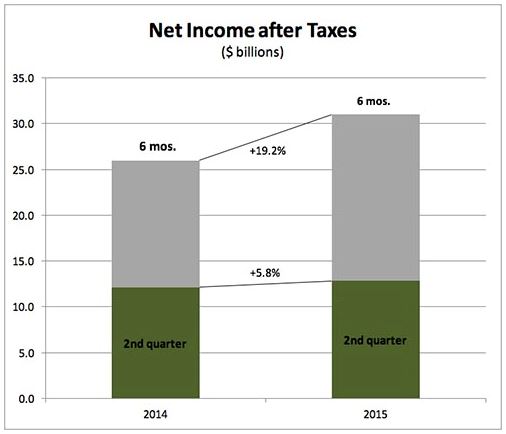

Low catastrophe losses contributed to a rise in net income for property/casualty insurers in the first half of this year, to $31 billion from $26 billion in the first half of 2014, according to ISO, a Verisk Analytics business, and the Property Casualty Insurers Association of America (PCI). Insurers’ overall profitability, measured by their rate of return on average policyholders’ surplus, grew to 9.2% from 7.8%.

“While Old Man Winter did his best to disrupt things in the Northeast during the first half of 2015, insurers overall incurred lower domestic catastrophe losses than they did during the first half of last year due to a relatively quiet tornado season and the slow start to hurricane season,” Robert Gordon, PCI’s senior vice president for policy development and research, said in a statement. “Insurers’ combined ratio and rate of return all improved in the first half of 2015, while premium growth and investment income remained relatively stable.”

Beth Fitzgerald, president of ISO Solutions noted, “Still, it’s important to note than U.S. catastrophe losses during the first half of 2015 were only slightly lower than the 10-year average. As the devastation caused by meteorological conditions associated with Hurricane Joaquin highlights, it’s crucial for insurers to remain disciplined in their underwriting and look at analytics to be ready not only for weather disasters but also for other major challenges the future may hold.”

According to the report, insurers’ combined ratio improved to 97.6% for first-half 2015 from 98.9% for first-half 2014, and net underwriting gains went to $3.39 billion from $237 million. Net written premium growth remained unchanged at 4.1 percent for the first half of 2014 and 2015.

Also in first-half 2015, earned premiums grew 4.0% to $247.5 billion, while losses and loss adjustment expenses (LLAE) rose just 1.8% to $171.3 billion. Other underwriting expenses rose 4.7% to $71.8 billion, and policyholders’ dividends were mostly unchanged at $1.0 billion. Net underwriting gains increased to $3.4 billion from $0.2 billion.

In second quarter, consolidated net income after taxes for the P&C industry rose to $12.8 billion from $12.1 billion in second-quarter 2014.

P&C insurers’ annualized rate of return on average surplus increased to 7.6% in second-quarter 2015 from 7.3% a year earlier.

Net written premiums rose $5.5 billion, or 4.4%, to $130.6 billion in second-quarter 2015 from $125.1 billion in second-quarter 2014.