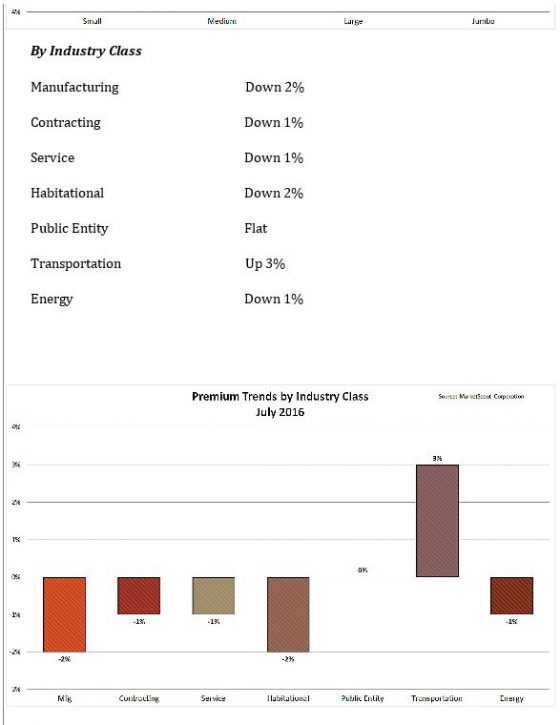

“While insurers continue to grant minor rating concessions, many are pushing for an end to any further rate reductions,” Richard Kerr, CEO of MarketScout said in a statement. In the transportation sector, however, pricing is increasing “on all but the very best accounts. The poor loss experience in transportation has prompted underwriters to demand rate increases and restrict underwriting appetite.” Insureds that are unable to convince underwriters they can control losses are left with few options “and ultimately end up paying a much higher rate/premium which impacts their profit margins,” he said.

underwriters they can control losses are left with few options “and ultimately end up paying a much higher rate/premium which impacts their profit margins,” he said.

Kerr continued that insurance buyers in the transportation industry are complaining about the lack of cooperation they are seeing from insurers as they try to manage their risk portfolio. “Business owners and corporate CEOs are concerned their insurance premiums will be larger than what was budgeted therefore negatively impacting net profits,” he said.

He advised these insureds to “allocate capital towards implementing loss control and companywide safety programs. That is how they will get cooperation from their insurers.”

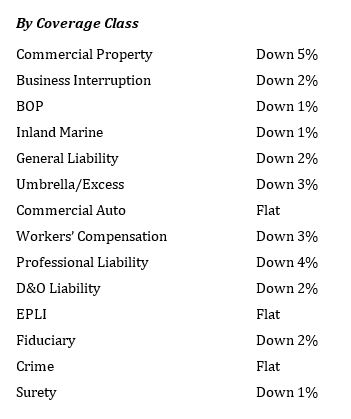

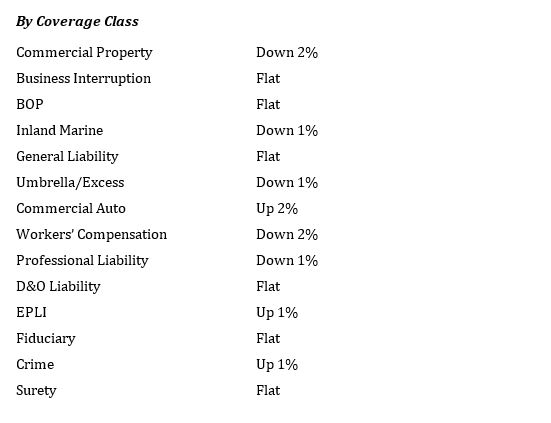

A comparison of June 2016 to July 2016 rates by coverage classification reveals that workers compensation and property coverages were the most aggressively priced at minus 2%. Business interruption, business owners policies (BOP), fiduciary and directors & officers all moderated by moving rates from minus 1% to flat, or no increase. Professional liability rates moved from down 2% to down 1%. Rates for all other coverages were unchanged.

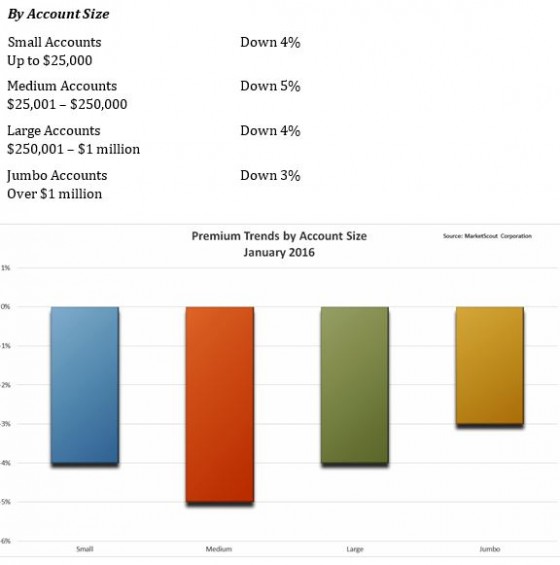

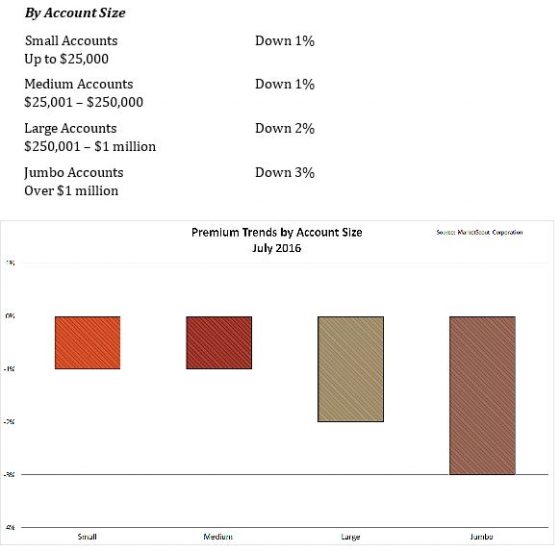

There were no rate adjustments by account size from June to July.

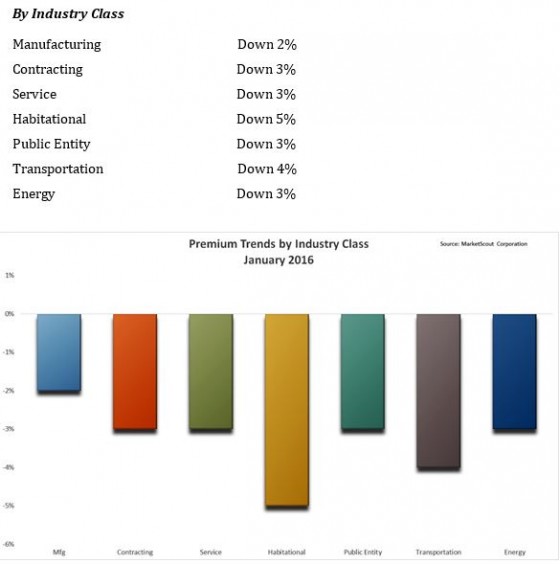

By industry classification, rates for public entities moved up from minus 1% in June to flat or no increase in July. Transportation accounts were assessed at the largest rate increases from up 1% in June to up 3% in July, according to MarketScout.

prevent commercial property rates from dropping further.”

prevent commercial property rates from dropping further.”