The coffee industry is poised for moderate growth in the next five years, but is warned of an emerging risk: an informed consumer, according to a recent IBISWorld report.

The coffee industry is poised for moderate growth in the next five years, but is warned of an emerging risk: an informed consumer, according to a recent IBISWorld report.

“Despite long-term, aggregate declines in healthy eating, consumers are more aware of health issues associated with fatty foods and are increasingly going out of their way to avoid them,” its latest Coffee & Snack Shops industry report notes. Consumers who are more aware of the nutritional information of a Starbucks Frappuccino, for example, may be less inclined to make repeat purchases. “The healthy eating index is expected to stagnate [in] 2018, but as consumers’ diets progressively improve, this driver continues to pose a threat to industry operators,” IBISWorld said.

Last week, in Starbucks’ financial release, President and CEO Kevin Johnson acknowledged his clientele’s evolving tastes. “We must move faster to address the more rapidly changing preferences and needs of our customers,” he said.

And so, with the Seattle-headquartered roaster and retailer leading the charge, the industry is expected to get creative and a bit more versatile. In its five-year forecast, IBISWorld suggests that coffee alone can no longer fuel the industry’s expansion, which is expected to stay resilient at an annualized rate of 0.9% to $51 billion. “Nontraditional, high-margin menu items, such as iced coffee drinks, breakfast items and wraps,” featured in “unsaturated markets while experimenting with different store formats,” will help generate growth, the report stated.

Furthermore, the collective habits may change everything from coffee retailers’ food and beverage offerings to their physical store layouts. The IBISWorld report stated:

Major operators, such as Starbucks and Dunkin’ Donuts, are expected to expand their menus and remodel the designs of their locations over the five years to 2023 to increase sales and draw a wider range of customers.

Assessing the Risk of Growth

The forecast was certainly prophetic, considering that Starbucks announced plans to close 150 stores due to underperformance just last week. It seems that more manageable expansion efforts will level some profit margins; where Starbucks wanted to hit 3-5% growth, 1% is more pragmatic. According to the company’s statement:

Starbucks is optimizing its U.S. store portfolio at a more rapid pace in FY19, including shifting new company-operated store growth to underpenetrated markets, slowing licensed store growth, and increasing the closure of underperforming company-operated stores in its most densely penetrated markets to approximately 150 in FY19 from a historical average of up to 50 annually. In FY19, this will result in a slightly lower growth rate in net new company-operated stores.

Last August, Risk Management Monitor reported that Starbucks’ expansion efforts were to the point that there was almost a store on every corner—with an estimated 3.6 locations within a one-mile radius of each other. The realization marked the end of an aggressive growth strategy, in which 8,000 shops were added over a seven-year period. It was also underscored by a 1% downgrade in its share price. IBISWorld still ranks ‘Bucks as the leader of the coffee and snack shops market in the U.S. with a 23.2% market share (followed by Dunkin’ Brands at 17%), and the move is apparently part of a refocused strategy.

Michael J. Mazarr, a senior political scientist at RAND Corporation noted that reassessing Starbucks’ growth rate will help maintain its leadership status. And while businesses can learn by following the company’s example, they should ask deeper, more strategic questions.

“Clearly a major risk to a company like [Starbucks] would be even a modest swing in consumers who believe that the company has gotten too big. The fascinating questions would be: ‘To what extent did they analyze this?,’ ‘anticipate possible changes?,’ ‘think clearly about risks and outcomes?,’ and ‘did they get some assumptions or expectations slightly wrong?” Mazarr told Risk Management Monitor. “Businesses obviously have invalid expectations all the time—not all of those cases are examples of failed risk management or being blind to consequentialist thinking. Sometimes they are trying to think deeply and rigorously about consequences; they just guess wrong.”

Mazarr has contributed to Risk Management magazine with an article exploring consequence management and the “character of risk,” which you can read here.

The NSC information released earlier this week dovetails with the end of

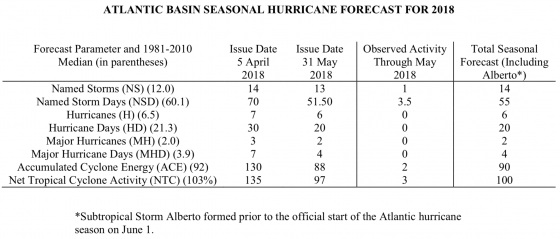

The NSC information released earlier this week dovetails with the end of  The criteria is heavily based on the number of hurricanes and not their economic impact. Look to other years with similar buzzword descriptors to determine if its impact is included in your organization’s systematic risk.

The criteria is heavily based on the number of hurricanes and not their economic impact. Look to other years with similar buzzword descriptors to determine if its impact is included in your organization’s systematic risk. Strategic Initiatives Carol Fox, who authored the report. “Even so, given increasingly uncertain times, risk management professionals would be unwise to declare victory or become complacent.”

Strategic Initiatives Carol Fox, who authored the report. “Even so, given increasingly uncertain times, risk management professionals would be unwise to declare victory or become complacent.”