The composite rate for property and casualty insurance dropped 1% in March compared to March 2014,  indicating a softening market, according to MarketScout.

indicating a softening market, according to MarketScout.

“March is an important month. There is a considerable volume of U.S. business placed with both the U.S. and international insurers,” noted Richard Kerr, CEO of MarketScout. “While a small change from February, the downward adjustment in rates may be an indicator of what is to come for the next six months.”

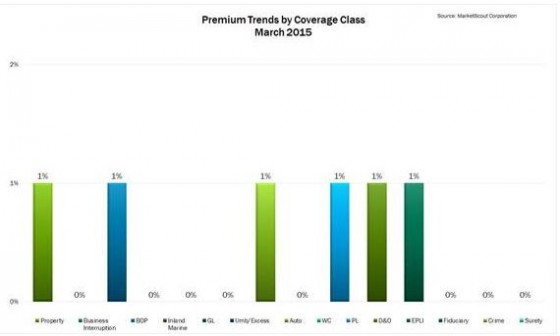

By coverage classification, general liability and umbrella/excess liability dropped from up 1% in February to flat or 0% in March. Commercial auto, professional liability, and employment practices liability (EPLI) were also down 1% in February as compared to March. No coverages reflected a rate decrease.

By account size, small accounts (up to $25,000 premium) adjusted downward from up 2% to up 1%. Large accounts ($250,000 to $1,000,000 premium) were flat as compared to up 1% in February. The rates for all other accounts were unchanged.

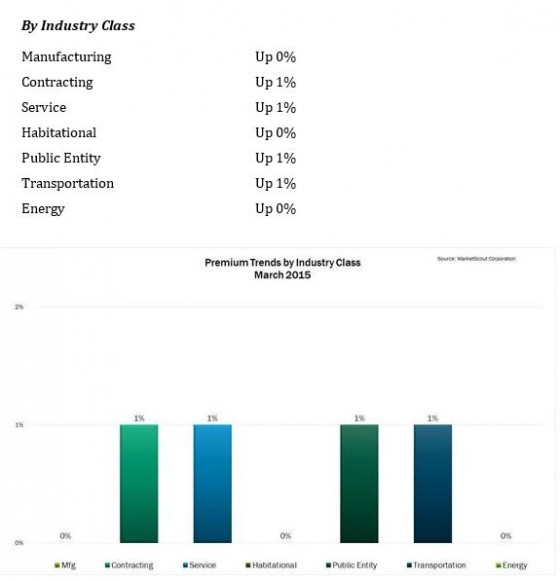

Industry classifications all remained the same as in February, except for contracting and transportation, which were up 1%t in March, compared to up 2% in February. Habitational was flat or up 0% in March, compared to up 1% in February.

Summary of the March 2015 rates by coverage, industry class and account size:

| By Coverage Class | |

| Commercial Property | Up 1% |

| Business Interruption | Up 0% |

| BOP | Up 1% |

| Inland Marine | Up 0% |

| General Liability | Up 0% |

| Umbrella/Excess | Up 0% |

| Commercial Auto | Up 1% |

| Workers’ Compensation | Up 0% |

| Professional Liability | Up 1% |

| D&O Liability | Up 1% |

| EPLI | Up 1% |

| Fiduciary | Up 0% |

| Crime | Up 0% |

| Surety | Up 0% |

The information stated in the above article is very useful and gives a brief description about the trends in P&C Rates. I find this article very informative.