In a new report based on research from UK national weather service the Met Office, Lloyd’s has found that extreme weather events may be modeled independently. While extreme weather can be related to events within a region, these perils are not significant correlated with perils in other regions of the world.

The study’s key findings include:

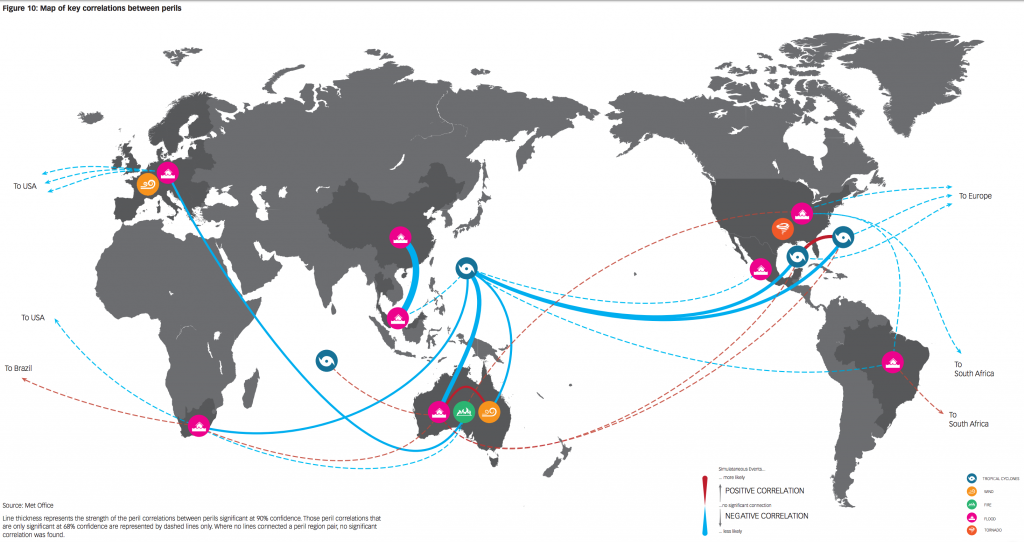

- Met Office research found that the majority of perils are not significantly correlated, but identified nine noteworthy peril-to-peril teleconnections, most of which are negatively correlated

- Lloyds’ modeling finds that these correlations were not substantial enough to warrant changes to the amount of capital it holds to cover extreme weather claims

- Even when there is some correlation between weather patterns, it does not necessarily follow that there will be large insurance losses. Extreme weather events may still occur simultaneously even if there is no link between them

- An assumption of independence for capital-holding purposes is therefore appropriate for the key risks the Lloyd’s market currently insures

- The methodology released in the report enables scenario modeling across global portfolios for appropriate region-perils

“This important finding supports the broader argument that the global reinsurance industry’s practice of pooling risks in multiple regions is capital efficient and that modeling appropriate region perils as independent is reasonable,” the report concluded.

According to Trevor Maynard, head of exposure management and reinsurance at Lloyd’s, “This challenges the increasingly held view among some regulators around the world that capital for local risks should be held in their own jurisdictions. Lloyd’s believes this approach reduces the capital efficiency of the (re)insurance market by ignoring the diversification benefits provided by writing different risks in different locations and, in so doing, needlessly increases costs, to the ultimate detriment of policyholders. Insisting on the fragmentation of capital is not in the best interests of policyholders.”

Check out the map below for further insight from the Met Office about large-scale weather perils that do demonstrate statistically significant correlation: