It seems more and more insurers are choosing to stick with writing policies and collecting premiums while leaving the management of their assets to others.

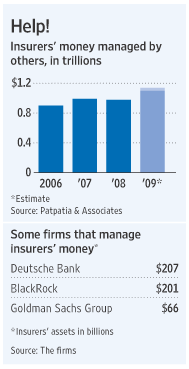

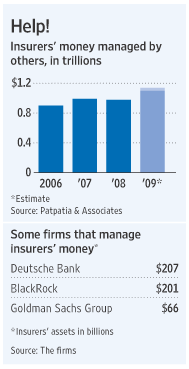

This is good news for Wall Street since its money managers have watched their asset bases dwindle during the downturn. According to industry estimates stated in The Wall Street Journal, insurers last year outsourced management of more than $1.1 trillion, up from about $980 billion in 2008.

Last year, the company chose BlackRock Inc. to look after $23 billion of bond securities of its nearly $160 billion portfolio. Allstate Corp. got out of the stock-picking business by hiring Goldman Sachs Group Inc. to manage a $5 billion equity portfolio out of its overall $100 billion investment pool.

Other big winners include Conning & Co., of Hartford, Conn.; State Street Global Advisors, part of State Street Corp.; and General Re-New England Asset Management, owned by Warren Buffett’s Berkshire Hathaway Inc.

Deutsche Bank AG and BlackRock are the two biggest money managers for insurers, controlling about $200 billion in insurance assets each, according to data from the money-management firms and Patpatia & Associates, a Berkeley, Calif., consulting firm that tracks insurers’ outside investments and advises them on outsourcing

Last year, the company chose BlackRock Inc. to look after $23 billion of bond securities of its nearly $160 billion portfolio. Allstate Corp. got out of the stock-picking business by hiring Goldman Sachs Group Inc. to manage a $5 billion equity portfolio out of its overall $100 billion investment pool.

Other big winners include Conning & Co., of Hartford, Conn.; State Street Global Advisors, part of State Street Corp.; and General Re-New England Asset Management, owned by Warren Buffett’s Berkshire Hathaway Inc.

Deutsche Bank AG and BlackRock are the two biggest money managers for insurers, controlling about $200 billion in insurance assets each, according to data from the money-management firms and Patpatia & Associates, a Berkeley, Calif., consulting firm that tracks insurers’ outside investments and advises them on outsourcing.

Both Deutsche Bank and BlackRock claim that 2009 was a record year for them in terms of new insurer assets. Goldman Sachs has seen their asset base increase 50% in just a few years. In 2007 Goldman had “five people on the team managing $32 billion of assets; it now has a staff of 38 managing $66 billion.” We can clearly see the increase in insurer assets under management with the following chart:

But not all insurers feel the need to outsource their asset management. Prudential Financial is one example. The company employes a staff of 3,000 to manage it’s $260 billion investment portfolio, along with billions of dollars in assets from other companies. Prudential is a unique exception however, as it considers asset management one of its core business units.

It remains to be seen if 2010 will surpass last year in terms of insurers turning to others to manage their investment portfolio, but all signs are point to yes as most insurers realize outsourcing is more economical.