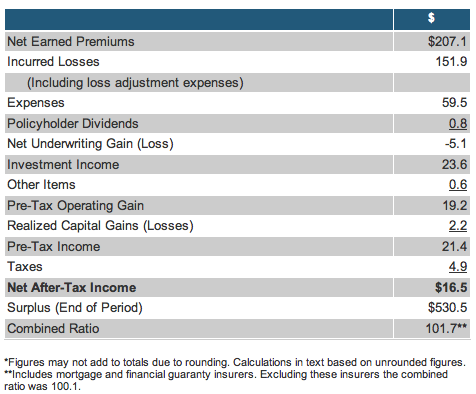

It seems the P/C market continues to rally. The Insurance Information Institute (III) issued a release stating that private U.S. property/casualty insurers’ net income after taxes rose to $16.5 billion in the first half of 2010 — up from billion in the first half of 2009.

“Property/casualty insurers’ positive results for first-half 2010 are yet another testament to the conservative investment strategies and superior risk management that enabled insurers to emerge from the financial crisis and great recession essentially unscathed,” said David Sampson, PCI’s president and CEO. “Combining insurers’ $530.5 billion in policyholders’ surplus as of June 30 with their 6.

buy ciprodex online youngchiropractic.com.au/wp-content/uploads/2023/10/jpg/ciprodex.html no prescription pharmacy1 billion in loss and loss adjustment expense reserves and their $202.3 billion in unearned premium reserves, insurers had nearly $1.3 trillion on hand to pay claims and meet other contingencies — up from $1.2 trillion at June 30, 2009. This means we can all be confident that insurers have the financial resources to fulfill their obligations to policyholders when catastrophes strike.”

It’s not all good news, however. Insurers’ net losses on underwriting grew to $5.1 billion for the first half of this year, compared to .

1 billion for the same period of 2009. Below are the financial results for private U.S. P/C insurers, courtesy of III.

First Half 2010 Financial Results *

($Billions)

We must take good or optimistic financial news for this industry with a grain of salt. There are still many challenges facing P/C insurers, including the excruciatingly slow pace of the economic recovery and fierce competition in the commercial insurance markets.

Fantastic site, I hadn’t noticed http://www.riskmanagementmonitor.com earlier in my searches!

Keep up the superb work!