It stands to reason that larger organizations would be more at risk of embezzlement by employees, but the reverse has been shown to be the case.

Organizations with fewer than 150 employees are particularly at risk, accounting for 82% of all embezzlement cases, Hiscox found in its new report, Embezzlement Study: A report on White Collar Crime in America. Smaller organizations with tight-knit workforces are particularly vulnerable because of the trust and empowerment given to employees.

found in its new report, Embezzlement Study: A report on White Collar Crime in America. Smaller organizations with tight-knit workforces are particularly vulnerable because of the trust and empowerment given to employees.

Incorporating employee theft cases active in the U.S. federal court system in 2015, the study found that 69% represented companies with less than 500 employees. Perpetrators are often “regular people who are smart, well-liked, and those you’d least expect to steal,” according to Hiscox.

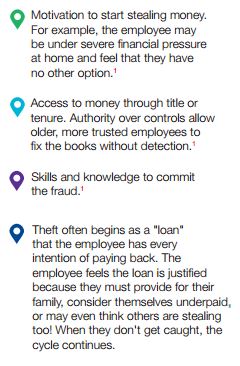

How does a trusted employee become a criminal?

Motivations can range from financial pressure to a belief that they are underpaid by the company.

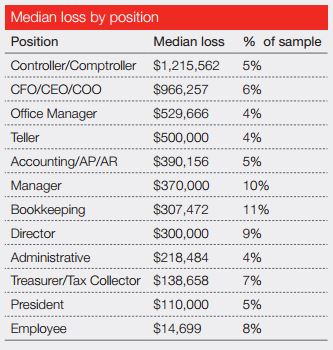

Employees with more tenure, access and control over finances are found to take the largest amounts. While the type of fraud can vary by industry, what is consistent is access to funds. In fact, managers were found more likely to steal than other employees.

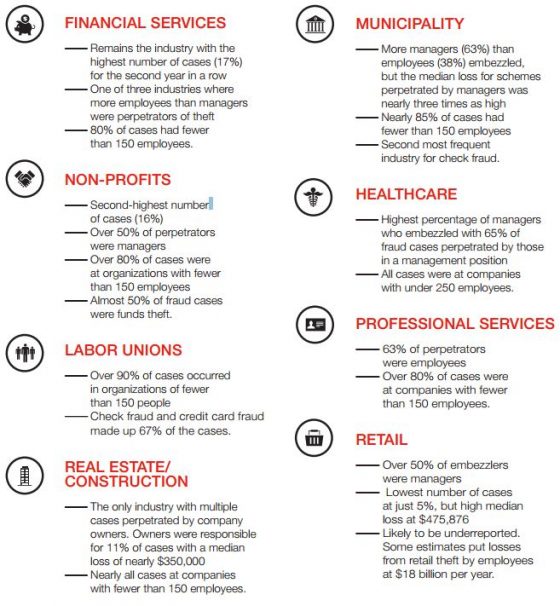

For the second year in a row, the greatest number of cases, 17%, was in the financial services industry and second was nonprofits at 16%. Labor unions ranked third, followed by real estate/construction. The largest scheme was a $7 million loss in Texas; followed by ones in Connecticut at $9 million, Ohio at $8.7 million and Utah at $4 million.

Schemes include taking cash or bank deposits, forging checks, fraudulent credit card use, fake invoices and false billing of vendors and payroll fraud.

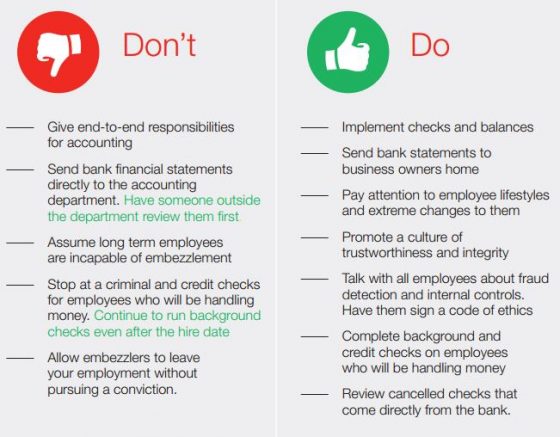

Companies can protect themselves in a number of ways, including putting checks and balances in place, performing background checks on employees who handle money and teaching employees how to detect fraud, according to Hiscox.

The study findings also include: