Companies that sign contracts, including renewals, without careful review could be in for an unpleasant surprise if the unexpected happens. For example, extra caution would have saved “Widget Corp.” a lot of money and time in its dispute with “Acme Inc.

”

Here’s the scenario: Widget Corp. enters into a contract with Acme Inc. While Acme Inc. expects to earn more than a million dollars from the contract, Widget Corp. later closes its doors after selling most of its assets. Angered and disappointed, Acme Inc. decides to sue Widget Corp. over the contract even though it has a weak claim that Widget Corp. did anything wrong.

The risk is that, perhaps recognizing it will lose on its breach of contract claim, Acme Inc. points to a peculiar provision in the contract that, in a nutshell, requires Widget Corp. to pay Acme Inc.’s attorney fees—win or lose.

(Can you guess which company drafted the contract?)

The result: At arbitration, a respected arbitrator hears arguments on the contract dispute and concludes that Widget Corp., in fact, had done nothing wrong and had not broken its contractual promises to Acme Inc. The arbitrator, nonetheless, required Widget Corp. to pay Acme Inc.’s attorney fees incurred in litigating the dispute—those fees exceeded $150,000.00.

Widget Corp.’s counsel raised a number of defenses:

- As a general rule, courts won’t interpret contract provisions in such a way that creates absurd or unreasonable results. Widget Corp.’s counsel argued that it would be absurd if Acme Inc. could sue Widget Corp., lose all of its arguments, but still collect attorney fees.

- Attorney fees aren’t typically awarded unless the side getting the attorney fees wins at least part of the dispute. This is so because courts view attorney fees as a form of damages, and if the other side did nothing wrong, then there is no damage to award—including attorney fees.

- An attorney fee award must be “reasonable.” Widget Corp.’s counsel argued that it is unreasonable to award any attorney fee whatsoever given that Acme Inc.

online pharmacy zetia with best prices today in the USA

lost the entire dispute.

The arbitrator found these arguments unpersuasive and enforced the contract as written. Since the contract said what it said, at the end of the day Widget Corp. signed the contract. As the arbitrator aptly quipped, the provision was “awful but lawful.”

Lessons:

- Companies must read contracts carefully to understand what they mean. Companies may be particularly tempted to sign without internal or legal review when renewing an annual or semi-annual contract; companies sometimes assume that the renewal contract will contain the identical language, and the companies do not want to spend additional time or money to review what has already been reviewed. Nothing guarantees that next year’s contract will match the current contract, however. Companies are thus wise to review even renewal contracts to ensure they understand the terms, exposure and risks.

- Get a second (and even third) set of eyes on the contract before signing. Companies would be prudent to devote even more resources to reviewing contracts that impose more liability. The rub is that companies often do not comprehend their contractual exposure until multiple people review the contract.

- Assume the worst when it comes to a particular, seemingly unreasonable contractual provision. In other words, assume the provision will be enforced as written. Reasonable minds can differ as to what constitutes a “reasonable” provision and it is foolhardy to assume that a court or arbitrator will disregard what parties agreed to—particularly when those parties are businesses.

- Remember, if a provision seems questionable in what it purports to do, it is easier to request that the other side remove the provision before you sign than to ask a court or arbitrator to ignore the provision despite your agreement. As Benjamin Franklin once advised fire-threatened Philadelphians, an ounce of prevention is worth a pound of cure.

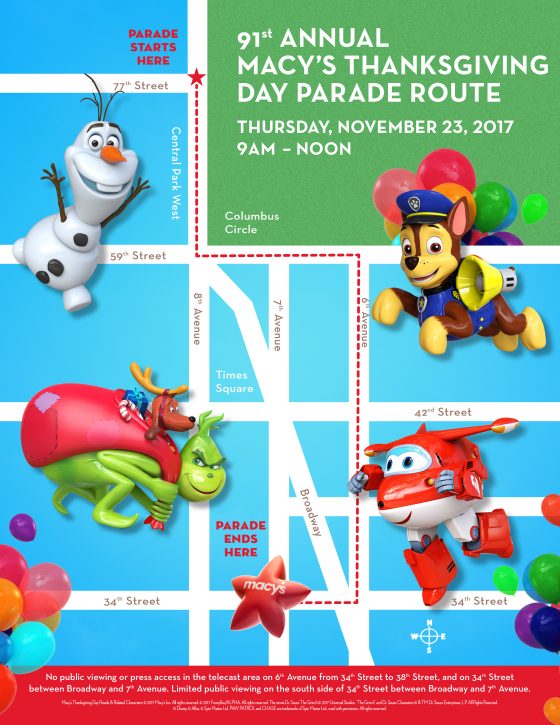

Theresa Morzello, the managing director for asset services for CBRE in New York City, has advised many companies who stay open or host events coinciding with parades and holidays. She said the first steps in mitigating disruption involve communicating with the event organizers and disseminating that information to tenants.

Theresa Morzello, the managing director for asset services for CBRE in New York City, has advised many companies who stay open or host events coinciding with parades and holidays. She said the first steps in mitigating disruption involve communicating with the event organizers and disseminating that information to tenants.