National Cyber Security Awareness Month (NCSAM) kicks off this week. And in the wake of last month’s Equifax breach announcement—in which nearly 145.5 million Americans learned their personal information may have been compromised, coupled with the government’s recent efforts to combat cyber threats—NCSAM’s timing could not be better.

The Department of Homeland Security (DHS) hosts the annual NCSAM and will provide online and in-person tools to engage and educate the private and public sectors about cyberrisks. The DHS will also offer mitigation tips and techniques in tandem with this year’s campaign, which is divided into five different weekly themes:

Week 1: Oct. 2-6 –Simple Steps to Online Safety

Week 2: Oct. 9-13 –Cybersecurity in the Workplace is Everyone’s Business

Week 3: Oct. 16-20 –Today’s Predictions for Tomorrow’s Internet

Week 4: Oct. 23-27 –Consider a Career in Cybersecurity

Week 5: Oct. 30-31 –Protecting Critical Infrastructure from Cyberthreats

But NCSAM’s nationwide events are not limited to those themes and will cover topics that run the cybersecurity gamut through formats like workshops, webinars, twitter chats and conferences – some of which can be livestreamed. One major highlight will be the day-long global launch of NCSAM’s international adoption on Oct. 3 in Washington D.C. Featured speakers at other events include FTC Acting Chairman Maureen Ollhausen, White House Cybersecurity Coordinator Rob Joyce, Senate Homeland Security Chair Ron Johnson, and Palo Alto Networks CEO Mark McLaughlin. Visit here for an event calendar.

NCSAM is part of the ongoing DHS cybersecurity awareness program, Stop.Think.Connect., which began in 2009 as part of President Obama’s Cyberspace Policy Review. Non-profit organizations, government agencies, colleges and universities are encouraged to join Stop.Think.Connect. as “partners,” while individuals can become “friends” to engage their respective communities and memberships. The program also offers handy toolkits organized by topics such as mobile security and phishing, and by audiences, which range from corporate professionals to young children and law enforcement.

Increasingly, the government is taking cyberrisk seriously. In September, the SEC announced two initiatives to enhance its enforcement division’s efforts to combat cyber-based threats and protect businesses, investors and the public. A new Cyber Unit will focus on targeting misconduct which includes market manipulation schemes involving false information spread on social media, violations involving initial coin offerings and distributed ledger technology and hacking, among others. Its Retail Strategy Task Force will combat fraud in the retail investment space, from everything involving the sale of unsuitable structured products to microcap pump-and-dump schemes.

In August, President Trump elevated the United States Cyber Command’s status to Unified Combatant Command, with a focus on cyberspace operations. The elevation, he said, will increase “resolve against cyberspace threats, reassure our allies and partners and deter our adversaries,” by streamlining operations under a single commander, which will also ensure adequate funding. In connection with the elevation, the president said Secretary of Defense James Mattis would examine “the possibility of separating United States Cyber Command from the National Security Agency” and will eventually announce recommendations.

coverage argument under the law.”

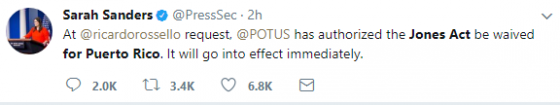

coverage argument under the law.” Maria wiped out power on the island and destroyed infrastructure and cell towers, leading to massive shortages. Even though a waiver had been granted to Texas and Florida after Hurricanes Harvey and Irma, the Department of Homeland Security initially said there was no need to waive the restriction for Puerto Rico, as it would not address the issue of the island’s damaged ports.

Maria wiped out power on the island and destroyed infrastructure and cell towers, leading to massive shortages. Even though a waiver had been granted to Texas and Florida after Hurricanes Harvey and Irma, the Department of Homeland Security initially said there was no need to waive the restriction for Puerto Rico, as it would not address the issue of the island’s damaged ports. TORONTO—The 2017 RIMS Canada Conference quickly found its groove on Monday morning, kicking off the annual conference with performances by a choir of local schoolchildren and an opening session centered on the theme of community.

TORONTO—The 2017 RIMS Canada Conference quickly found its groove on Monday morning, kicking off the annual conference with performances by a choir of local schoolchildren and an opening session centered on the theme of community. depends on recruiting and retaining the best talent, which requires an enterprise-wide culture that actively works to ensure representation and advancement.

depends on recruiting and retaining the best talent, which requires an enterprise-wide culture that actively works to ensure representation and advancement.