The “Timeline” portion of the November issue of Risk Management (online and in print November 1) features a disturbing sequence of workplace homicides based on retaliation, from the first Post Office shooting that coined the term “going postal” to the more recent shooting near the Empire State Building. All instances focused on employees retaliating against managers, supervisors or coworkers.

But retaliation can manifest itself in many ways, including managers firing or demoting an employee due to that employee doing what they feel is the right thing — whistleblowing. A recent workplace retaliation report by NAVEX Global found that this type of retaliation is occurring now more than ever in the workplace, and that “only 15% of respondents said organizations inform employees about retaliation trends and reporting — a low and concerning statistic.”

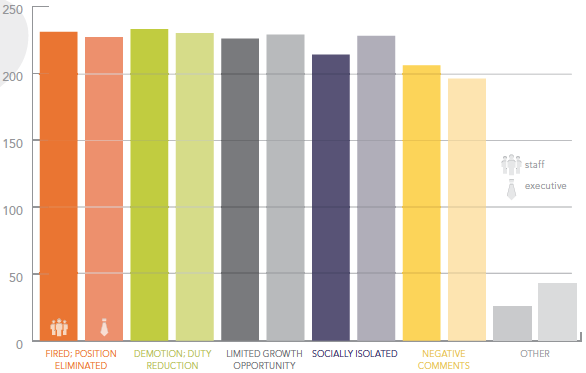

The survey also found that the definition of retaliation is maturing. The graph below illustrates what both staff and executives define as retaliation.

The study found that the majority of respondents (72%) agreed that whistleblowers who report issues to the government have already reported the issues internally and felt it wasn’t adequately addressed. In addition, 35% said executives are coached after they engage in retaliation, as opposed to more formal disciplinary measures, and 12% reported that no action is taken.

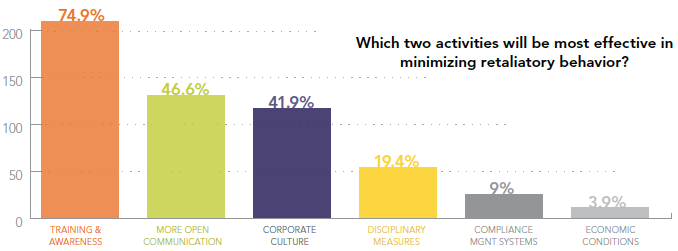

So how do we curb retaliatory in the workplace?

Using whistleblower reporting data to strengthen ethics and compliance programs is a starting point.

Just last week, the Obama administration extended whistleblower protections to national security and intelligence employees in a Presidential Policy Directive, signaling just how important protection against retaliation has — and will likely continue — to become.

In other, lighter news, the 168th edition of the Cavalcade of Risk was published this morning.

Check it out here for links to the best insurance and risk management blogging.