Residents of Los Angeles are serious about their cars. Really serious. Since traffic jams are routine in and around the city, an 80-hour closure of a major artery like Interstate 405 is nothing to be taken lightly. This is why the Metropolitan Transportation Authority needed a plan to get the attention of drivers before they made repairs to the 405—which carries more than 300,000 vehicles a day and is one of the heaviest traveled in the country.

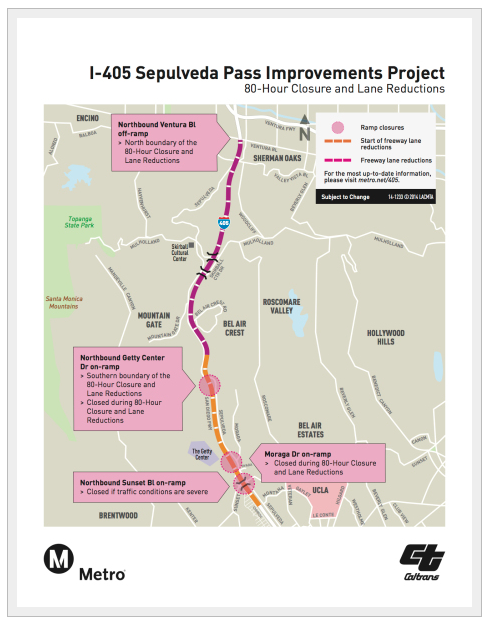

The $1 billion 405 Freeway construction project over President’s Day weekend added a carpool lane and improvements to entrances and exits along a 10-mile pass. It also required full and partial closure of the northbound lanes.

To get the attention of motorists, the project was dubbed “Jamzilla.

” According to the Los Angeles Times, this follows the lead of closures of the 405 in 2011 and 2012, with replacement of the Mulholland Bridge. Local media dubbed the events “Carmageddon” and “Carpocalypse,” and “Carmageddon II.” While the names may sound frivolous, the media hype helps make sure that drivers pay attention and stay away.

For Presidents Day weekend, “we wanted to come up with a term that would be like Carmageddon in its ability to influence the public,” said Dave Sotero, a spokesman for the Los Angeles County Metropolitan Transportation Authority, told the Times. The strategy has been successful in the past. In 2011, the Metrolink commuter train system, in fact, reported their ridership was 50% higher during the construction at the same time the previous year.

Jamzilla was a complex paving operation in a 5.6-mile stretch, with the contractor, Kiewit Infrastructure West, pouring single layers of pavement at a time. Metro officials compared the job to “baking layers of a wedding cake—a far more delicate task than the bridge demolition that prompted the ‘Carmageddon’ full-freeway closures.”

K.N. Murthy, executive director of transit project delivery at the Metropolitan Transportation Authority said, “Operationally speaking, demolishing a bridge is a much simpler operation than paving and striping freeway lanes that must return to public use as quickly as possible. It’s the essential difference between destroying a structure and building a structure. Building something is much more difficult, and the paving methods we are using vary between each material type and have specific requirements that must be adhered to.”

Last week I visited Los Angeles and found Jamzilla to be a topic of conversation everywhere. Trips to destinations on the West side of L.A., such as the J. Paul Getty Museum right off of the 405, were scrapped and an extra half-hour was added to my already generous travel time to LAX early Sunday morning.

The good news is that all the hype surrounding Jamzilla resulted in success. Fortunately for me, traffic was so sparse that I arrived at the airport an hour early. Traffic overall was said to be lighter than usual on the 405 with no major jams. The Times reported a successful project and the 405 was opened an hour ahead of schedule. So much for Jamzilla.