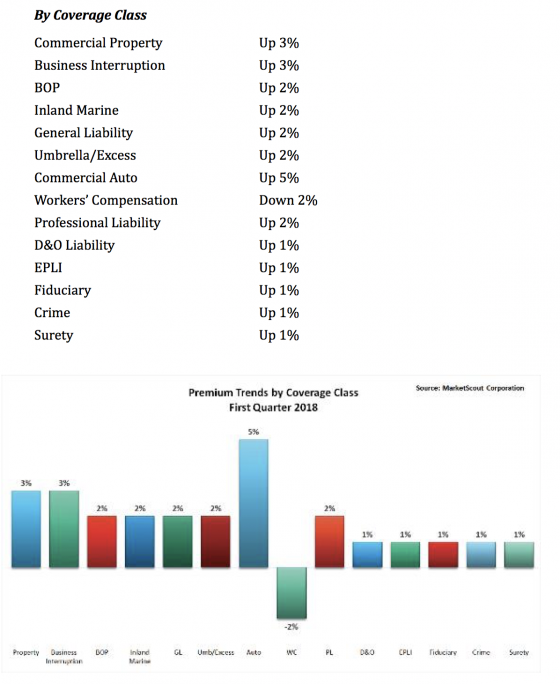

The U.S. property and casualty industry continues to show rate increases, with a first quarter composite rate of plus 2%, according to MarketScout. The increase is in all lines except workers compensation, which had a rate decrease of 2%. The trend follows a 2% increase in the fourth quarter of 2017.

By coverage classification, business interruption, inland marine and professional lines all raised rates 1% higher than in the last quarter of 2017. Only EPLI rates moderated.

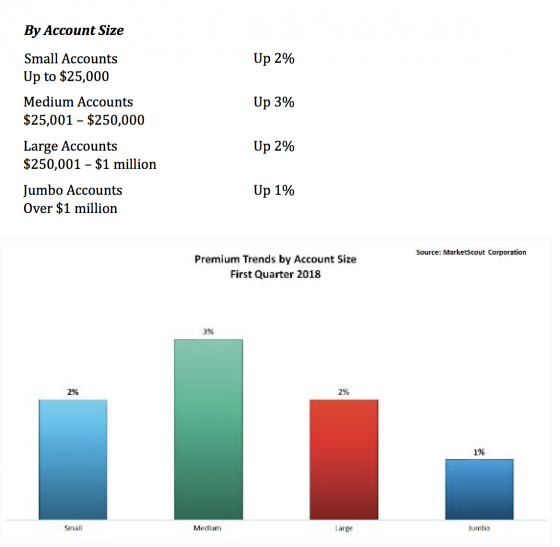

By account size, rates for medium accounts ($25,001 to $250,000 premium) increased from plus 2% in the final quarter of 2017 to plus 3% in the first quarter of 2018.

By account size, rates for medium accounts ($25,001 to $250,000 premium) increased from plus 2% in the final quarter of 2017 to plus 3% in the first quarter of 2018.

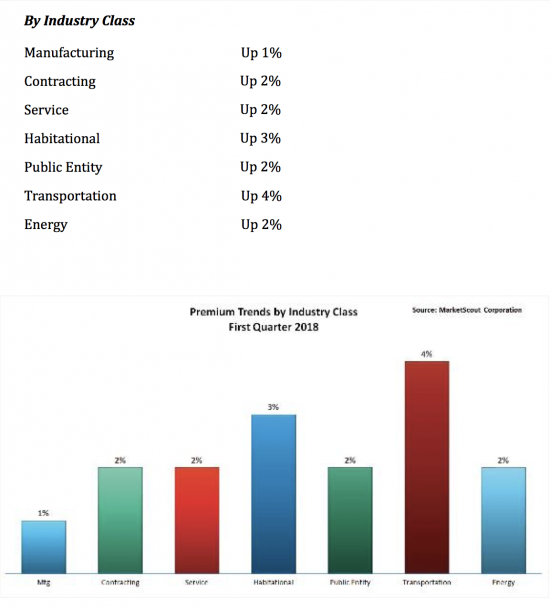

By industry group, service contractors, public entities, and energy accounts were assessed larger rate increases in the first quarter of 2018 than in last quarter of 2017. Transportation accounts had a quarter-over-quarter price decrease from plus 5 to plus 4%.

By industry group, service contractors, public entities, and energy accounts were assessed larger rate increases in the first quarter of 2018 than in last quarter of 2017. Transportation accounts had a quarter-over-quarter price decrease from plus 5 to plus 4%.

Richard Kerr, chief executive officer of MarketScout noted, “Automobile and transportation exposures continued to experience the greatest rate increases due to increasing expenses and adverse claim development. Insurers are struggling with this segment of our industry. Part of the problem is actual underwriting results, part is expense ratios, and in our view, a larger part is the uncertainty of the long-term prospects for the auto insurance industry.”

Richard Kerr, chief executive officer of MarketScout noted, “Automobile and transportation exposures continued to experience the greatest rate increases due to increasing expenses and adverse claim development. Insurers are struggling with this segment of our industry. Part of the problem is actual underwriting results, part is expense ratios, and in our view, a larger part is the uncertainty of the long-term prospects for the auto insurance industry.”

He noted that the questionable future of auto insurance could be impacting insurers’ willingness to invest in new safety concepts, pricing models and distribution alternatives. “Autonomous vehicles are going to change the auto insurance industry forever. Many tech firms are working hard to deploy new insurance alternatives, which reflect the lower claims frequency and severity anticipated by driverless or driver assisted trucking exposures. Traditional auto insurer opportunities will shrink unless they adapt their business model to get in the middle of the autonomous vehicle parade,” Kerr said.