DENVER—Interest in risk management is now firmly established within organizations, with strategic risk is becoming more central to senior leaders and boards, but there is still uncertainty about where primary responsibilities for executing risk management reside, according to a study released here by Marsh and the Risk and Insurance Management Society.

The Excellence in Risk Management XI study, “Risk Management and Organizational Alignment: A Strategic Focus,” found that regarding risk management’s influence on setting an organization’s business strategy, 93% of executives agreed it carries some or significant influence.

Discussing the standouts of the study, Brian Elowe, a managing director at Marsh said, “In the past I had seen incremental improvements in risk management to meet the demands of the C-suite and the boards. This year we’re seeing a much greater alignment around strategic planning.

Strategic is very strong and the alignment between risk professionals and the C-suite is very strong. We saw that this is the higher need and the need to take risk management to the next level as well.”

Elowe added that risk professionals are finding they need to become versed in finance, as finance officers learn more about risk. Financial or business institutions generally require more financial knowledge, whereas technical or legal businesses look for expertise in their specific areas. But overall, he said, organizations are expecting risk managers to have a basic business background.

According to the survey, senior leadership has a heightened interest in emerging risks—”black swans” and the uncertainties that come with them. With this interest comes the expectation that risk professionals should provide higher levels of insight and education on these issues—in addition to their current responsibilities managing traditional insurance, claims, and mitigation functions.

“The conversation has moved from a focus on the insurance program itself, to taking those insurance buying decisions to part of the overall risk capacity of the organization,” said Carol Fox, director of the strategic and enterprise risk practice at RIMS.

“It’s not just about deductibles anymore, it’s not just about premiums or conditions, it’s looking at it from a broader risk perspective.”

Asked whether organizations treat risk management as a key strategic function, more than half of both the C-suite and risk professionals said their companies view it as such. They were close in agreement (69% of C-suite and 75% of risk professionals) that their organizations are managing risk effectively. They also agreed that their risk functions were not being used to their greatest ability—20% of executives and 25% of risk professionals.

When asked what types of knowledge, abilities and skills will be most important to meeting the organizations’ risk management needs over the next three to five years, more than half the respondents chose an aptitude for strategy and business acumen. Both are areas closely connected to an organization’s finances and operations.

Looking at risk management needs over the next five years, risk professionals and executives closely agreed—63% for C-suite and 65% for risk managers—that a strategic view of risks is most important to the role of risk management.

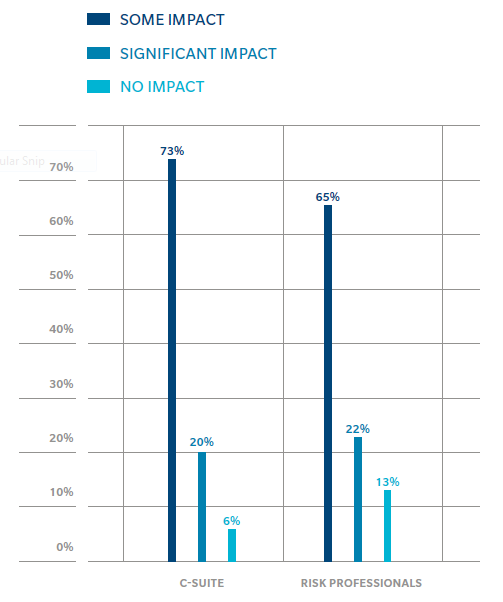

Graph: What impact does risk management have on setting the business strategy of your organization?

Source: 2014 Excellence in Risk Management Survey