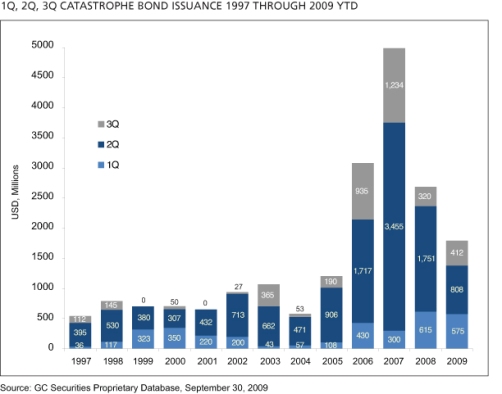

The catastrophe bond market saw a very slow recovery (if we can call it that) in the beginning of this year, with the number of bonds issued down 33% year over year.

But the fourth quarter is looking much more promising, according to a report from Guy Carpenter.

The report, “Cat Bond Update: Third Quarter 2009,” says that various trends and activity within the cat bond market could result in a total of between $3 billion and $4 billion worth of issuance in 2009. Also encouraging is the report’s statement that new risk capital issued in the third quarter of 2009 rose 28.8% compared with the same quarter of 2008.

Though the cat bond market is still severely behind its 2007 performance, the conclusion of the fourth quarter of this year may see 2009 catch up to 2008 in terms of issuance.

David Priebe, chairman of global client development for Guy Carpenter suggests both caution and optimism with views of the cat bond market:

Given the increase in risk capital and the performance of the two bonds issued in the third quarter — both in terms of pricing and size — a fourth quarter that would account for more than 40 % of the year’s total issuance is not unattainable. [However], redemptions resulting from cat bonds maturing and a fairly light Atlantic hurricane season should also increase demand for new issuance.

The report offers the following fourth quarter 2009 outlook:

- Improvement in global financial market conditions and advances in the insurance-linked securities (ILS) collateral solutions — coupled with a stronger demand for issuance and the increasing capacity of investors — have resulted in a shift in the ILS market relative to the beginning of 2009.

- Investors are increasingly focusing on capital deployment and stimulating additional primary issuance, which is contributing to spread tightening.

- The consensus estimate for 2009 total issuance remains from billion to billion, implying a fourth quarter issuance rate of $2 billion to $2.2 billion.

Eleven more weeks of cat bond market activity will prove this prediction right or wrong.