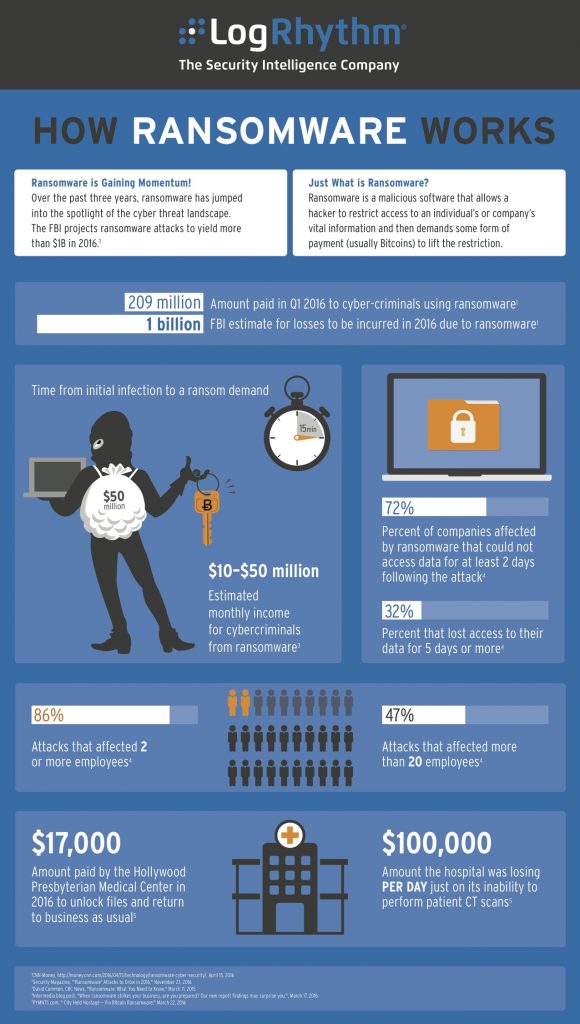

At the beginning of the year, Risk Management put ransomware at the top of the list when surveying the 2016 cyberrisk threat landscape, and these attacks have arguably come to the fore as cyberthreat of the year, whether you measure by buzz or by increase in incidents.

Indeed, ransomware is not just grabbing headlines—these cyberattacks have quadrupled in 2016, according to a recent Beazley Breach Response Services review of client data breaches. Authorities report a similar surge at large, with the Department of Justice estimating that more than 4,000 ransomware attacks have occurred daily since the beginning of the year, representing a 300% increase from 2015.

In July and August alone, 20% more of Beazley’s clients suffered a ransomware attack than in all of 2015. While the ransoms remain low, often in the range of $1,000, the firm points out that the true costs are dramatically higher due to the extensive review of company systems and data required to ensure the malware has been removed and data is clean.

Looking at specific industries, Beazley noted a significant uptick in attacks against financial institutions in the first three quarters of 2016, with hacking and malware accounting for 39% of breaches in the sector, up from 26% in 2015, and in higher education, these attacks increased from 38% last year to 46% in 2016. Hacking and malware account for a relatively steady proportion of just over half of breaches in the retail sector.

Among healthcare organizations, however, human error has spiked, with 40% of industry incidents caused by unintended disclosure compared to 28% last year.

“From what we are seeing, it appears that many hackers are finding it easier to make money by holding companies to ransom for bitcoin than through selling personal data on the dark web,” said Katherine Keefe, global head of BBR Services. “But, the persistently high levels of hacking and malware attacks of all kinds are a reminder that organizations across industries, and of all sizes, need actionable plans ready to implement when a breach occurs.

”

Check out the infographic below from security intelligence firm LogRhythm for more background on the rise in ransomware, how these attacks are impacting businesses, and how businesses are responding.

the Oshawa Flex Assembly in Canada.

the Oshawa Flex Assembly in Canada.