DENVER—Only 37% of the 664 captive insurers formed in the U.

S. are done so for federal income tax advantages, according to a survey by Marsh. The findings suggest that captives are predominately formed for their operational and risk management value to organizations.

The report, “The Evolution of Captives: 50 Years Later” also found that onshore versus offshore single parent captives remained flat in 2013 with 56% of captives onshore and 44% located in offshore domiciles.

While it was believed that the Dodd-Frank Act would drive captives to redomicile to their home state, that has not been the case, Arthur G. Koritzinsky, managing director, captive solutions for Marsh explained during a press conference here. Only 11 out of 1,200 captives were redomiciled in 2013, down from 16 in 2012. The only state that has responded with enforcement measures is Texas.

General liability tops the list of most popular risks in captives, with 30.8% of captives writing this line of coverage. Second is property risk—included in 29.4% of captives. The study found that more captive insurers are being used for non-traditional coverage, such as crime insurance/crime deductibles and cyber liability and 40 captives are being used for crime coverage. While captive use for this risk is growing, so far only 3.5% underwrite crime. Thirty-four captives are used for medical stop loss, 32 for trade credit and 17 for cyber liability. Third party risks, including employee benefits, customer risks and pooling arrangements, account for 18% of captives and voluntary employee benefits such as ID theft, critical illness, pet insurance, group home, group auto and group umbrella are becoming more common.

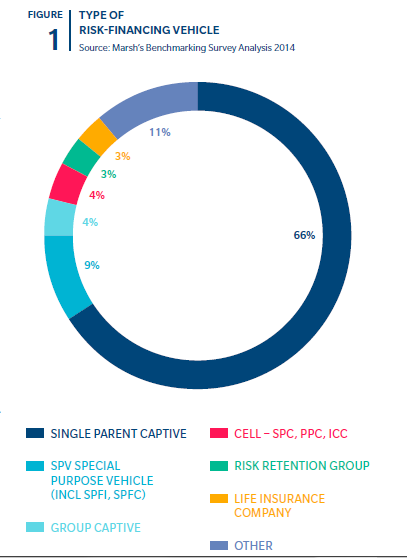

The favored structure is still single parent captives—66% of those were formed—which give companies more autonomy over claims processes and service providers. Use of special purpose vehicles increased to 9% of captives in 2013.

The largest three domiciles — Bermuda, the Cayman Islands, and Vermont — represent 36% of all captives. There is also a trend toward emerging domiciles, as more global and U.S. domiciles are created. Of parent companies that own captives, 58% are based in the United States, 28% in Europe and 14% in Latin America, Asia and Africa, the study found.