One of Wall Street’s longest-running dramas closed Feb. 10 as New York State and Maurice “Hank” Greenberg finally ended a legal clash which began in 2005 under the stewardship of then Attorney General Elliot Spitzer.

Former American International Group, Inc. CEO Greenberg and the Attorney General’s office reached a settlement over accusations that the company engaged in fraudulent transactions to boost reserves and hide losses.

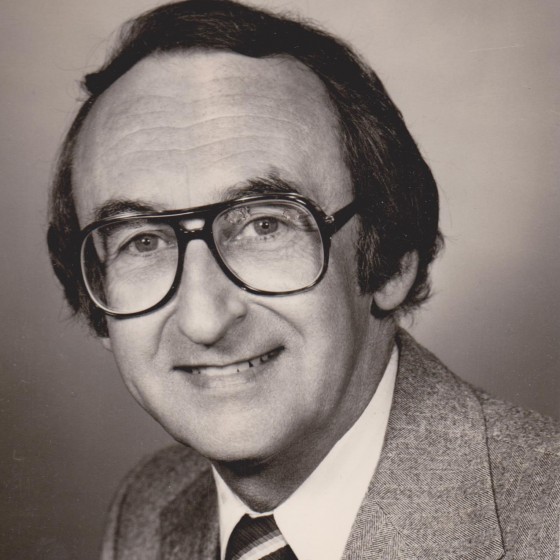

Greenberg, who was chairman and CEO of AIG from 1967 until his ouster in 2005 and now serves as chairman and CEO of C.V. Starr & Co., will pay some $9 million to end his role in the saga. Also, Howard Smith, former AIG CFO and Greenberg’s lieutenant will pay $900,000 to settle the charges stemming from two alleged transactions designed to misrepresent company finances.

This included a $500 million deal in the year 2000 with reinsurer General Re, part of businessman Warren Buffet’s Berkshire Hathaway Inc., to pad AIG’s loss reserves. Greenberg allegedly initiated the Gen Re deal with a call to the company’s CEO.

The two former AIG leaders were also said to be involved in a deal with Capco Reinsurance Co., which masked a $210 million underwriting loss as an investment loss.

The sums paid by the men are related to performance bonuses earned from 2001 to 2004, according to New York Attorney General Eric Schneiderman, who inherited the long-running conflict. Schneiderman sought to ban the men from the securities industry and from serving as directors and officers of public companies as part of the settlement, which ultimately did not include these provisions.

Schneiderman had previously dropped a $6 billion damage claim against Greenberg and others, once a class action settlement was approved in 2013 under which Greenberg paid $115 million to AIG shareholders.

A 2009 settlement with the U.S. Securities and Exchange Commission over charges related to AIG‘s accounting saw Greenberg pay $15 million and Smith $1.5 million to the agency.

Late last year Greenberg and the Attorney General’s office turned to mediation after trial testimony had already begun in state court. The mediation, which ultimately produced the settlement, was run by alternative dispute resolution specialist Kenneth Feinberg.

The finale to the case was perhaps more of a whimper than a bang, with settlements hardly headline-grabbing and no one admitting to much more than accounting slips.

In a press release from the N.Y. State Attorney General’s Office, Schneiderman sounded a triumphant tone. “Today’s agreement settles the indisputable fact that Mr. Greenberg has denied for 12 years: that Mr. Greenberg orchestrated two transactions that fundamentally misrepresented AIG’s finances,” Schneiderman said in the statement. “After over a decade of delays, deflections, and denials by Mr. Greenberg, we are pleased that Mr. Greenberg has finally admitted to his role in these fraudulent transactions and will personally pay $9 million to the State of New York.”

Greenberg, who was unapologetic, in his statement said, “The Gen Re transaction was done for the purpose of increasing AIG’s loss reserves, and the Capco transaction was done for the purpose of converting underwriting losses into investment losses. I knew these facts at the time that I initiated, participated in and approved these two transactions…As a result of these transactions, AIG’s publicly-filed consolidated financial statements inaccurately portrayed the accounting, and thus the financial condition and performance for AIG’s loss reserves and underwriting income.”

The pundits had their say as well, split as to what it all meant.

“The taxpayers of New York State should be furious,” said the Wall Street Journal’s Paul Gigot, editorial page editor. “The $9 million fine amounts to pin money for Mr. Greenberg…It won’t come close to covering the state’s costs for pursuing the case over so many years…The real lessons of the Greenberg case start with the absurd lengths that progressive prosecutors will go to punish capitalists they don’t like,” Gigot said.

Mr. Greenberg’s lawyer David Bois called the deal with the Attorney General a “nuisance settlement,” according to the New York Times.

Others were less forgiving of Mr. Greenberg. “Just because he hasn’t pled guilty to fraud doesn’t mean he’s been vindicated,” David Schiff, a former insurance analyst who followed AIG, told the Times.