High taxation is the number one risk faced by North American businesses, according to a new survey from Lloyd’s of London.

Lloyd’s Risk Index 2013, which was also published in 2009 and 2011, surveyed more than 500 C-suite and board-level executives to determine the threats that they were most concerned with. High taxation, which only came in 13th in 2011, took the top spot. Lloyd’s Chief Executive Richard Ward pointed to the increased debate around economic issues and the perception of how corporations pay their taxes as one reason for the increase in concern:

The public scrutiny given to corporate taxation has become increasingly intense over the last two years, with governments and the taxpayer alike demanding greater transparency and changes to legislation. Since 2011, this pressure has clearly been felt by respondents, who now rank the risk of high taxation as their highest overall risk, up from number 13 in 2011. In the U.S., the priority scores given to this risk are particularly high.

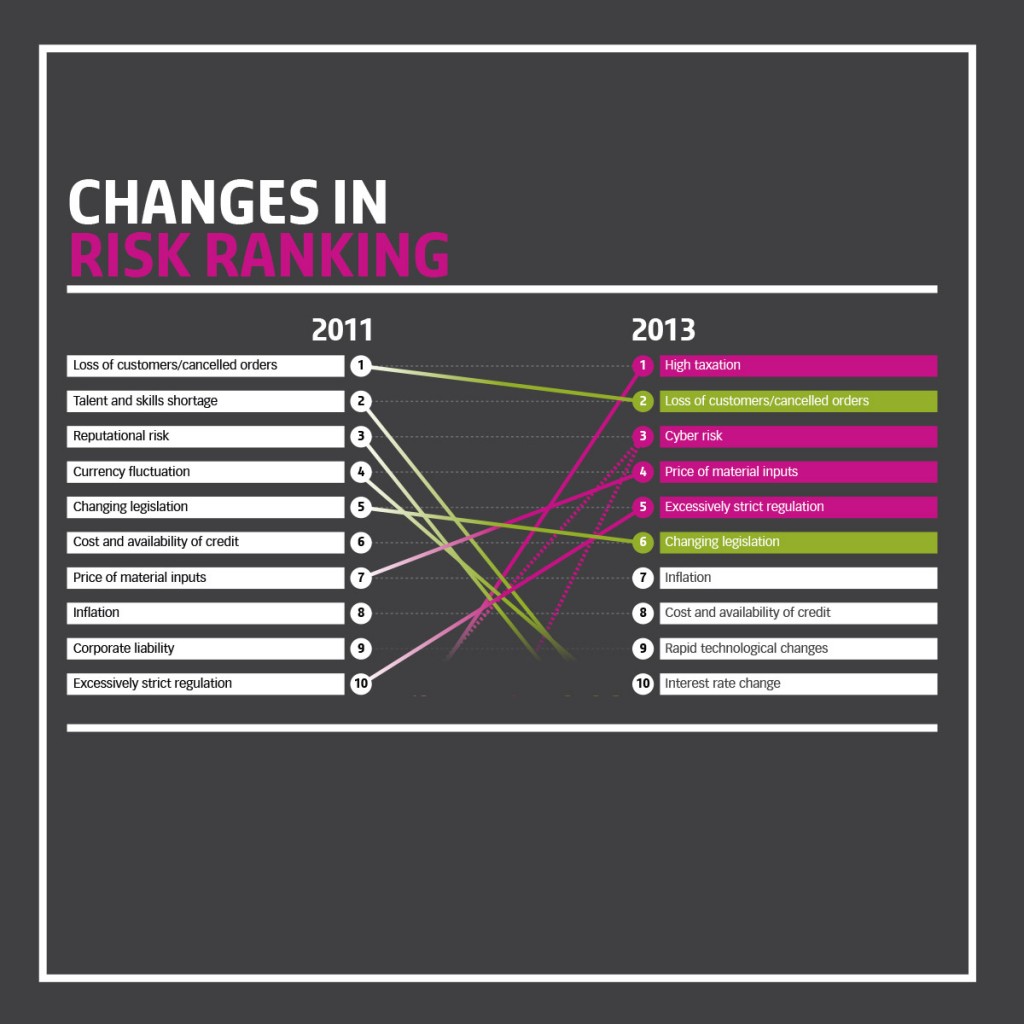

After high taxation, the rest of the top five risks cited were:

- loss of customer/cancelled orders

- cyber risk

- price of material inputs

- excessively strict regulation

Of these, only the loss of customers was a top 5 risk in 2011:

The survey findings seems to indicate that large companies are more prepared for these risks than their smaller counterparts. But since the balance sheets of smaller companies are more vulnerable, they especially need to find ways to address these issues. Overall however, Ward warned against taking a short-term outlook and said it will take “expert risk management” to insulate companies from these threats.

“With business tax in the spotlight and rising up the political agenda, executives are understandably concerned. Yet the danger is that an emphasis on near-term, operational issues comes at the expense of significant, strategic decisions that have previously exercised business leaders.

buy nolvadex online imed.isid.org/wp-content/uploads/2023/10/jpg/nolvadex.html no prescription pharmacyWith the timetable for global economic recovery likely to be much longer than we hoped, a focus on long-term sustainability and effective risk management should be a priority for boards across the world.

buy inderal online imed.isid.org/wp-content/uploads/2023/10/jpg/inderal.html no prescription pharmacy”