For risk professionals in India, the COVID-19 pandemic has underscored the critical need to build business resilience and develop mature yet flexible business continuity plans to address both short- and long-term threats. In the new Marsh and RIMS report Excellence in Risk Management India 2020, Spotlight on Resilience: Risk Management During COVID-19, 63% of risk professionals in India said a new pandemic or continued fallout from COVID-19 was a top risk facing their organization, followed by cyberattacks (56%), data fraud or theft (36%), failure of critical infrastructure (33%), fiscal crises (31%), and extreme weather events (25%).

This mix of top risks illustrates the critical task before risk professionals heading into 2021: ensuring capability and procedures to respond to fast-emerging disasters, while not losing sight of the critical work to boost baseline resilience against foreseeable risks across the enterprise.

“Organizations need to balance their focus between longstanding and emerging risks,” said Sanjay Kedia, country head and CEO of Marsh India. “While there has long been an awareness of weather-related risks, low-frequency risks generally receive less attention. The pandemic has underlined the need for risk managers to keep all perils on their radar.”

Indeed, Marsh and RIMS found risk assessment and modeling are critical gaps for India-based risk professionals to focus on to mature their risk management programs. “As businesses recover from COVID-19, many senior leaders are shifting attention to questions of resilience.

But, as our survey shows, the use of advanced risk management techniques in India remains limited—for example, more than one-fifth of respondents do not assess or model emerging risks,” the report noted.

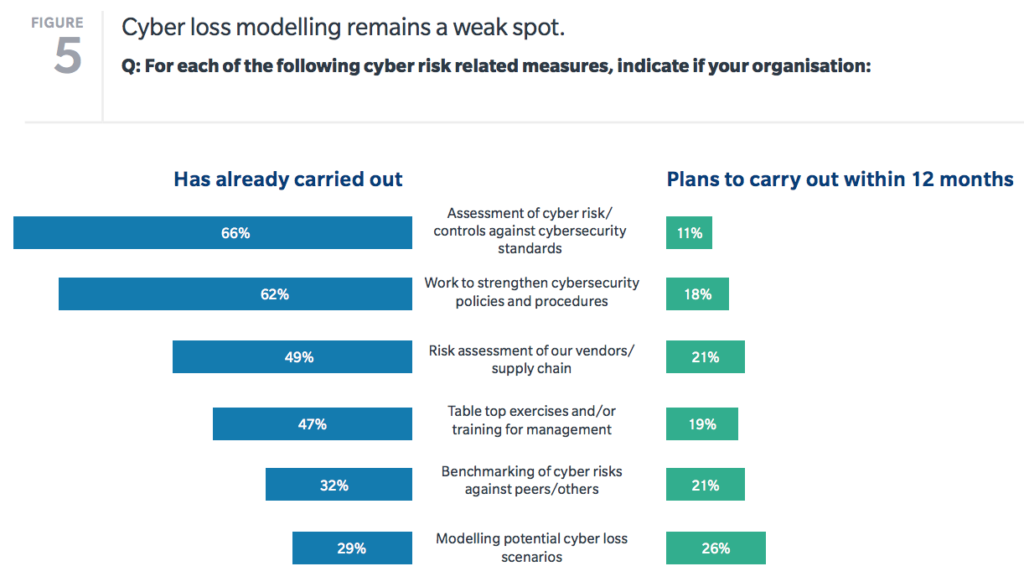

This is particularly the case with emerging cyberrisks. Cyberattacks and data loss or theft ranked among the top three threats, and the pandemic escalated the already rising number of cyberthreats to companies in India with the shift to remote work, online business, and ransomware attacks. Indeed, the report noted that the pandemic led to a surge in cyberattacks against Indian companies, with New Delhi among the top 10 most often attacked cities with regard to ransomware in 2020, and more than a third of Indian respondents to a June survey by Microsoft reporting they had fallen prey to a pandemic-related phishing email. Yet only a third of respondents to the Marsh/RIMS report said they model potential cyber loss scenarios, and only 26% plan to do so in the next year. Key cyberrisk management measures and the rate of implementation among Indian companies include:

Whether it is phishing attacks on employees or internet outages interrupting operations in the supply chain, the report notes that the next major event for Indian companies could well be a cyberattack. Focusing on building cyber resilience was one of the report’s four key recommendations, noting “organizations should shift their focus from solely trying to prevent an attack to accepting the inevitability of a cyber event and taking action to mitigate its effect.”

The report’s other top recommendations for risk professionals in India were:

- Regularly review existing business continuity plans – “Companies should carefully review and refine their business continuity plans. They should ensure their plans enable them to respond effectively to threats that bring short-term pain and long-term and widespread challenges, as is the case with COVID-19.”

- Embrace the changing working environment – “Lockdowns intended to stem the spread of COVID-19 required many companies to quickly move to remote working, change their business models, and implement new safety measures upon return to the workplace. Other perils, like a natural disaster, could necessitate and precipitate such shifts, even if shorter in duration. Businesses should invest in structures that allow employees to work remotely effectively, efficiently, and safely and should educate employees on new ways of working under changing circumstances.”

- Remap and remodel your supply chain – “The COVID-19 pandemic emphasizes the need to re-examine supply chains regularly, with special focus on understanding the resilience and reliance of vendors. Companies would benefit from understanding their vendors’ ecosystems; both to provide a clearer view of how they could be affected by different risks and to review contracts to better understand liabilities.buy inderal online greendalept.com/wp-content/uploads/2023/10/inderal.html no prescription pharmacy

”

Moving forward, there is considerable room for risk professionals to be more involved in scenario analysis and strategy

In December, RIMS introduced additional resources specifically for risk professionals in India looking to elevate their risk practice. The report was released around the recent RIMS Virtual Risk Forum India 2020, which brought together hundreds of risk and insurance professionals from across India and around the world. Soon thereafter, the risk management society also announced the official formation of a RIMS India Chapter.

“The exchange of knowledge and experience drives the risk management profession, allowing practitioners to more effectively enhance corporate decision-making, strengthen resiliency and leverage new and exciting opportunities for their organizations,” said Roop Kumar, chief of risk at SBI Life and inaugural president of the India chapter’s board of directors. “RIMS India Chapter will quickly become an exceptional resource for all business leaders. We look forward to delivering cutting-edge risk management insight to support our members as they advance their programs and their careers.”

Other members of the inaugural board of the India chapter include: Keerthana Mainkar, head ERM at Infosys; Amol Padhye, head of market risk at HDFC Bank; Amber Gupta, head legal and corporate secretary at Birla Sunlife Insurance; Anand Shirur, CEO of Digitangle Consulting PVT, Ltd; Steward Doss, associate professor at National Insurance Academy; Monika Mittal, professor at BIMTECH; Shibyanshu Sharma, vice president of risk management at SBI Life; and Yogesh Ghorpade, head of ERM and insurance lead at Thermax Industries.

“RIMS India’s Board of Directors truly represent a cross-section of the country’s risk management community,” said Gopal Krishnan K S, head of RIMS India Operations. “The Society looks forward to learning from their unique experiences and welcoming others to contribute so that, together, we can develop the highest standard of risk management education to address corporate India’s biggest concerns.

”