April is Distracted Driving Awareness Month, and the National Security Council (NSC) released new data this week that explores added transportation risks when emergency responders are en route to provide aid. It is clear that the mere presence of emergency personnel on the road can cause distractions for drivers and bystanders. To date, 16 emergency responders have been struck and killed by vehicles this year in the United States.

According to a survey released jointly by the NSC and the Emergency Responder Safety Institute (ERSI), 16 percent of respondents said they either have struck or nearly struck a first responder or emergency vehicle stopped on or near the road. Yet still, 89 percent of drivers say they believe distracted motorists are a major source of risk to first responders.

Key findings included:

- 71% of drivers take photos and text while driving by emergency responders on the side of the road (this drops to 24% under normal driving conditions)

- 60% take time to post to social media and 66% email about the situation

- 80% admit to “rubbernecking” – that irritating, but also risky, practice of slowing down all traffic to get a better look

- 49% say that possibly being struck by a vehicle is “just part of the risk” of being a first responder

As part of its #justdrive campaign, NSC has developed a free Safe Driving Kit to help employers keep their workers safe and is hosting a webinar on April 23, titled “You’re Not As Safe As You Think You Are,” to educate employers on the real risks of distracted driving and what safety-forward companies are doing to combat them.

“The cruel irony is, we are putting the people who are trying to improve safety in very unsafe situations,” said Nick Smith, interim president and CEO of the NSC. “Our emergency responders deserve the highest levels of protection as they grapple with situations that are not only tactically difficult but also emotionally taxing. Save your communications for off the road; disconnect and just drive.”

Already on the NTSB’s List

Earlier this year, Risk Management Monitor reported on the National Transportation Safety Board’s (NTSB) Most Wanted List of transportation safety improvements for 2019-2020, and “Eliminating Distractions” for all vehicle drivers is at its top.

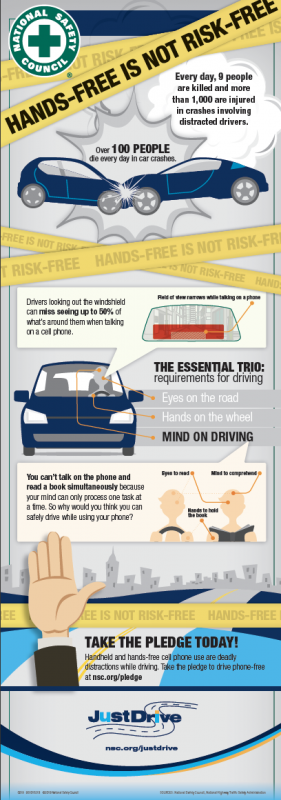

In 2016, more than 3,100 fatal crashes on U.S. highways were attributed to driving-while-distracted. These crashes involved 3,210 distracted drivers, according to the National Highway Traffic Safety Administration (NHTSA), because some of them involved more than one distracted driver. Furthermore, the Virginia Tech Transportation Institute concluded that commercial drivers are at extremely high risk of a crash when texting—23 times greater than when otherwise engaged.

The NTSB states:

Contributing to the problem is the widespread belief by many drivers that they can multitask and still operate a vehicle safely. But multitasking is a myth; humans can only focus cognitive attention on one task at a time. That’s why executing any task other than driving is dangerous and risks a crash.

Personal electronic devices (PEDs), such as cell phones, are one of the greatest contributors to driver distraction and the NTSB recommends banding all PED use on U.S. roadways. The District of Columbia and 37 states restrict the use of cell phones by novice drivers, and 47 states, DC, Puerto Rico, Guam, and the US Virgin Islands ban text messaging for all drivers.